Solid result as more New Zealanders choose to bank with BNZ

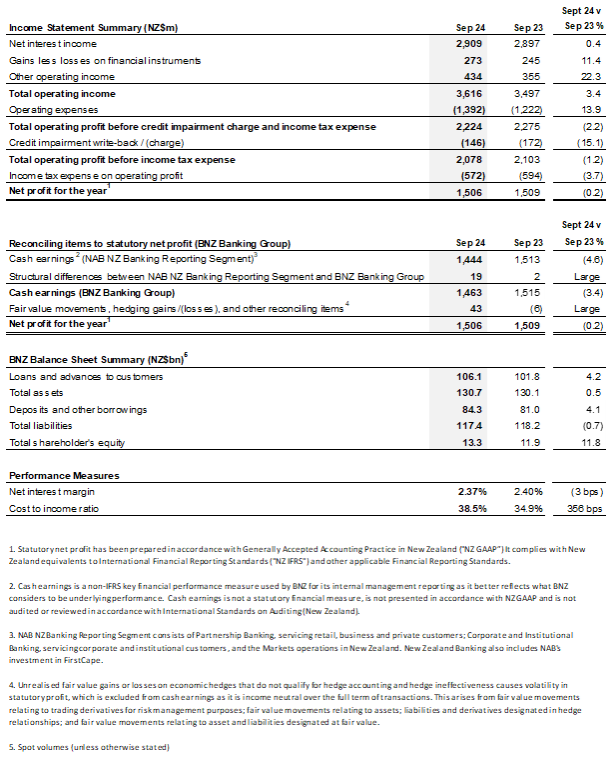

7 Nov 2024Bank of New Zealand (BNZ) today announced a statutory net profit of $1,506 million for the 12 months to 30 September 2024, down $3 million or 0.2% which is broadly flat on the prior financial year.

This was driven by lending and deposit growth partially offset by lower net interest margins, higher operating expenses and includes the impact of the sale of BNZ’s wealth business.

BNZ CEO Dan Huggins says this is a solid result in challenging conditions, which reflects BNZ’s continued growth as more New Zealanders choose to bank with BNZ.

BNZ’s total lending increased $4.3 billion or 4.2%, with business lending up $2.0 billion or 4.6% and home lending up $2.4 billion or 4.1%. Total customer deposits increased by $3.8 billion or 4.8%.

Mr Huggins says BNZ continues to support its customers through one of the most difficult economic cycles in recent history.

“With inflation back within the Reserve Bank’s target band and as interest rates begin to fall, this will be welcome news for many households and businesses.

“However, there is always a lag between changes in monetary policy and its impact on the economy, and it will take some time for the benefits to flow through. For customers feeling under pressure our message is get in touch,” says Mr Huggins.

Backing business

Mr Huggins says businesses will be crucial to driving the economic growth that will help power the recovery.

In the 12 months to 30 September 2024, BNZ was the largest lender to New Zealand’s productive sector, with almost half of New Zealand’s total business and agri lending growth coming from BNZ.

“As New Zealand’s largest business bank, we’re proud that we have backed our business customers through the economic cycle with an understanding that while times are tough now, there will be opportunities for growth ahead,” he says.

Supporting home ownership ambitions for all New Zealanders

Mr Huggins says in addition to supporting businesses, BNZ has continued to back customers’ ambitions to buy their first or next home.

“Over the past 12 months, more than 6,500 New Zealanders have chosen BNZ to help them into property ownership, with first home buyers representing around half of that figure,” he says.

“For our existing home loan customers, we have been focused on helping them manage in the current higher interest rate environment.

“Customers are paying close attention to interest rates, and we’ve seen a significant shift towards shorter fixed term loans. Over 70% of our home loan customers are due to roll off their fixed term loans within the next 12 months.”

BNZ has also focused on unlocking home ownership on Māori land. This year BNZ launched and then expanded its innovative funding model which enables iwi, as well as individuals and whānau in Māori land trusts and incorporations, to secure home loans for housing on Māori land at standard home loan interest rates.

“We’re proud that we’ve managed to develop a solution that can not only enable home ownership on whenua Māori, but also acknowledges and protects the deep connection Māori have with their whenua,” says Mr Huggins.

Investing in open banking

With more than 250,000 customers already benefitting from BNZ’s API technology, BNZ has reinforced its market leading position in open banking. This year, BNZ was the first New Zealand bank to deliver on all industry API milestones required to enable open banking in New Zealand, having led the industry to meet each new open banking standard over multiple years.

BNZ recently announced it is backing Payap, an easy-to-use digital wallet and point of sale/e-commerce app powered by open banking and developed by Centrapay. This new way to pay and be paid, has the potential to revolutionise how New Zealanders manage their money and handle payments.

BNZ also announced it has joined forces with leading New Zealand fintech BlinkPay. BlinkPay offers seamless, cost-effective payment services which save customers time and money. BNZ’s investment will help accelerate BlinkPay’s development of new products and services powered by open banking to improve outcomes for consumers across Aotearoa New Zealand.

“These initiatives support industry competition and demonstrate BNZ’s significant investment and commitment to accelerating open banking as we continually strive to make banking simpler and easier for all of our customers,” says Mr Huggins.

An unaudited summary of financial information for the 12 months ended 30 September 2024 follows:

Bank of New Zealand Banking Group