BNZ targets $10 billion sustainable finance and SME partnerships to reduce carbon emissions

10 Dec 2020Bank of New Zealand (BNZ) has released its first sustainability report and announced changes to its lending policy and ambitious targets to work with SMEs to reduce New Zealand’s carbon emissions.

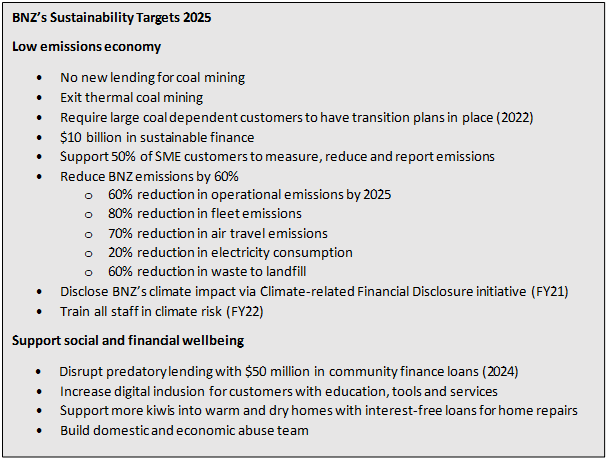

In the next five years, BNZ has committed to delivering $10 billion in sustainable finance and will be embedding a focus on helping intensive carbon emitting customers to transition to new ways of doing business.

A stronger ESG framework to be launched next year will increase investment in businesses and projects that deliver carbon reduction and sustainable benefits. BNZ has also committed to supporting half of all its SME customers (around 100,000 businesses) to adopt and use a Digital Climate Change Toolkit to measure, reduce and report on their emissions by 2025.

Angela Mentis, BNZ CEO, says, “We’re clear about what we stand for. BNZ is a bank that protects the environment, works with its customers to reduce emissions and supports the long-term improvement of the social and financial wellbeing of all New Zealanders.

“In reporting our impacts today, we are not only showing what we will do to reduce emissions and support New Zealanders, but signaling to the market the types of businesses we want to work with to grow the New Zealand economy in a sustainable way,” she says.

To deliver its sustainability targets, BNZ is committing to two principles that are important to the long-term future of our country: Kaitiakitanga, to accelerate the just transition to a low emissions economy, that supports the regeneration of the natural environment; and Manaakitanga, to grow the long-term social and financial wellbeing of all New Zealanders.

Mentis says it was important that BNZ’s sustainability strategy reflect a Te Ao Māori worldview that ensures the bank takes an interconnected, long-term and intergenerational view of the way its people work and engage with customers and stakeholders, and BNZ’s impacts on communities and the environment.

Kaitiakitanga: Supporting a transition to a low emissions economy

In addition to the $10 billion sustainable finance target, BNZ will introduce an updated and enterprise-wide ESG framework in 2021, embed sustainability risk as a material risk category and roll out climate risk training for all staff within the next two years.

Mentis says, “It used to be that lending decisions considered a narrow range of economic factors, but new ambitious targets will hardwire sustainability into how we work. We’re serious about changing the way we work and the people we do business with for the benefit of New Zealand and its people.”

Mentis is excited about working with New Zealand’s SMEs to tackle climate change. In partnership with the Sustainable Business Network, BNZ will provide a Digital Climate Change toolkit to its SME customers. The simple self-assessment tool works through an easy to follow step by step ‘climate action journey’ of advice and support. This is then tailored to the specific motivations and conditions of each business and will connect them to good quality existing information, tools and resources.

“SMEs are the lifeblood of the New Zealand economy, they must have a place in a new low carbon economy. The toolkit will be a vital initiative to make it easy for SMEs to increase the sustainability of their operations and have a significant impact on carbon emissions,” she says.

Manaakitanga: Growing long term social and financial wellbeing of all New Zealanders

BNZ’s Sustainability Report outlines initiatives and targets that the bank will focus on to ensure New Zealanders can benefit from the acceleration in digital technology and support those in vulnerable circumstances.

Mentis says, “COVID-19 has changed the economy dramatically and put pressure on businesses and individuals. The future is digital and it’s important that no one gets left behind as the country recovers.”

She says BNZ will build on initiatives such as its dedicated Over 70s phone line and BNZ’s Scam Savvy to support people to feel safe and capable online, and participate in an increasingly digital world. She says the bank is also going to step up its support for people in vulnerable circumstances.

“Everyone can have a moment of vulnerability – it just takes an unexpected life event. We will partner with social organisations across the country to tackle some of the toughest issues we face such as domestic and economic abuse, inadequate housing and access to finance to support families and job seekers,” she says.

Since 2014, BNZ’s Good Loans initiative has partnered with a number of community organisations to offer people on limited incomes fee-free, low-interest and no-interest loans. When COVID-19 hit, BNZ worked with its partner, Good Shepherd NZ, to extend its Community Finance programme, allowing $5 million of no-interest loans to be accessed by families that were financially impacted by the pandemic. The bank also launched a domestic and economic abuse team and received Living Wage Accreditation this year.

You can find the report here.