Why New Zealand is an ideal home for emerging technology creators

17 May 2024

The world of EmergingTech is, ‘emerging’ – in every sense – from the regulatory, ethical, social, political, and environmental landscape around it, to the very nature of the products and services created. Across all of these aspects, I believe New Zealand offers unique advantages for this sector.

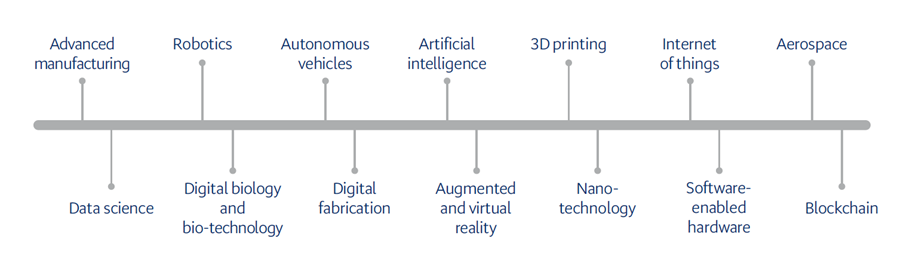

EmergingTech refers to technology businesses that produce – or have core to their offering – general purpose technologies that are new and exponentially growing. This includes, but is not limited to the following – many of which are fast growing in New Zealand, from our vantage point:

While we refer to the above as EmergingTech, businesses in this area will often be referred to as ‘deep tech’.

New Zealand’s success so far in EmergingTech has been within niche areas often centered around key personalities with a deep area of expertise. In my view, we have the opportunity to add to these niches and, over time, leading to a natural bias to create and build EmergingTech businesses in New Zealand as opposed to importing or adopting emerging technologies from overseas.

For many people, the notion of creating emerging technologies can be both fascinating and frightening. I think New Zealand is an ideal home for it to develop and grow.

The New Zealand Opportunity

B.F Skinner once said; “The real problem is not whether machines think but whether [people] do*.” While there’s a valid debate to be had about the risks associated with the invention of thinking machines, there’s little argument about the need for EmergingTech to develop in the hands of people who can think critically, creatively, sustainably, ethically, and commercially. If anyone can do this, it’s us.

New Zealand is a trusted business partner on the world stage, with robust export controls and strong values around protecting people and place. A key advantage that many tech leaders globally recognise in New Zealand is the proximity between the public and private sector, including capital providers. This is a particular advantage in this context, given the heightened potential regulatory, political, and social considerations for emerging technologies.

Our history says a lot about our future

Historically, New Zealand has been recognised as a great testing ground for new technologies, in part due to our population size, demographic, and diversity. These ingredients still seem to hold true, which means we are fortunate to have a valuable testing ground in our front yard.

Baked into the New Zealand psyche is the ability to improvise. There’s something about being left alone to get on with things that has turned our (relative) geographic isolation into an advantage.

Take the Gallagher business for example, it started – quite literally – with number eight wire (fencing) and has since transformed into a leading global exporter of cutting-edge security solutions. Fisher & Paykel is also notable with its transition from refrigeration to healthcare, and for nurturing talent who have gone on to work in a myriad of emerging technology start-ups.

In more recent times, New Zealand boasts world-leading examples of avatar development, nanofiber, aerospace, satellite propulsion, and prosthetics to name a few. While this is evident all over the country, there’s a particularly strong and growing EmergingTech foothold in Christchurch – home to the impressive Engineering School at the University of Canterbury. This is where we are founding and growing BNZ’s EmergingTech team, starting with the appointment of Jason P Hill, Head of EmergingTech Business. Jason’s focus is supporting the growth of the industry in New Zealand through non-dilutive financing, expertise, and networks.

Investing in specialist knowledge and expertise among unique sub sectors, at a leadership level, is a key part of how we support New Zealand’s growth sectors (see also Watch these spaces, BNZ triples down on tech sector, Stacking up: BNZ steps up support for the FinTech and PayTech sectors, and The greater good: capital and connections to accelerate the Climate and CleanTech sector). Jason has seen firsthand the region transition from more traditional manufacturing to high tech and advanced manufacturing with a growing reputation as a global leader in aerospace, among other things.

How we get growing

There is a lot more thinking to be done around the environmental, social, governance, security, political, and ethical implications of EmergingTech. I believe New Zealand could lead this by example and creation.

Much like the rest of the technology industries, EmergingTech and emerging technologies are evolving quickly, both within New Zealand and overseas. With this, we will continue to face new challenges, including how we, including us as a bank, think about and mitigate environmental, social, and governance (ESG) considerations risks. At BNZ, we are taking an open-minded approach and realise that this changing environment may require us to adapt internal bank policies to cater for new opportunities and risks as they arise. We are continuously learning, and will remain adaptive, so that we can play a meaningful part in supporting the growth of our customers within this sector.

In addition to the above, we recognise that growing an EmergingTech business tends to be particularly capital intensive; and capital is a big part of what we do. We have a range of funding solutions in order to support with capital earlier than a more traditional banking approach. These include revenue-based financing, contract-receivables financing and an initiative we call Project Scale Up. For any business or stakeholder operating in the EmergingTech space, I warmly encourage you to reach out to either Jason Hill, our new Head of EmergingTech, or myself. It’s not just about capital, we are actively working to bring people together – across private and public – to nurture and grow this unique sub-sector, including with the support of our wider Growth Sectors team.

This article is solely for information purposes. It’s not financial or other professional advice. For help, please contact BNZ or your professional adviser.

No party, including BNZ, is liable for direct or indirect loss or damage resulting from the content of this article. Any opinions in this article are not necessarily shared by BNZ or anyone else. References to third party websites are provided for your convenience only. BNZ accepts no responsibility for the availability or content of such websites. Any views expressed in this article are the personal views of Timothy Wixon and do not necessarily represent the views of BNZ, or its related entities. This article is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Neither BNZ nor any person involved in this article accepts any liability for any direct or indirect loss or damage arising out of the use of, or reliance on, all or any part of the content.

*B F Skinner Contingencies of Reinforcement (1969) ch. 9