A round-up of the year for our BNZ KiwiSaver Scheme members

11 May 2021

It’s hard to believe it’s been over a year since New Zealand was placed into its Level 4 COVID-19 lockdown. At around that time, share markets experienced some of their largest one-day falls since the market crash of 1987. However, fast-forward a year and markets appear to be in a good spot. Peter Forster provides a round up of financial markets over the year to 31 March 2021, and looks at how the BNZ KiwiSaver Scheme funds performed over this time.

Share markets have fully recovered their sharp declines despite many countries being in a state of lockdown for much of this time. However, it’s important to note that while performance for the year to 31 March 2021 looks particularly strong in comparison with other years, this performance came on the back of those sharp losses at the end of the previous year. This year markets have been supported by historically low interest rates, and an unprecedented amount of government help for businesses and families alike. News of vaccine breakthroughs and their swift roll-out also helped.

Hopes that many countries would be able to reopen their economies earlier than expected spurred markets on, as this is seen as being good for economic growth, company profits, and employment. Against this backdrop, some share markets finished the year at, or close to, record highs.

How did the BNZ KiwiSaver Scheme funds perform?

It’s been a strong year for investors in our funds, despite some ups and downs along the way.

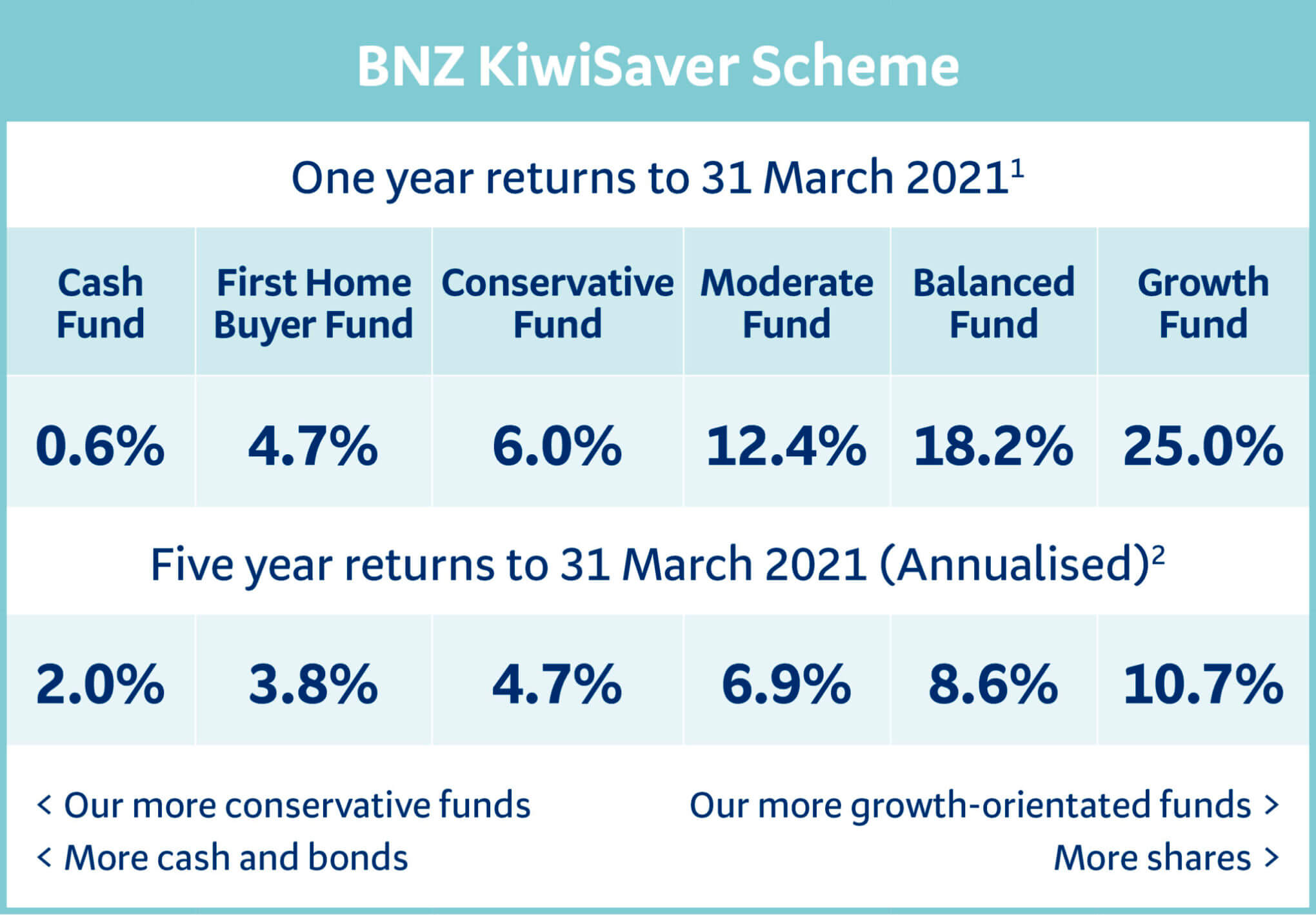

While all our funds ended the year on a very strong note, our growth-orientated funds delivered the best returns because of their higher weighting to the strong-performing share markets.

Our more conservative funds, which have a higher weighting to bonds, also did well, delivering strong but more modest returns.

In light of the low interest rate environment, our Cash Fund registered a small but positive return, and we expect to see continued low returns from cash investments until interest rates rise in the future.

Once again, it should be remembered that this one-year period immediately followed the market falls seen in early 2020 and, for that reason, the returns delivered, particularly by our growth-orientated funds, are unusually high and shouldn’t be expected each and every year.

Where to from here

The global economic recovery is gaining momentum, and this is likely to continue in 2021 as the vaccine roll-out picks up speed. While markets and economies look forward to ongoing recovery, further ups and downs can be expected. However, low interest rates and ongoing government support continues to reassure businesses and investors – and we don’t expect that to change anytime soon.

Of course, as always, it’s important to remember that market ups and downs are part and parcel of investing and taking a long-term approach to your investments and ensuring you are in the right fund for your investment timeframe will help you ride through these periods.

1 KiwiSaver returns are based on the March Quarter 2021 Morningstar KiwiSaver Survey. Performance shown is for the year to 31 March 2021. Each investor’s return will vary based on the unit price applicable to each contribution or withdrawal that is made and how long they’ve been invested for. Returns are calculated after deducting management fees (excluding any member fees) and before deducting tax. Returns represent historical performance and are not an indication or guarantee of future performance. The value of a fund may rise or fall depending on market conditions.

2 5-year returns are annualised.

BNZ Investment Services Limited, a wholly owned subsidiary of Bank of New Zealand, is the issuer and manager of the BNZ KiwiSaver Scheme. A product disclosure statements is available at bnz.co.nz or at any BNZ branch. Investments in the BNZ KiwiSaver Scheme are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, possible delays in repayment, possible loss of income and possible loss of principal invested. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of capital. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand but a licensed bank in Australia and is subject to the supervision of the Australian Prudential Regulation Authority.

This blog is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser.