BNZ launches new anti-scam tool to lock scammers out of online banking

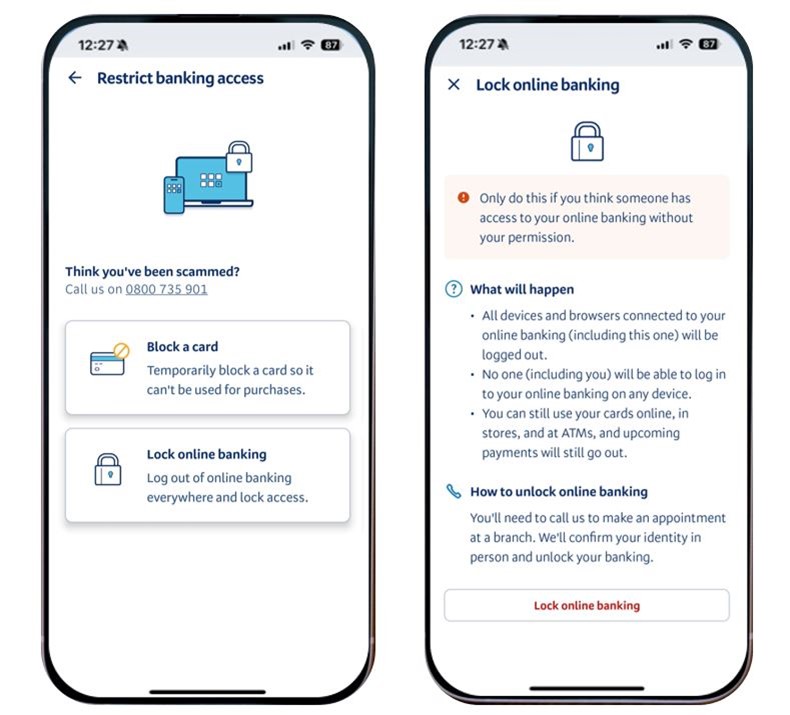

9 Oct 2024BNZ is rolling out its latest anti-scam and fraud measure, launching an ‘online banking lock’ feature which gives customers the ability to disable all online banking activity and lock access to their online banking if they suspect a scammer has gained access to their accounts.

“BNZ is continually looking for new ways to enhance protection for customers and combat criminal scammers,” says BNZ’s Head of Financial Crime Ashley Kai Fong.

“While anyone who thinks they’re being scammed should call their bank straight away, this new tool – available in the BNZ app – gives customers the ability to lock their online banking while they’re making the call, potentially speeding up the process to lock their accounts and shut scammers out,” says Kai Fong.

Once the online account lock is activated, it disables all current internet banking and BNZ mobile account activity and locks all access.

To prevent scammers from regaining access, customers will need to verify their identity at a BNZ branch to regain access to their accounts.

Customers will still be able to use their cards online, instore and at ATMs while their account is locked, unless they have also chosen to block their card. To minimise disruption, scheduled payments, like rent or mortgage payments, will still go out as scheduled.

Kai Fong says BNZ invests tens of millions of dollars every year in scam and fraud protection measures.

“While there is no silver bullet in the fight against scammers, this is another tool in the anti-scam and fraud toolbox to help protect our customers. It’s just one of a number of new features, BNZ has introduced, including:

- introducing a way for customers to verify their identity through the BNZ app when prompted by a BNZ staff member to confirm it is the bank calling

- introducing additional two-factor authentication (2FA) within internet banking for high-risk actions such as changing personal contact details, creating a new payee, editing an existing payee, or making payments to unsaved payees. This is required regardless of whether a customer has already completed 2FA in their current session.

- deploying ID readers in branch to help identify fraudulent documents

Kai Fong says customers also have a role to play in keeping themselves safe from scams and fraud:

- keeping account details, passwords and pin numbers safe

- never clicking on links or attachments sent by someone you don’t know or that seem out of character for someone you do know

- keeping your computer and phone security software up to date

- contacting your bank as soon as possible if you think you’ve been scammed

Top tips to stay scam savvy – BNZ will never:

- email or text you links to online banking and ask you to log in

- send you a text message with a link to a website, or link to call us

- ask you for information about your PIN number, bank account number, or password

- ask you to verbally share the authentication codes sent to you by text or email, even with a BNZ staff member

- ask you to transfer money to help catch a scammer or a bank employee who is scamming customers

- send you a text message about account issues with a link to log in

- ask you to download software to access your Internet Banking remotely

- use international phone numbers to call or send you notifications.