Small changes can make a big difference for your retirement

23 Nov 2022

The start of a new year is a good time to review your savings goals. This has been a challenging time, against a backdrop of rising costs and difficult markets. For some, the cost of KiwiSaver contributions above the minimum may not be a priority right now, but it is worth considering the impact that your contribution rate can have on your future account balance.

For most investors, KiwiSaver is a long-term investment, and time is on your side. Because of this, small changes in the amount you contribute along the way can make a big difference to your account balance when you reach retirement age.

Every little bit helps

If you’ve looked at your own circumstances and found you’re able to maintain a higher level of KiwiSaver contributions, this could help set you up for a better retirement. It’s worth checking in to see how you’re tracking, as you may find you need to adjust your contribution rate to better suit your future plans.

Tip: Use our online calculator to see how your KiwiSaver savings might grow between now and age 65, and the impact your fund choice or contribution rate could have on your lifestyle when you retire. What’s more, you can see what impact some simple changes could have on your future account balance. You can find out more about the BNZ KiwiSaver Scheme here

Regular contributions add up to a bright future

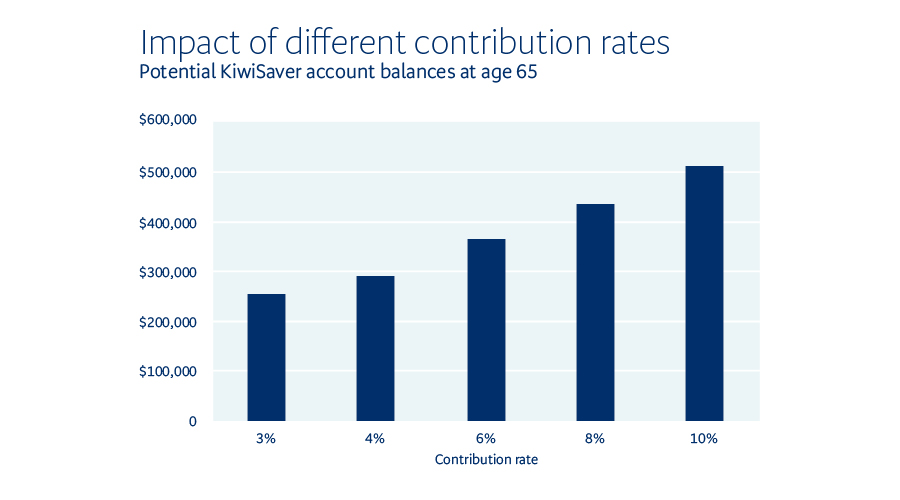

Let’s take a look at the potential impact of different KiwiSaver contribution rates. We’ve based this example on a hypothetical KiwiSaver member called Ana.

Ana is 30-years old and currently earns $55,000 per year before tax. She has already saved $15,000 in her KiwiSaver account and has selected a Growth fund to save for her retirement. The assumptions used to calculate these projections are set out at the base of this article*.

At age 65, Ana’s KiwiSaver savings could be worth $257,000 if left at the 3% contribution rate, but if she switches to the 4% rate now (at age 30), her savings could be worth $294,000 by the time she is 65. This increases up to $514,000 at age 65, if she chooses the 10% contribution rate at age 30. Depending on your situation, a manageable increase in contributions to your KiwiSaver account could make a big difference in the long term.

How do I change my contribution rate?

It’s easy to take care of your BNZ KiwiSaver Scheme account in the BNZ app or Internet Banking. You can change your contributions, check your balance, view transactions, and make voluntary contributions. You can learn more about this here.

Choosing how much of your pay you want to save can make a surprisingly big impact on your future account balance. If you’re employed, you can choose to contribute between 3%, 4%, 6%, 8%, or even 10% of your before-tax pay. While many New Zealanders get started with 3% employee contributions when first joining KiwiSaver, it’s worth reviewing your contribution rate to make sure your savings are still tracking well for your future plans. You can change your KiwiSaver contribution rate once every 3 months, unless your employer agrees to a shorter timeframe.

What if I’m self-employed?

If you’re working as contractor, sole trader, or freelancer and not earning PAYE income, then you can still make regular contributions to your KiwiSaver. Many self-employed people choose to set up a direct debit or automatic payment to keep their savings on track. You can choose your own level and frequency of contributions.

This will also help make sure you get the most out of the annual Government contribution. That’s because just like all KiwiSaver members, you need to put at least $1,042.86 into your KiwiSaver account before 30 June each year, to receive the maximum Government contribution of $521.43. You can find out more about Government contributions and eligibility criteria here.

Taking control of your KiwiSaver account now could mean more money saved for your future goals. The more you contribute now, the more you’ll likely have to retire on when the time comes. Even small increases can really add up over time.

*Ana’s KiwiSaver account projections are for the purposes of illustrating the impact a different contribution rate can have on a KiwiSaver account balance at retirement and are based on several assumptions which are set out below in more detail. These hypothetical KiwiSaver account projections are therefore unlikely to reflect an actual KiwiSaver account balance at retirement. For example, actual investment returns are likely to move up and down due to investment and other risks. Returns may be negative over some time periods.

How this example works:

- The value of Ana’s KiwiSaver account at age 65 is adjusted for inflation so you can see what her account balance would be worth in today’s money.

- The results obtained in this example are not guaranteed to occur, and the example is simply an illustration to help you understand how choosing a different contribution rate can impact the value of your KiwiSaver account at age 65.

- The retirement projections in this example are based in part on assumptions for a Growth fund set by the Government. These assumptions may not reflect actual market conditions. A summary of the assumptions as used in this example is provided below, however, further details about the Government assumptions for retirement projections can be found on the Financial Markets Authority website.

The account balance projections calculated in this example are based on the following assumptions:

- Salary and wages assumed to increase by 3.5% each year.

- No savings suspensions are taken.

- No amounts are withdrawn for first home purchase or financial hardship.

- Assumes continuous eligibility for and availability of Government contributions (calculated at 50c for every $1 contributed by the member up to a maximum of $521.43 each year).

- The member remains invested in a Growth fund until age 65.

- The rate of return for the Growth fund assumes a positive rate of return each year of 4.5% p.a, which is stated after fees (using an industry average for the fund type that may not reflect actual fees) and after tax (using a prescribed investor rate of 28%).

- The projections are adjusted for inflation, and the inflation assumption is 2% per annum.

Important information:

Any views expressed in this article are the personal views the author and do not necessarily represent the views of BNZ, or its related entities. This article is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Neither Bank of New Zealand nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, information, representation or omission, whether negligent or otherwise, contained in this article.

BNZ Investment Services Limited, a wholly owned subsidiary of Bank of New Zealand (‘BNZ’), is the issuer and manager of the BNZ KiwiSaver Scheme. A copy of the BNZ KiwiSaver Scheme Product Disclosure Statement is available on bnz.co.nz. Investments made in the BNZ KiwiSaver Scheme do not represent deposits or other liabilities of BNZ or any other member of the National Australia Bank Limited group, and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of BNZ or any other member of the National Australia Bank Limited group, the Supervisor, and any other director of any of them, the Crown or any other person guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of capital.