BNZ optimistic about year ahead – FY20 Results

5 Nov 2020Bank of New Zealand (BNZ) today released its full year result to 30 September 2020 and says it is well-capitalised to support its customers and reshape its business to meet increasing digital service demand.

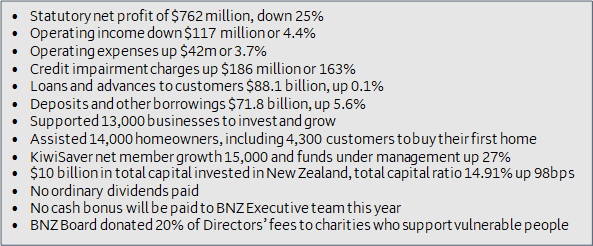

BNZ announced its statutory net profit decreased by $260 million or 25% to $762 million. BNZ’s financial performance was significantly impacted by COVID-19, the lower interest rate environment and a reduction in BNZ’s capitalised software balances. Credit impairment charges are up $186 million or 163% driven by a forward-looking economic adjustment due to deterioration in broader macro-economic factors as a result of COVID-19.

BNZ deposits and other borrowings remain strong up $3.8 billion or 5.6% to $71.8 billion with a preference for short dated deposits.

Opportunities ahead

BNZ CEO Angela Mentis says, “It has been a challenging year and I’m proud of how our people have responded. We’re focused on supporting our customers and are optimistic about the future.

“We have seen New Zealanders quickly reshape how they work, shop and live. They are doing things differently, seizing opportunities and banking in different ways. We will continue to grow and adapt in this rapidly changing environment,” Ms Mentis says.

She says in the past year, customers have dramatically changed how they interact with their bank. The increasing use of digital and self-service options has seen cash and cheque transactions in branches fall by more than half and 80% of transactions that can be completed by Smart ATMs are no longer happening over the counter.

“COVID-19 has fast tracked trends we’ve seen for some time with nearly three quarters of all our customers online or using our app,” she says.

Open for business

Ms Mentis says, “BNZ is well-capitalised with over $10 billion in total capital invested in New Zealand and we’ve increased our total capital ratio to 14.91% up 98bps.

She says BNZ will continue to support New Zealanders and their businesses in a prudent and proactive way.

Supporting customers and New Zealand

Ms Mentis says, “Since March this year, we’ve had tens of thousands of conversations with personal, home-owner, KiwiSaver and business customers on how BNZ can best support them through COVID-19.

“Our COVID-19 response has been conversation-led as we’ve sought to understand the individual position of each and every customer,” she says.

BNZ’s support measures accounted for more than $6 billion in home loan support1 and $4 billion of support2 via business lending products. While many customers continue to access support measures, BNZ’s proactive approach has seen many resume normal payments.

As the leading lender for the government backed Business Finance Guarantee Scheme, BNZ has supported more than 405 businesses with loans.

“Many of our business customers have acted quickly to change what they do and how they work, and home loan support measures have given many New Zealanders confidence in their financial position,” she says.

Ms Mentis says she is pleased that over the past year BNZ has assisted over 14,000 home-owners including helping 4,300 customers buy their first home, and supported more than 13,000 businesses to invest and grow their enterprises.

BNZ has also supported vulnerable New Zealanders on limited incomes with $8.4 million of no and low interest loans via its Community Finance initiative and launched a domestic and economic abuse banking team to help those in need.

BNZ focused on digital future

“This year’s events have shown the importance of being able to run your business digitally. We saw that for ourselves, as did our customers,” says Ms Mentis.

“Breaking down barriers to digital banking access is important and we’re committed to offering a range of services and programmes like our Over 70s line and Scam Savvy Week that give New Zealanders support and guidance to get online and enjoy the benefits,” she says.

BNZ has seen a significant increase in over-70-year-old customers becoming digitally active. At its peak the bank saw more than 1,500 customers transitioning to online banking per month (up from around 20).

