Consumer card spending beginning to bounce back

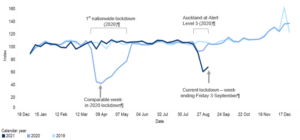

8 Sep 2021New data from Bank of New Zealand (BNZ) show card spending is beginning to bounce back from the previous week.

BNZ Chief Economist, Paul Conway, says, “There are tentative signs that the bounce back from the lockdown is underway, with card spending up 12 per cent on last week. It is now sitting at 37 per cent below pre-lockdown levels.

“With most of the country now at COVID-19 Alert Level 2, it’s expected that spending would rise, but with our biggest city and the centre of the economy still in Alert Level Four that rise will be somewhat sluggish.

“There’s definitely room for optimism. At the same point in the nationwide lockdown in 2020, card spending was 61 per cent below the pre-lockdown average. We continue to see online spending growing too, suggesting that people and businesses may be more adept at operating online, which could be helping to soften the economic impacts,” says Conway.

Total card spending (indexed)

Conway says that across regions, the hit to spending relative to pre-lockdown levels ranges from 63% in Marlborough to 33% in Tasman. The Auckland and Wellington regions have seen spending declines of 40% and 41% respectively.

“We’re also seeing a difference in what New Zealanders are spending their money on. Spending on IT equipment and software, internet payment services, and financial services has surged well ahead of pre-lockdown levels. Spending on hotels, travel, and restaurants has picked up from last week but is still every low compared to normal times.

“As the lockdown eases and the country gets ahead of the outbreak, we hope to see these trends begin to revert back to normal. The pressure on businesses during lockdown is difficult, but we know from previous experience that we can bounce back quickly,” says Conway.

Full report is available here.