BNZ: Robust and ready to help rebuild New Zealand’s economy – HY20 Results

28 Apr 2020Bank of New Zealand (BNZ) today released its half year results to 31 March 2020 and says while the operating environment has changed, BNZ is well-capitalised and has the balance sheet strength to play its part in helping get New Zealand back on its feet.

BNZ announced its statutory net profit of $367 million for the first half of the financial year which included a software capitalisation policy change that reduced BNZ’s capitalised software balance. Excluding this specific item, statutory net profit decreased by $74 million (13.5%) over the prior comparable period.

COVID-19

BNZ CEO Angela Mentis says, “Together with the New Zealand Government and Reserve Bank, our focus has been on rapidly responding to assist our customers as they navigate this very difficult time.”

During March and April BNZ supported its customers with a variety of support measures including assisting over 16,000 customers with new and restructured home lending to the value of $7 billion.

Ms Mentis says, “We have been working with our business customers, having open conversations to ensure they have the information to make the right decisions. For some sectors and businesses, the path to recovery is going to be very challenging and we will be responsive while remaining responsible in our support for them.”

BNZ has helped tens of thousands of its business customers through a combination of BNZ’s business support measures and the Business Finance Scheme provided in partnership with the Government.

To assist businesses, BNZ removed all contactless debit transaction fees for SMEs for three months, lowered overdraft interest rates, provided extensions of trade credit and principal repayment deferrals, amongst other initiatives. BNZ has also launched its QuickBiz portal, an online, 24/7 capability for businesses to apply for up to $100,000 without additional security.

Ms Mentis says, “Through Level 4 lockdown we kept those that are most vulnerable in our community at the forefront of our minds.

“We introduced an Aged Customer Care Helpline for our over 70-year-old customers to provide targeted support, including getting them started on internet banking, and opened branches on Thursdays for customers who needed access to physical service,” she says.

BNZ also helped people avoid the perils of predatory lenders.

Ms Mentis says, “Together with Good Shepherd NZ, we extended our Community Finance no-interest loan scheme with $5 million to help people pay outstanding bills like rent and utilities, or to refinance or consolidate existing high-cost debt.”

Digital acceleration

Ms Mentis says, “More than ever our customers are choosing to interact with us via digital channels and we will continue to invest significantly in the technology and digital capability to meet those expectations. The most recent example is the use of digital signing to improve convenience for customers.

“COVID-19 has fast tracked online banking activity and customers have adopted this as a convenient and practical way to stay safe and get things done during the Level 4 lockdown,” she says.

Strong and supportive

Ms Mentis acknowledged the challenges New Zealanders now face from COVID-19 but says that in the six months to 31 March this year, BNZ helped 7,720 Kiwis buy homes including 2,616 customers buy their first home. BNZ also supported more than 9,000 SMEs start or grow their businesses and year on year has achieved growth of 15% in KiwiSaver members.

“While our response to COVID-19 and the ongoing support for our customers is the priority, BNZ continues to perform strongly,” she says.

BNZ COVID 19 support measures

| COVID-19 Support | Number | Volume |

| Home loan support | >16,000 customers | $7 billion |

| Business Finance Scheme loans | >1,000 applications | $200 million pipeline |

| Business Assistance | >17,200 customers | $16 billion |

| Calls to contact centre | >140,000 | |

| Calls to Aged Customer Care Helpline | >14,000 | |

| Branches open during lockdown | 48 |

Key Financial Results

*Note: compared to the six months ended 31 March 2019, unless otherwise stated.

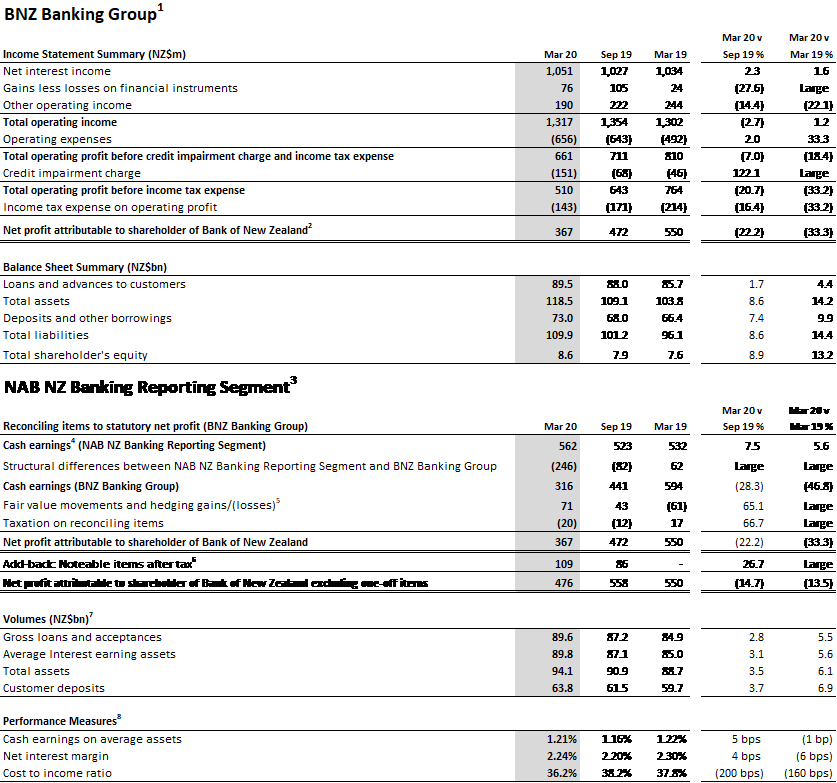

BNZ Banking Group1

Statutory net profit2 of $367 million, a decrease of $183 million, impacted by:

- Software capitalisation policy change that increased the minimum threshold at which software is to be capitalised from $2 million to $5 million.

- Increase in credit impairment charge driven by an increase in the economic adjustment.

- Strong volume growth supporting net interest income.

- Net favourable mark to market movement driven by offshore debt instruments and related swaps.

NAB NZ Banking Reporting Segment3

Cash earnings4 of $562 million, an increase of 5.6% reflecting higher revenue which benefitted from growth in housing and business lending, and lower operating expenses due to productivity benefits achieved through continued simplification of the business and reduced amortisation charges.