Ms Mentis says digital technology has improved the way customers bank and enabled its employees to work remotely and flexibly. She expects new ways of working at BNZ to be reflected in a 30% reduction in its property footprint.

“Our people have embraced flexibility, our online banking is fast and easy and our bankers are serving our customers irrespective of where they are,” she says.

1. Home loan support predominantly in the form of repayment deferral and growth in Interest Only from 28 February 2020 and includes home loan support to business customers.

2. Business lending support includes total business lending predominantly in the form of Interest Only, loan top-ups, extensions and covenant waivers.

Key Financial Items

*Note: compared to the twelve months ended 30 September 2019, unless otherwise stated.

*An unaudited summary of financial information for the year ended 30 September 2020 follows.

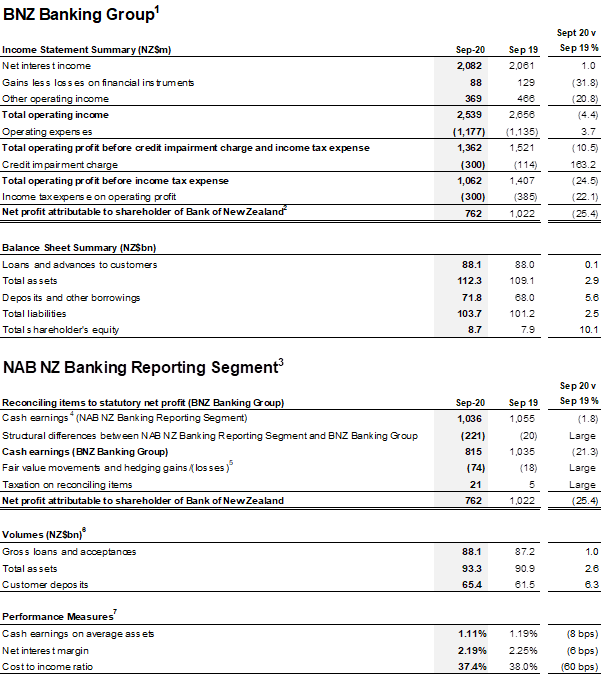

1. BNZ Banking Group excludes the Insurance operation in New Zealand and includes BNZ’s Group Capital Management, BNZ’s Markets Trading operations and other central units.

2. Statutory net profit has been prepared in accordance with Generally Accepted Accounting Practice in New Zealand (“NZ GAAP”) It complies with New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”) and other applicable Financial Reporting Standards.

3. NAB NZ Banking Reporting segment consists of Partnership Banking, servicing consumer and SME segments; Corporate and Institutional Banking, servicing Corporate, Institutional, Agribusiness, and Property customers, and includes Markets Sales operations in New Zealand. New Zealand Banking also includes the Wealth and Insurance franchises operating under the ‘Bank of New Zealand’ brand, but excludes Bank of New Zealand’s Markets Trading operations

4. Cash earnings is a non-IFRS key financial performance measure used by BNZ for its internal management reporting as it better reflects what BNZ considers to be underlying performance. Cash earnings is calculated by excluding fair value movements and hedging gains/(losses) as they introduce volatility and/or distortion within the statutory net profit which is income neutral over the full term of transactions. A reconciliation of cash earnings to statutory net profit is included. Cash earnings is not a statutory financial measure, is not presented in accordance with NZ GAAP and is not audited or reviewed in accordance with International Standards on Auditing (New Zealand).

5. Unrealised fair value gains or losses on economic hedges that do not qualify for hedge accounting and hedge ineffectiveness causes volatility in statutory profit, which is excluded from cash earnings as it is income neutral over the full term of transactions. This arises from fair value movements relating to trading derivatives for risk management purposes; fair value movements relating to assets; liabilities and derivatives designated in hedge relationships; and fair value movements relating to asset and liabilities designated at fair value.

6. Spot volumes (unless otherwise stated) and performance measures are based on NAB NZ Banking Reporting segment operations.

7. Performance measures are calculated on a cash earnings basis.