HY22 Result: BNZ backing business and innovating for customers

5 May 2022Bank of New Zealand (BNZ) today released its half year result to 31 March 2022 and says a resilient New Zealand economy, revenue growth and focused capital management have put it in a strong position to help customers navigate continued uncertainty.

BNZ announced its statutory net profit increased by $49 million or 7.4% to $709 million.

Excluding notable items, statutory net profit increased by $10 million (1.8%) over the prior comparable period to $668 million.

Supporting New Zealanders

BNZ CEO Dan Huggins says, “We’ve worked hard to support our customers to invest in their businesses, homes and futures. New Zealand’s resilience and success can be seen in our results.”

In the last six months, BNZ has supported its business customers to navigate uncertainty, innovate and grow and helped 5,876 New Zealanders buy and invest in homes. BNZ’s total lending grew 7.8% on the prior comparable period.

Mr Huggins also thanked customers for their ongoing support and loyalty as BNZ received further awards for its internet and app banking platforms and its market leading position in consumer NPS*.

“While there is uncertainty ahead, we also see opportunity. We’ll continue to be flexible and supportive and find ways to make banking easy for our customers,” he says.

Delivering for business

Mr Huggins says he’s proud of BNZ’s efforts to support a business-led recovery: “New Zealand’s business owners deserve the country’s thanks. Over the past two years they’ve poured everything into keeping their doors open and people in jobs. BNZ’s been there every step of the way and will continue to be.”

In addition to supporting tens of thousands of businesses through the pandemic response and economic uncertainty, BNZ helped 7,621 small and medium businesses with new or increased lending in the last six months.

“With uncertainty continuing to dominate the outlook, we’ve set about making life easier and more predictable for our business customers with low-cost lending, and increased flexibility and value in how businesses transact,” he says.

BNZ has continued to lead the market in delivering innovative banking technology to customers and will soon launch New Zealand’s first Android “tap on phone” solution, which will give small retailers the option to use a smartphone as a payment terminal. It follows BNZ unveiling a new small business payments package late last year that reduces costs and allows a wider range of payment types.

Banking made easy and sustainable

Since September last year, BNZ has maintained a number 1 position in consumer banking* and received first place awards in consecutive years for its online and app-based banking.**

“We listen to our customers, continually improve, innovate and strive to deliver them the easy and accessible digital banking experience they demand,” says Mr Huggins.

“We’re integrating the latest technology into how we work and how our customers bank. It’s about adaptation and resilience, and helping our customers be more productive,” he said.

As part of BNZ’s focus to increase sustainability for customers and deliver a low emissions economy, it will this month launch New Zealand’s first Agri-Sustainability Linked Loan product (Agri-SLL). Available to New Zealand’s farmers, the Agri-SLL will support them to invest in measures that help to protect the environment, lower emissions and increase the long-term sustainability of their farms.

Key Financial Items

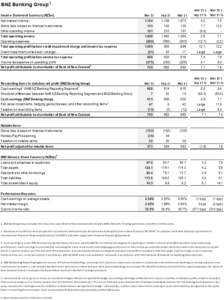

Note: compared to the six months ended 31 March 2021, unless otherwise stated.

- Statutory net profit of $709 million increased by $49 million (or 7.4%)

- Excluding notable items, statutory net profit increased by $10 million (or 1.8%)

- Loans and advances to customers increased 7.8% supported by home loan growth

- Deposits and other borrowings increased 9.1%

- KiwiSaver funds under management increased by $800 million, up 23%

- Total Capital Ratio 15.3% – more than $11 billion total capital invested in New Zealand

- More than $1 billion of payments to New Zealand employees and income tax in last 12 months

*First in customer loyalty and satisfaction, as measured by consumer Net Promoter Score (NPS): September 2021 and April 2022

**Canstar Online Bank of the Year: 2018, 2019, 2020 and 2021

An unaudited summary of financial information for the six months ended 31 March 2022 follows: