BNZ FY23 Results: Solid performance as economy slows

9 Nov 2023BNZ announced a statutory net profit of $1,509 million for the 12 months to 30 September 2023, up 6.7% or $95 million on the previous year. The result reflects a strong first half, with a decline in Net Profit of 12.5% in the second half reflecting the broader economic slowdown in New Zealand.

CEO Dan Huggins says challenging economic conditions have impacted business and household confidence and this has flowed through into BNZ’s result in the second half of the year.

“Inflation, while softening, remains high, and as the official cash rate has risen, businesses and households have taken a more cautious approach to borrowing.

“Despite the slowing economy and intense competition across the banking sector, we’ve continued to see growth across the business as more New Zealanders choose to bank with BNZ.

“Customer deposits are up 5.8% to $78.5 billion compared to the same period last year. Home lending increased 5.3% to $57.7 billion, with nearly 5,000 home loan customers switching to BNZ from other lenders in the 12 months to 30 September.”

Mr Huggins says BNZ remains strong, stable and well capitalised. “With more than $12 billion in total capital, we’re well positioned to continue supporting our customers and the New Zealand economy.”

Supporting our customers

BNZ recognises the cost-of-living pressures that are challenging household budgets, and the concerns New Zealanders have about keeping safe from scams and frauds.

“While most of our home lending customers have moved onto higher rates, we continue to proactively contact those who we have identified as potentially needing additional support,” says Mr Huggins.

“With an increase in scams and fraud impacting more New Zealanders, protecting our customers and helping them stay safe online remains a priority. We continue to invest significantly in fraud protection measures, and we support the establishment of a multi-agency anti-scam centre and the introduction of account name and number matching, which will add additional layers of protection for New Zealanders.

“We continue to work alongside our business customers as they navigate their way through a variety of ongoing challenges. The impacts of adverse economic conditions and this year’s severe weather events are still being felt by a number of our customers.

“We have made $1 billion in low-cost lending available through our Business Recovery and Resilience Fund, committed more than $50 million in interest relief, and provided nearly $900,000 in cash and community grants,” says Mr Huggins.

Outlook

Economic growth is expected to remain flat for the next 12 months, however, Mr Huggins says BNZ is cautiously optimistic that business and household confidence will begin to rebuild in 2024.

“New Zealanders are resilient, and while the year ahead will remain challenging, we are optimistic about New Zealand’s future potential and prosperity. As BNZ has done for the past 160 years, we’ll continue to support our customers and New Zealand.”

Key Financial Items

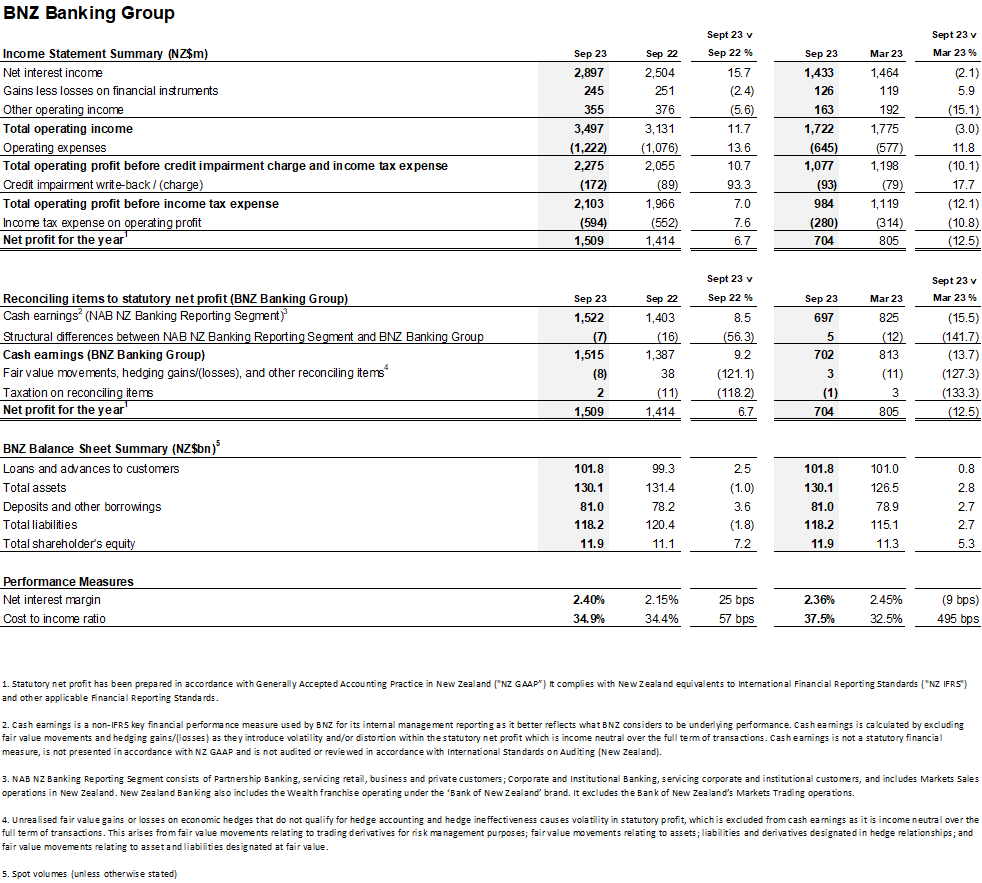

Note: compared to the year ended 30 September 2022, unless otherwise stated.

Statutory net profit of $1,509 million increased by $95 million, or 6.7%

- Loans and advances to customers increased by $2.5 billion to $102 billion driven by home loan growth

- Customer deposits and other borrowings increased $2.8 billion to $81 billion

- KiwiSaver funds under management increased by $733 million, up 17%

- Total Capital Ratio 15.7% – more than $12 billion invested in New Zealand

An unaudited summary of financial information for the 12 months ended 30 September 2023 follows: