BNZ backing New Zealand’s business-led recovery – HY21 Results

6 May 2021Bank of New Zealand (BNZ) has today released its half year result to 31 March 2021 and is focused on supporting businesses large and small to lead New Zealand’s economic recovery.

BNZ announced its statutory net profit increased by $293 million (or 80%) to $660 million driven by non-repeat of March 2020 notable items and a strong bounce back in the New Zealand economy. Excluding notable items, statutory net profit increased by $64 million (13%) over the prior comparable period.

BNZ CEO, Angela Mentis, says BNZ’s result is evidence of a stronger and swifter than expected recovery.

“The continued resilience of our economy is testament to New Zealand’s effective response, and the creativity and courage of businesses in the face of the pandemic,” she says.

Business-led recovery

Ms Mentis says, “An effective and determined response from Government and the Reserve Bank coupled with a strong banking and business sector has helped New Zealand weather the storm.

“As we did during the GFC, we’ve supported more than 10,000 business customers and the vast majority have transitioned from focusing on survival to growth,” she says.

Ms Mentis says BNZ’s determination to support businesses saw it use its full Government Business Finance Guarantee Scheme allocation and use the Reserve Bank’s Funding for Lending Programme to develop a new $1 billion scheme (Good to Grow) designed to support businesses’ ambitions to go digital, increase sustainability and productivity and develop new products.

“BNZ is in a great position to get behind New Zealand businesses to build the more sustainable, productive and inclusive economy we all want. New Zealand’s SMEs will be key to that and supporting business owners to make bold calls will keep our economy accelerating,” she says.

New Zealanders investing in their homes

“Being at home during lockdown has seen many of our customers decide to make improvements and undertake renovation projects. We’ve seen a 20% increase in customers investing in renovations,” says Ms Mentis.

Ms Mentis says she is pleased that over the past six months BNZ has assisted nearly 15,000 home-owners including supported around 2,300 customers buy or build their first home.

Sustainable New Zealand

Ms Mentis says BNZ is well capitalised to support the business-led recovery and is committed to working with customers to become more sustainable and help reduce New Zealand’s emissions.

“During this half we committed to deliver $10 billion of sustainable finance by 2025 and to support customers to transition to less intensive ways of doing business,” she says.

Ms Mentis says BNZ’s farm sustainability-linked loan for Southern Pastures, a first of its kind in New Zealand, will be the first of many and she is excited about working with customers to tackle climate change.

“This year we launched the Digital Climate Change toolbox and have an ambitious target of supporting more than 100,000 SME customers to increase the sustainability of their operations. New Zealand is well positioned to make sustainability a commercial advantage,” she says.

Building an inclusive and productive economy

Ms Mentis says digital acceleration presents New Zealand with a fantastic opportunity to build a more inclusive, productive and efficient economy that could result in potential gains of tens of billions of dollars over the coming decade if done right.

“The future is digital and it’s important that no one gets left behind.

“We’re running digital education sessions at our branches and in partnership with local government. Our dedicated Over 70s and Over 50s team has had more than 9,000 conversations per month supporting customers to get comfortable banking online, and our Scam Savvy tools have helped tens of thousands of Kiwis to be safer online,” she says.

Ms Mentis says customers have changed the way they bank. Nearly 75% of BNZ customers are digitally active and engaged and 80% of transactions that used to be done in branch are now completed via Smart ATMs, online or via the phone.

Key Financial Items

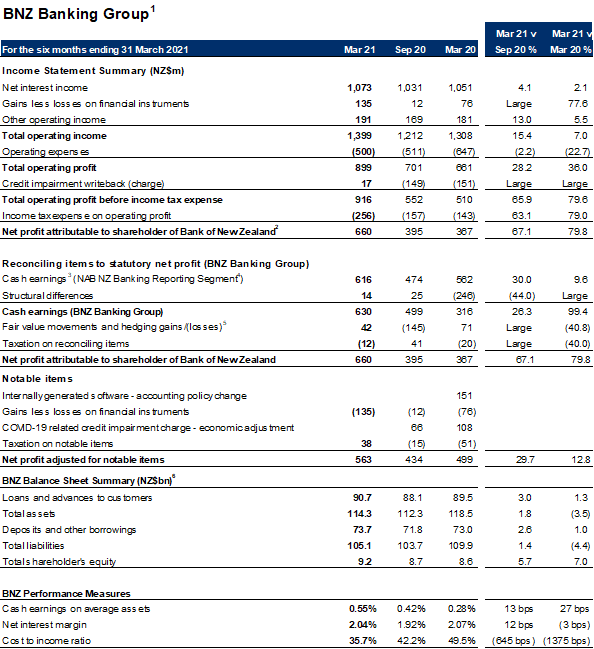

*Note: compared to the six months ended 31 March 2020, unless otherwise stated.

- Statutory net profit of $660 million increased by $293 million (or 80%).

- Excluding notable items, statutory net profit increased by $64 million (or 13%).

- Loans and advances to customers increased 1.3% supported by home loan growth.

- Deposits and other borrowings increased 1.0%.

- Credit impairment writeback/(charge) $17 million, down $168 million.

- More than 97% of customers with COVID-19 home loan deferrals have resumed regular payments.

- KiwiSaver funds under management $3.6 billion, up 32%.

- Total Capital Ratio 16.0% – more than $10 billion total capital invested in New Zealand.

- No ordinary dividends paid to the BNZ parent in Australia.

*An unaudited summary of financial information for the six months ended 31 March 2021 follows:

1. BNZ Banking Group excludes the Insurance operation in New Zealand and includes BNZ’s Markets Trading operations and other central units.

2. Statutory net profit has been prepared in accordance with Generally Accepted Accounting Practice in New Zealand (“NZ GAAP”) It complies with New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”) and other applicable Financial Reporting Standards.

3. Cash earnings is a non-IFRS key financial performance measure used by BNZ for its internal management reporting as it better reflects what BNZ considers to be underlying performance. Cash earnings is calculated by excluding fair value movements and hedging gains/(losses) as they introduce volatility and/or distortion within the statutory net profit which is income neutral over the full term of transactions. A reconciliation of cash earnings to statutory net profit is included on the final page. Cash earnings is not a statutory financial measure, is not presented in accordance with NZ GAAP and is not audited or reviewed in accordance with International Standards on Auditing (New Zealand).

4. NAB NZ Banking Reporting Segment consists of Partnership Banking, servicing consumer and SME segments; Corporate and Institutional Banking, servicing Corporate, Institutional, Agribusiness, and Property customers, and includes Markets Sales operations in New Zealand. New Zealand Banking also includes the Wealth and Insurance franchises operating under the ‘Bank of New Zealand’ brand. It excludes the Bank of New Zealand’s Markets Trading operations.

5. Unrealised fair value gains or losses on economic hedges that do not qualify for hedge accounting and hedge ineffectiveness causes volatility in statutory profit, which is excluded from cash earnings as it is income neutral over the full term of transactions. This arises from fair value movements relating to trading derivatives for risk management purposes; fair value movements relating to assets; liabilities and derivatives designated in hedge relationships; and fair value movements relating to asset and liabilities designated at fair value.

6. Spot volumes (unless otherwise stated).