FY21 Result: Strong and stable BNZ backing business

9 Nov 2021Bank of New Zealand (BNZ) today released its full year result to 30 September 2021 and says it is backing business to lead New Zealand’s COVID-19 recovery.

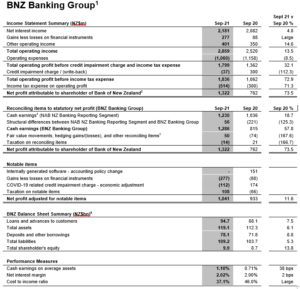

BNZ announced its statutory net profit for the financial year increased by $560 million or 74% to $1.32 billion driven by a strong bounce back in the New Zealand economy, non-repeat of notable items from the prior financial year and strong revenue growth. Excluding notable items, statutory net profit increased by $108 million (12%) to $1 billion over the prior comparable period.

New Zealand’s business bank

BNZ CEO Dan Huggins says BNZ is strong, stable and well-capitalised to support a business-led recovery: “Business is in our DNA. We’re being flexible and innovative, and backing customers to find opportunities.

“We were the leading lender under the Government backed Business Finance Guarantee Scheme and our own Good to Grow scheme has supported businesses with nearly $300 million to help drive sustainability, productivity, growth and expansion plans.”

Mr Huggins says BNZ is intent on playing its part to support the country’s health response and help build more resilient and sustainable businesses.

“We cut merchant and contactless fees, which has helped to reduce costs for businesses and enable them to provide contactless payments, and our Direct Cash service has streamlined change orders and reduced the need for physical contact.

“We’re incentivising environmental and social improvements through new lending products, integrating environmental, social and governance considerations into our decision making and working with customers to transition to a low carbon future.

“Likewise, digital technologies have the potential to improve environmental outcomes and productivity, and last month we launched an initiative with Zeald to help transform businesses by accelerating their digital presence,” he says.

Supporting homeowners

Mr Huggins says he is pleased that BNZ has been able to support first home buyers in a competitive housing market.

“In the last 12 months we have supported 4,678 New Zealanders into their first home and partnered with Kāinga Ora on its First Home Partner shared ownership scheme that makes it easier for Kiwis to own their first home,” he says.

Additionally, BNZ helped 11,764 New Zealanders to renovate and invest in existing properties and supported the development of more than 1,600 new home builds.

Simple, digital, human when it matters

Mr Huggins says BNZ is focused on making banking simple and accessible for its customers and has seen digital use continue to accelerate with more than half of all home loan rollovers, lump sum payments and changes to repayments now occurring digitally.

“The pandemic has changed the way our customers bank, they are online and on the phones,” he says.

Mr Huggins says BNZ is supporting its customers to bank digitally and has reconfigured its operations to be more simple and accessible, helping connect customers to bankers no matter how they choose to get in touch.

“When it comes to the big decisions in their life, customers want to speak to our bankers. In addition to our digital services, we’ve increased our availability on the phones on video and online while maintaining a 140 strong branch and business banking centre network,” he says.

Mr Huggins says BNZ has made good progress on simplifying its product range: “Three years ago we promised to halve our banking product range and we will hit that milestone this year. It frees up our people to support customers and speaks to our continued focus on reducing complexity and making banking easy,” he says.

Building an inclusive New Zealand economy

Mr Huggins says digital technology has the potential to help business and all New Zealanders.

“We’re supporting our customers to embrace online banking and New Zealanders to connect digitally and stay safe online. It’s the key to delivering a more inclusive and productive economy,” he says.

BNZ is a member of the Digital Boost Alliance and in addition to the initiative with Zeald, this year, BNZ’s annual Scam Savvy week helped more than 50,000 people learn how to identify and avoid online and phone scams.

Key Financial Items

*Note: compared to the 12 months ended 30 September 2020, unless otherwise stated.

- Statutory net profit of $1.32 billion increased by $560 million (or 7.4%)

- Excluding notable items, statutory net profit increased by $108 million (or 12%)

- Loans and advances to customers increased by 7.5% supported by home loan growth

- Deposits and other borrowings increased by 8.8%

- Credit impairment writeback of $37 million

- KiwiSaver funds under management of $4.1 billion, increased by 24%

- Total capital ratio of 16.9% – approximately $10 billion total of shareholder’s equity invested in New Zealand and around $120 billion in assets

- More than $1 billion of New Zealand income tax, wage and salary payments related to FY21

*An unaudited summary of financial information for the year ended 30 September 2021 follows:

- BNZ Banking Group excludes the Insurance operation in New Zealand and includes BNZ’s Markets Trading operations and other central units.

- Statutory net profit has been prepared in accordance with Generally Accepted Accounting Practice in New Zealand (“”NZ GAAP”) It complies with New Zealand equivalents to International Financial Reporting Standards (“”NZ IFRS””) and other applicable Financial Reporting Standards.

- Cash earnings is a non-IFRS key financial performance measure used by BNZ for its internal management reporting as it better reflects what BNZ considers to be underlying performance. Cash earnings is calculated by excluding fair value movements and hedging gains/(losses) as they introduce volatility and/or distortion within the statutory net profit which is income neutral over the full term of transactions. A reconciliation of cash earnings to statutory net profit is included on the final page. Cash earnings is not a statutory financial measure, is not presented in accordance with NZ GAAP and is not audited or reviewed in accordance with International Standards on Auditing (New Zealand).

- NAB NZ Banking Reporting Segment consists of Partnership Banking, servicing retail, business and private customers; Corporate and Institutional Banking, servicing corporate and institutional customers, and includes Markets Sales operations in New Zealand. New Zealand Banking also includes the Wealth and Insurance franchises operating under the ‘Bank of New Zealand’ brand. It excludes the Bank of New Zealand’s Markets Trading operations.

- Unrealised fair value gains or losses on economic hedges that do not qualify for hedge accounting and hedge ineffectiveness causes volatility in statutory profit, which is excluded from cash earnings as it is income neutral over the full term of transactions. This arises from fair value movements relating to trading derivatives for risk management purposes; fair value movements relating to assets; liabilities and derivatives designated in hedge relationships; and fair value movements relating to asset and liabilities designated at fair value. Other reconciling items includes costs associated with discontinued operations of the NAB Group.

- Spot volumes (unless otherwise stated).