The exciting world of Venture Capital

17 May 2021

We’ve partnered with OurCrowd to offer our wholesale investors access to global Venture Capital opportunities. Dan Bennett, Managing Partner at OurCrowd, discusses the attraction of investing in this sector and why it’s growing in popularity and significance.

Why is everyone talking about Venture Capital and what is it?

Venture Capital (VC) investing supports company start-ups of various sizes (and at different stages) with funding to help fuel their growth. The global demand for VC and the size of the market is swelling. Recent data from Crunchbase, shows global venture investments reached an all time high of US$125b in the first quarter of 2021, marking a 94% increase year-on- year.

In the past, cautious investors in search of growth could deposit their money in the bank or buy government bonds and enjoy healthy, if not spectacular, returns. But the yields on these low risk investments have fallen significantly; US Treasury bond yields have fallen from around 14% in the 1980s, to 6% in 2000, and to around 2% today. As investors begin to look for returns elsewhere, VC as an alternative asset class has exploded, suggesting huge potential. This has resulted in global investors, such as Yale’s Endowment Fund, increasing its VC portfolio allocation.

Why VC?

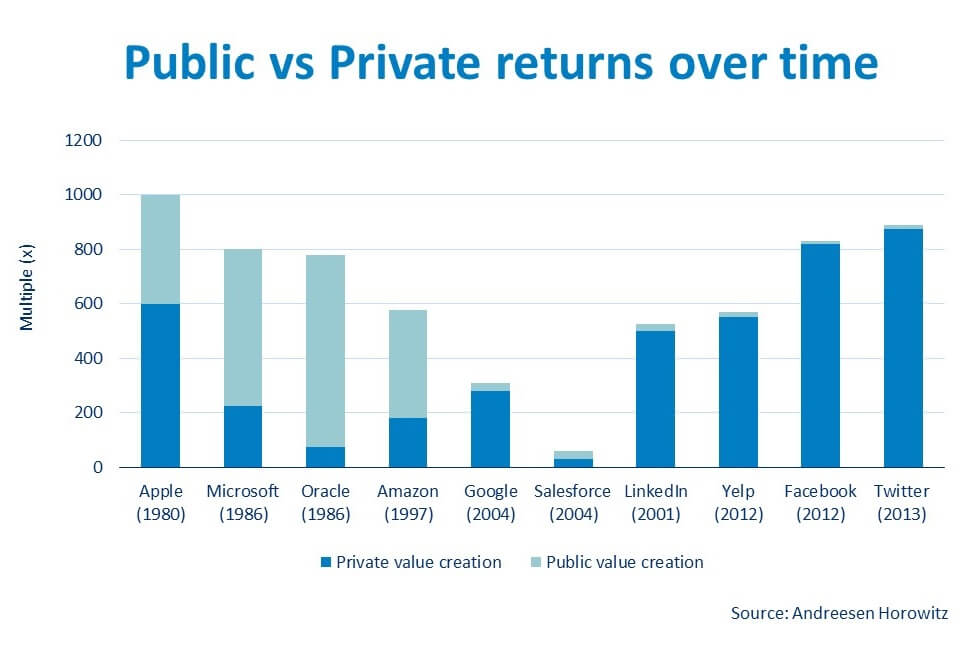

Companies are now delaying Initial Public Offerings (IPOs) to much later in their life-cycle as a result of the influx of seed and growth capital. This, alongside huge strides forward in technology, has allowed private markets to operate more efficiently. According to the US Securities and Exchange Commission (SEC), investors raised $1.4t of new capital in IPOs during 2018, compared to $2.9t in private markets.

When VC succeeds, it can be highly successful. In 2005, Venture Capital firm Accel Partners turned a few heads when it acquired 11% of Facebook for US$12.7m. However, at Facebook’s IPO in 2012, Accel Partners realised a return of 800x its original investment. In 2011, Bessemer Venture Partners acquired nearly half of Intucell, an Israeli start-up, for US$6m in its Series A (and only) investment round. Two years later, Intucell was acquired by Cisco for nearly US$500m, giving Bessemer a return of 25-30x its original investment.

Of course, returns like these are infrequent and VC investments come with a higher risk profile which requires careful management by smart investor strategies or by experienced investment managers. OurCrowd generally advises clients to have a diversified portfolio of 20 or more start-ups across a range of industry sectors, geographies, and stages of investment.

The tech ecosystem and VC

Technology start-ups represent a dynamic opportunity for investors to back fast-growing companies at an early stage, which is when a successful investment often yields the biggest returns. In fact, new start-ups are being created in ever-increasing numbers. In the US alone, the number of businesses less than a year old grew from 733,000 in 2018, to 804,000 in 2020.

Biotech start-ups hit the headlines in 2020 when the first coronavirus vaccines were produced in record time, not by government scientists or corporate giants, but by two biotech companies founded barely a decade earlier. Both Moderna and BioNTech spent 10 years perfecting their groundbreaking research, financed by billions of dollars of VC and other funding lines, before going public in 2018 and 2019 respectively. Their research into new technology and their ability to pivot to bring that technology to bear on the COVID-19 pandemic demonstrated the agility and ingenuity of start-up entrepreneurs.

Investors in tech start-ups are not just motivated by the prospect of profits. Entrepreneurs are addressing issues that investors genuinely want to fund for more altruistic reasons. A huge number of start-ups are developing technology that can improve our world: solving the looming freshwater crisis; reducing food and agricultural waste; combating climate change and reducing carbon emissions; and improving education and medical care for underserved communities. For this reason, OurCrowd’s portfolio purposefully has almost two-thirds of its companies aligned with the United Nations’ Sustainable Development Goals.

Why networks matter in a VC world

Thousands of early-stage entrepreneurs are looking for investors to fund their start-ups, but unless you know them personally or are connected to them through the tech ecosystem, you may never hear about them. It’s also very challenging for an ordinary investor to distinguish between a good start-up team with a great idea and a potential disaster.

Good VC firms, such as OurCrowd, carry out lengthy due diligence on every deal under consideration. They look at the team in great detail and, through years of experience, they interrogate the business plan, the market, the technology and dozens of other factors. In doing so, they reject far more companies than they end up funding. By the time a reputable VC firm adds a start-up to its portfolio, an investor can be confident that the decision is not a wild bet, but a carefully considered decision based on the rigorous due diligence work of highly-trained analysts and industry experts.

Who is OurCrowd?

Founded in 2013, OurCrowd was driven by the idea of democratizing access to investing in the world’s leading technology companies. OurCrowd itself invests in each and every company it puts forward to its investor community – which is generally only 1% of the deals it reviews. With over 80,000 members, and more than NZ$2.5b in committed capital in over 240 portfolio companies, OurCrowd is one of the global leaders in technology investing having enjoyed 45 company exits through IPO or acquisition – including Beyond Meat, Lemonade Insurance, Uber and others.

OurCrowd has global partnerships with leading institutions including Bank of New Zealand to help introduce and expand access to this important and increasingly assertive asset class.

Any views expressed in this article are the personal views of Dan Bennett and do not necessarily represent the views of BNZ, or its related entities.

References to third party websites are provided for your convenience only. BNZ accepts no responsibility for the availability or content of such websites.

This article is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. While BNZ has made every effort to ensure that the information provided is accurate, neither BNZ nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this article.