Eco-Pulse: Green shoots pruned

7 May 2024

- Economic concerns mounting

- As latest eco-news tilts a darker shade of grey

- Green shoots pruned rather than pulled

- Steadied by stabilising global economy and rate cut expectations

- No reason to change our view of a November OCR cut

Concerns about the state of the economy are creeping up to the top of firms’ list of challenges. That’s evident in both surveys and the tone of our recent client discussions. Skimming the past few weeks of eco-news, it’s not hard to see why.

- Retail card spending fell another 0.7% m/m in March, signalling the severe contraction in per-capita spending volumes remains very much in play

- Similar implications can be drawn from the hefty (5%) fall in ANZ consumer confidence in April. It abruptly flattened part of what had been a cautious recovery

- Business confidence remains relatively sturdier, but also fell over March and April

- Building intentions remain in decline – the value of residential consents was down 27% on year-ago levels in March, to be 37% below the 2022 peak

- Housing market activity remained listless in March, with inventory at 7-year highs and house prices flat-to-falling in most regions

- Employment fell 0.2% q/q in Q1 and, as of April, more firms now expect to lower staffing levels than increase them (according to the ANZ outlook survey)

- Manufacturing and service sector activity slid back into contractionary territory in March, according to the latest PMI and PSI readings

- Despite these economic fragilities, cost pressures remain intense

Against already shaky economic fundamentals, a chunk of the above likely reflects the further wearing off of some of the factors that had been sheltering us from the storm.

Most borrowers have now rolled off low mortgage rates. According to the Reserve Bank the average mortgage rate being paid is now 85% of the way to its estimated peak. The savings buffers of some households are being chewed through, fiscal support is being withdrawn, and the labour market is no longer in a strong state.

Confidence wobble

To the extent we’ve been bracing for some of these impacts, the gloomy vibe of incoming data hasn’t been too far out of line with our already dour economic forecasts. The exception, though, is the shrivelling in some of the more forward-looking indicators.

The earlier normalisation in business confidence (firms’ activity expectations especially) and perk up in the PMI/PSI, for example, had tended to support the idea that economic activity might sputter back into life over the second half of the year. With those green shoots wilting a little, that view is being tested.

The upshot is that we may need to moderate the magnitude of any resumption in GDP growth over the second half of this year. Our sense is still that we’re still scraping along the bottom of the business cycle and the cycle will turn late in the year. But even if it does it will probably be well into 2025 before it starts to feel that way.

Still cycling down

Alongside the downside risks, there are a couple of factors that are assumed to provide something of a floor for activity. The first is that, despite a grab bag of downside risks, the global economy looks to be past the worst. The second is that we’ll see interest rate cuts in NZ before the year is out.

Global worm slowly turning

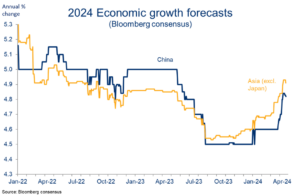

On the first, yes, the continued grind upwards in global growth expectations has largely been on the shoulders of the US. Expectations are also still well south of any sort of trend or average. But we’ve been encouraged recently to see some firmer news out of China and Asia.

Worm turning

Notably, this has included more measures aimed at supporting the struggling Chinese property market. They may well be more band-aids than fundamental fixes but, along with stabilising manufacturing activity, it’s feeding through to an improvement in growth expectations in the region (chart below).

This is important given NZ’s large trade exposures to China. At the margin it is a positive for our export demand and export prices at a time when parts of the agriculture sector remain under significant cash flow pressure.

Past peak pessimism?

Interest rate expectations unchanged

On interest rates, we haven’t changed our view that the Reserve Bank will be in a position to start lowering the official cash rate (OCR) in November. That’s earlier than the Bank’s own (Q2 2025) forecasts and our sense of the forecaster consensus generally.

The passing of the latest top-tier inflation and labour market statistics, on net, hasn’t done any damage to this view.

- CPI inflation fell to 4.0% in the March quarter. As has been widely reported, the ‘mix’ wasn’t particularly RBNZ friendly with services inflation still worryingly high (at 5.3% y/y). But these concerns need to be balanced against the clearly decelerating rate of quarter-to-quarter inflation. Some measures of annualised inflation are thus now inside, or close to, the RBNZ’s 1-3% target range (chart below). And we still anticipate headline CPI inflation will be well inside the target range by Q3 of this year (published in October). Formally, we expect a 2.7% annual print for the latter.

Annualised inflation falling rapidly

- The shift in labour market conditions appears to be occurring a touch faster than most expected which, in time, should help take the sting out of sticky services inflation. Last week’s Q1 labour market figures showed the unemployment rate lifting to 4.3%, and private sector wage growth easing to 3.8%y/y. Both trends have further to run. Labour supply growth through migration is moderating but continuing, at the same time as firms are pegging back hiring plans. Job ads remain in decline. In short, all roads point to the unemployment rate headed above 5% later in the year, further sapping wage growth, spending power, and housing market activity.

Of course, plenty can happen between now and November. The new government’s first Budget at the end of the month stands out as important. We’ll also be watching inflation indicators and inflation expectations measures particularly.

The recent trend depreciation of the NZ dollar is a new-ish risk to add to the pile. While not uniform in nature (NZD/JPY is up 2% since March), the fall in the currency could further frustrate progress in reducing inflation if it continues (the trade-weighted NZD is 1.1% below RBNZ assumptions). The flip-side is that it is assisting the rebalancing of the economy in part by offsetting some of the headwinds facing export revenues.

Over the remainder of the year, we continue to view a modest appreciation in NZD/USD as more likely than continued weakness. But the strong US economy and dimming hopes for mid-year US rate cuts mean we’ve nudged down the extent of any expected appreciation. Our forecasts imply it ending the year near the top of the recent 0.5800-0.6200 range.

| Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. |