Market update: COVID-19

19 Mar 2020

Information correct at the time of writing – 19 March 2020

The COVID-19 (coronavirus) outbreak continues to take a heavy toll across the world. There are now over 217,000 confirmed cases of the coronavirus, with over 84,000 recoveries, and 8,700 confirmed deaths. Fortunately, the spread of the virus in China has slowed dramatically and appears to be under control. However, the rate of infection outside of China has increased markedly. Most notably we are seeing community outbreaks across Europe and the US.

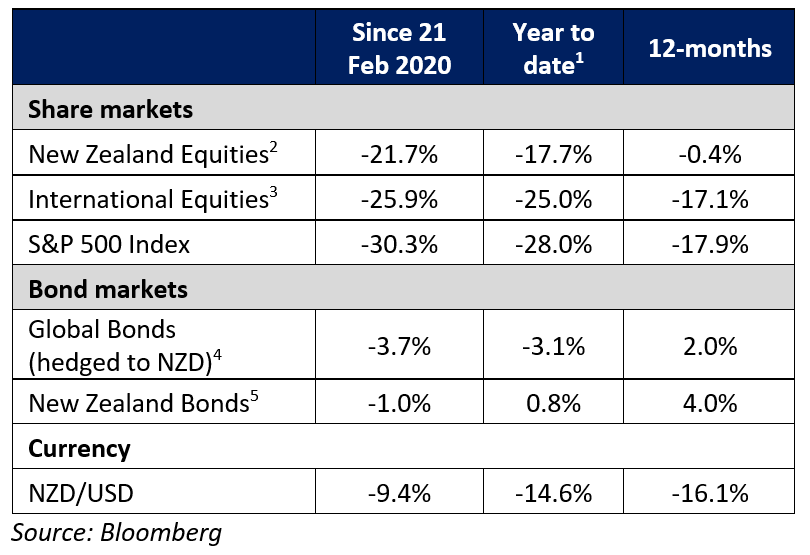

In recent weeks we have seen sharp sell-offs in global equity markets, and large movements in fixed interest and currency markets. These movements will impact the balances in YouWealth and BNZ KiwiSaver Scheme accounts (with the exception of those members only invested in the Cash Fund). Market volatility has also jumped to a record high.

How have markets been performing?

There have been some big moves in share prices over the last few days. In fact, on Monday, some markets experienced their biggest one-day falls since 1987.

As well as negative news about the spread of the coronavirus, a driver of the recent falls in share markets can also be attributed to the oil price war; where OPEC and Russia have fallen out and are openly driving down the price of oil.

The reason the oil price war has negatively impacted the share market is that, in general, the energy sector is highly-leveraged. With a lower oil price, it will be harder for oil companies, particularly those who are shale producers, to service their debt. It would not be an understatement to say that the oil price war is particularly unhelpful right now.

Restrictions on the movement of people

Over the last few days we have seen further restrictions on travel to contain the spread of the coronavirus globally. New Zealand has effectively closed its borders by implementing a 14-day mandatory self-isolation period for anyone entering the country. Other countries have introduced similar measures.

The US has closed its borders to foreign nationals who have recently been in Europe and the UK, and is testing for the coronavirus at its borders, while the UK, France and Germany have similarly put in stringent measures and are discouraging social contact to try to stem the spread of the virus.

Central banks are jumping to the rescue

Central banks have also been doing their bit and have indicated they are prepared to do even more with the use of unconventional monetary policy tools, if needed.

On Monday morning the Reserve Bank of New Zealand (RBNZ) held an out-of-cycle meeting and slashed the Official Cash Rate (OCR) by 0.75%, to an all-time low of 0.25%. The RBNZ also started using forward guidance as a monetary policy tool, and explicitly stated that the OCR will stay at least as low as 0.25% for the next 12 months. It has also delayed the introduction of the new bank capital changes for at least 12 months. Further to this, the RBNZ expects to begin a programme of asset purchases, not dissimilar to the quantitative easing (QE) programmes we have seen from other central banks in recent years.

On top of its previous 0.5% cut announced a few weeks ago, the US Federal Reserve also held an out-of-cycle meeting, following which it cut the Fed Funds Rate by a further 1.00%, taking it to a target range of 0.00% – 0.25%. It also announced a US$700 billion QE programme. Closer to home, the Reserve Bank of Australia has also committed to its own form of QE where it will likely start buying Australian Government bonds.

…and so are governments

The focus for governments globally has been two-fold. Firstly, governments appear to be focused on containing the spread of the virus and on finding a vaccine. Their secondary focus is on containing, as much as possible, the economic fallout. How successful governments are in getting in front of this will be key to how well the global economy fares and recovers over time.

A $12.1bn support package for New Zealand

On Tuesday, the New Zealand Government unveiled a NZ$12.1 billion support package for the economy, with almost half of the cash to be spent on a wage subsidy package for all the coronavirus-impacted businesses.

The plan accounts for 4% of New Zealand’s Gross Domestic Product (GDP). On a GDP basis, it’s the biggest government relief package announced so far, globally. This package has been described as the first tranche, with more tranches to come.

The Government will deliver its budget in May 2020 and we would speculate that it will include the beginnings of a recovery package as the second tranche. This support package comes on top of the already promised NZ$12 billion infrastructure package. Combined this represents an unprecedented level of fiscal stimulus to New Zealand.

Where to from here?

These are some big policy responses and we expect it may take some time to fully digest what this means for financial markets.

From here what we need to see is that, on a global level, the spread of the virus is being contained successfully, and that governments are willing to do whatever it takes to support economies, businesses and employees through this period. In the meantime, however, we still expect a significant slowdown in economic activity, which will likely be accompanied by ongoing financial market volatility.

It’s important to stay the course

We’ll close with a reminder that share markets do, from time to time, go through periods of weakness. While the recent share markets falls have been big, investors are responding to a big unknown.

However, there has been a pretty convincing policy response to date, and we should expect there to be more. It would also be fair to say that the current sell-off is very different to the Global Financial Crisis (GFC); the global economy was in reasonably good shape prior to this crisis, and compared to the GFC, we don’t have the same imbalances that existed back then.

While we know it’s unsettling to see the value of your investments falling, it’s important you maintain a long-term perspective and sit tight. Making changes to your investment strategy or fund choice now could mean you ‘lock in’ the recent losses. Just as quickly as they fall, markets have a habit of recovering, so changing your investment approach now may mean you miss out on any rebound in markets.

[1] Year to date from 01 Jan 2020

[2] As measured by the S&P/NZX 50 Gross Index

[3] As measured by the MSCI ACWI Index

[4] As measured by the Barclays Global-Aggregate Index

[5] As measured by the Bloomberg NZBond Govt 0+ Yr Index

BNZ Investment Services Limited, a wholly owned subsidiary of Bank of New Zealand, is the issuer and manager of YouWealth and the BNZ KiwiSaver Scheme. Product disclosure statements for both products are available at bnz.co.nz or at any BNZ branch.

The information in this article is provided for general purposes only, and is a summary based on selective information which may not be complete for your purpose. To the extent that any information or recommendations in this article constitute financial advice, they do not take into account your financial situation or goals and is not intended as personalised financial advice. While BNZ has made every effort to ensure that the information provided is accurate, you should not rely on this information to make any financial decision without first having sought advice specific to your circumstances from an authorised financial adviser. Neither BNZ nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from this article.