Housing affordability metrics to keep improving in 2023

19 Dec 2022

- Stonking Q3 GDP figures overstate economic momentum. We haven’t changed our interest rate view.

- We formalise a lower house price forecast. We now see a 20% peak-to-trough correction, with downside risk.

- Housing affordability metrics should continue to improve (from low levels) through 2023. We build a new index based on house prices, income growth, and debt servicing.

In this, our last missive for the year, we take a quick tour of recently released GDP and housing market figures, before finishing with a closer look at housing affordability. Have a safe and relaxing holiday period. See you next year!

Third quarter GDP growth booms

Last week’s third quarter (three months to September) GDP figures shot the lights out, helping to explain why capacity, labour market, and inflation pressures have been so pervasive this year.

GDP rose 2.0% over the quarter, miles above what anyone expected, including our top-of-market 1.3% pick. This lifted annual economic growth to a heady 6.4%, good enough to eclipse most of our key trading partners (chart below).

Simply put, NZ’s economy has overheated to a greater extent than elsewhere, and this is why our central bank continues to hike rates aggressively at a time when others (most notably in the US, Australia, and Europe) have been able to slow down the pace of hikes.

Despite the surprise, the Q3 growth numbers haven’t fundamentally altered our view of the world.

Good news is bad news?

There were plenty of stellar performances in Q3 that won’t be repeated. For example, the sizable lift in construction and larger-than-expected tourism contribution as the borders reopened. And, perversely, the higher level of economic activity achieved in the third quarter will make it more difficult to post economic growth from here. Meanwhile, more forward-looking indicators continue to slowly tilt southwards. We can put last week’s local housing and manufacturing data in this camp.

So, despite the much stronger starting position for the economy, our interest rate view remains the same (while eyeing the important inflation/labour market updates due in late January/early February). We continue to expect the Reserve Bank to lift the Official Cash Rate to a peak of 5.5% next year. This promises to keep, particularly short-term, mortgage rates biased higher early in the New Year.

House price forecast nudged lower

The local housing market remains out for the count. Far from showing any signs of spring zeal, the latest (November) REINZ housing figures, if anything, painted a picture of the downturn accelerating.

Mainland residence

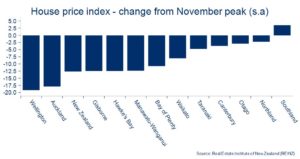

The 1.9% (seasonally adjusted) fall in the REINZ House Price Index was the largest monthly decline since the cycle peak a year ago. National prices have now fallen 14% from this peak but, as the chart above shows, there’s been plenty of regional variation within this. The outperformance of the South Island, for example, really jumps out.

In terms of the outlook, we reckon the various positives and negatives now net a little further to the downside. Here’s our quick tally up:

- Negative. The latest round of mortgage rate increases will put prospects for a summer house price bounce on ice.

- Negative. Turnover has slowed to a crawl. It’s running at the lowest level in 12 years. Houses are thus sitting on the market for longer, as prospective buyers remain absent. To us, this suggests the ‘true’ level of house prices is probably a bit lower than the printed numbers suggest, as sellers unhappy with available bids have tended to withdraw listings rather than meet the market.

- There’s more housing supply due to come on stream next year. The higher inventory recorded to date largely reflects reduced sales volumes.

- The broader economic outlook for next year is poor, and this won’t help confidence. We might also see a few wobbles in the currently red-hot labour market next year.

- The impact of the staged reduction in interest rate tax deductibility for investors is rising as mortgage rates rise.

- Positive. Net migration is running ahead of expectations, with a net inflow now recorded for the past four months.

- Employment and wage growth remain very strong.

The (im)balance of the above means we’ve further tabbed down our expectations for the housing downturn. We now see a 20% peak-to-trough correction, essentially formalising the lower end of the 15-20% range we’ve long had on the board.

Further to run for housing correction

Admittedly, the risk is for an outcome weaker than this but we’re all clutching at straws when it comes to picking the exact magnitude of the correction, so we’ll stick with -20%

for now. We continue to have more conviction about our view that any recovery in house prices over the second half of 2023 will be tepid.

Falling prices brings affordability into focus

The faster-than-expected house price correction is giving rise to chatter about improving (or ‘less bad’) housing affordability.

In thinking about the subject, the first point to note is that the (falling) price of a house isn’t the only game in town. There’s also the increased cost of servicing a mortgage to factor in. Carded mortgage rates are 2½ times higher than 18 months ago in some cases. Movements in the household incomes used to pay these bills also need to be accounted for. In practice, there’s a long list of other factors too, but house prices, debt servicing costs, and incomes stand out as the big ones.

The thing is, they’re all moving at different rates and, in some cases, different directions. This muddies the affordability waters somewhat (chart below).

Dancing to different beats

To help see through the murk, we pulled an index together that combines all three. It’s back of the envelope stuff, designed to get at ‘the average’ prospective home buyer. The reality is that all situations will be different. But it at least gives us an idea about the rough direction and magnitude of the net of the three variables noted above.

The design is such that the index effectively proxies housing costs for a prospective buyer, in just the first year of ownership (the majority of which will be the deposit).[1] It assumes a deposit of 20% of the median national house price can be cobbled together. To this we add debt servicing costs in the first year, based on 2-year fixed mortgage rates, all divided by the average household disposable income (our own proxy measure).

In this way, the index can be loosely interpreted as the multiples of household disposable income required to pay the deposit and first year of debt servicing costs. The chart below plots the resultant time series, incorporating our forecasts based on the individual components.

Improved, but not by much

We draw the following broad conclusions:

- Housing affordability has improved, but not by much. Our index (marked at Q3 2022) is about 10% above the recent December 2021 low point. This follows a steady period of deterioration.

- Higher wage/income growth is proving to be a significant offset to higher debt servicing costs.

- Affordability is expected to continue to improve through 2023 as lower house prices (over the first half of 2023) and steady growth in incomes offset higher expected debt servicing costs.

- Based on our projections, affordability, as proxied by the index, will have improved back to pre-COVID levels by around the end of 2023. This compares to our house price forecast which, if correct (a big ‘if’), would put house prices still 10-15% above pre-COVID levels by end 2023. Again, this is testament to solid household income growth.

Finally, and as a nod to still-swirling economic uncertainty, we’ve run a few different scenarios through the index, as illustrated in the chart below. These are run on a ‘holding all else equal’ basis but are hopefully interesting nonetheless.

Scenarios

To subscribe to Mike’s updates, click here

[1] Technically, the discounted value of all future costs – notably debt servicing – should be included, but we’ve made some simplifying assumptions for ease of interpretation.

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. This publication is intended only for the person in New Zealand to whom it is sent by BNZ, and must be treated as strictly confidential. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.