BNZ Wellbeing Report: COVID-19 starting to bite, but not for all

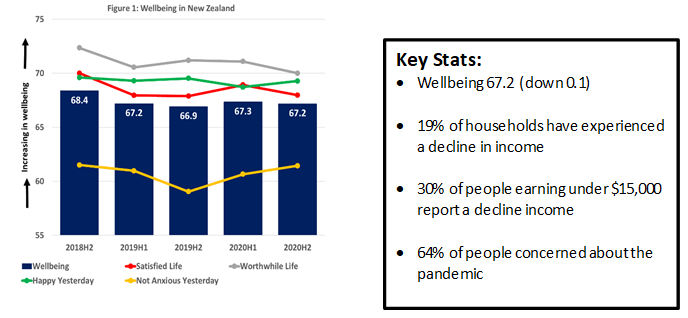

18 Dec 2020Bank of New Zealand (BNZ) released its second half 2020 Wellbeing Report, showing a small decline in overall wellbeing over the last six months.

While New Zealanders reported experiencing less anxiety and a little more happiness, sense of life worth and life satisfaction have both declined, most likely reflecting the impact of COVID-19.

BNZ Economist and report author, Paul Conway, says, “General wellbeing in New Zealand is hanging in there, which is reassuring given the global backdrop of the COVID-19 pandemic raging overseas, the damage it is doing to the global economy, and the threat it still poses to New Zealand.

“However, beneath the topline result there is significant deterioration in wellbeing for lower income people, younger people, and Maori and Pacific people, all seemingly driven by the pandemic,” he says.

Increasing financial stress and inequality the driver

Six months on from the previous BNZ Wellbeing Report, Conway says the economic impacts of the pandemic are starting to show up in people’s lives and it’s hurting New Zealanders disproportionately.

“2020 has been hard for young New Zealanders. They have been hit by the economic impacts of COVID-19 and their Wellbeing has dropped significantly, from 62 to 57. This likely reflects disruptions in their learning, less part-time jobs and the inability to travel.

“Likewise, people on low and very low incomes, and the unemployed, have experienced decreases in their wellbeing, as have those with vocational training, Maori and Pacific people.

“These groups are less likely to be able to work from home, more likely to be in industries that suffer more job losses during recessions, which is driving the increasing financial stress and deterioration in household finances.

“Skilled workers, particularly those in more digital or technology-based industries, have been able to switch to working from home and keeping their incomes and livelihoods more intact, but this has also had the effect of concentrating job losses in low-wage service industries that support office workers – retail, transport, and food.

“Outside of these demographic groups, we’ve seen a large increase in financial hardship for women, whereas it’s almost unchanged for men. This suggests that job losses are being concentrated in industries that tend to be dominated by women employees whereas government fiscal support for “shovel-ready” projects is aimed at industries dominated by men,” says Conway.

The report shows that the number of people reporting a decline in household income over the previous six months has widened to a net 19% of New Zealanders, from a net 10% after the first lockdown in May 2020.

This hit to household incomes is concentrated on low-income New Zealanders. For example, a net 30% of people on incomes below $15,000 report lower incomes whereas almost 20% of people earning $200k or more increased the incomes over the previous six months. Increased inequality is also apparent in the savings and debt numbers.

“COVID-19 is almost singularly responsible with the pandemic being identified as the main cause behind a drop in income for 70% of people, a drop in savings for 55% of people, and a rise in debt levels for 45%,” says Conway.

COVID-19 driving digital tools and environmental benefits

The survey showed that no one has been left untouched by COVID-19.

“Virtually everyone has changed some aspect of their lives as a result of COVID-19. The most common thing people say they are doing, or trying to do, is to reduce spending and increase savings. This is prudent given economic uncertainty, but the report shows that some parts of our society are able to this better than others.

“The pandemic has also driven an increase in digital use with 31% of people now meeting more online and a quarter of people working from home more often. This is having a flow-on effect for the environment too, with almost 40% of people saying they’re driving less.

“That’s not the only benefit with people saying working from home gives them more time with family and friends and a better work-life balance, while also allowing them to get more work done.

“On the face of it, these benefits point to a possible trend away from office-based work environments, which will be something all large employers will be keeping an eye on,” says Conway.

A better 12 months ahead?

Despite the immense challenges, expectations about the year ahead are looking slightly more optimistic.

“More people are expecting an increased household income in the year ahead, up from six per cent in May 2020 to 14%, while less people are a expecting their debts to increase.

“Overall, fewer people see COVID-19 having a sustained negative impact on their financial situation in the year ahead – there is a glimmer of light at the end of the tunnel,” he says.

The BNZ Wellbeing Report survey was conducted from 29th September to 13th October and has a sample size of 1500 people. It is carried out twice a year.