Looking back at 2024: What’s been happening with investment markets?

5 Dec 2024

We sat down with Chris Wilson, Co-CEO of Harbour Asset Management (Harbour), to discuss what’s been happening in investment markets this year, and a look ahead at what investors might expect in 2025. BNZ Investment Services Limited, the manager of the BNZ KiwiSaver Scheme and YouWealth, is a wholly owned subsidiary of Harbour.

How have investment markets performed this year?

Global stock markets have shown strong performance this year, particularly in the technology sector where innovations in artificial intelligence (AI) have catalysed growth. Major tech companies like Microsoft, NVIDIA, and Amazon have reported robust earnings, reinforcing investor confidence and driving broader market momentum.

In addition to tech and AI developments, several key factors have influenced markets:

- Corporate earnings have generally exceeded expectations

- The US presidential election cycle has influenced sentiment as investors monitor potential policy implications

- Inflation has been trending downwards, improving market sentiment

- Softening inflation is reshaping interest rate expectations.

How has inflation impacted investment markets?

Inflation has been moderating globally, with the US seeing rates stabilise around 2.6%, a significant shift that has boosted market confidence. This cooling inflation trend paves the way for central banks around the world to ease their monetary policy stance.

Here in New Zealand, the Reserve Bank of New Zealand (RBNZ) has recently pivoted towards interest rate cuts, a welcome move for many households. This shift in monetary policy outlook could help local and global share markets, particularly for interest rate-sensitive sectors like property and utilities, while also supporting broader market sentiment.

How’s performance looking for the BNZ KiwiSaver Scheme and YouWealth?

Performance of the BNZ KiwiSaver Scheme and YouWealth funds has been strong this year – rewarding investors who remained patient through the more challenging markets of 2022 and 2023.

This recovery demonstrates the benefits of maintaining a long-term investment approach during periods of market turbulence. While most investors will have seen positive returns overall this year, it’s important to note that markets have experienced their share of ups and downs along the way.

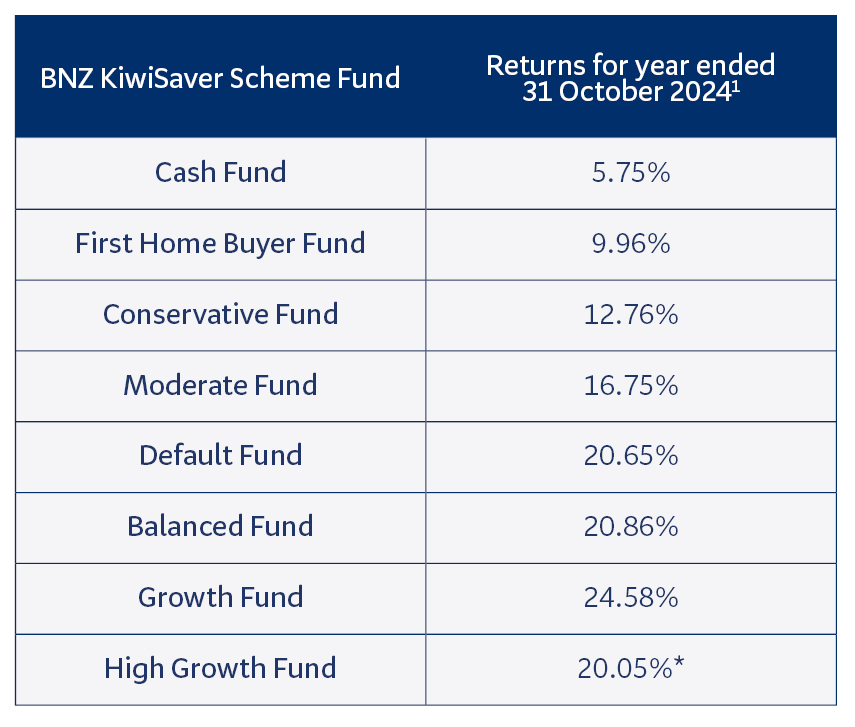

BNZ KiwiSaver Scheme – One year performance to 31 October 2024

*The High Growth Fund return shown is since inception on 28 November 2023.

To view fund performance for YouWealth visit the YouWealth managed funds hub

What about responsible investing – how is this evolving?

Environmental, social, and governance (ESG) factors are now firmly in the mainstream and are no longer on the sidelines of investment decisions. This shift reflects a fundamental change in how companies are valued and assessed. We’re seeing this particularly with climate-related risks and opportunities, where companies are being evaluated not just on their financial performance, but on how well they’re preparing for the transition to a lower-carbon economy.

Human rights and nature are increasingly key focus areas for responsible investing.

- As a serious human rights violation, modern slavery presents a material risk in global supply chains. Investment managers have a crucial role in driving corporate transparency and accountability in addressing these issues.

- Companies operating in areas affected by armed conflict face heightened human rights risks. Investors are increasingly scrutinising these companies, focusing on potential violations and the need for rigorous risk assessment.

- Protecting nature and biodiversity requires significant investment, estimated at US$1 trillion per annum, with current investment sitting around US$1 billion per annum.

What might influence markets in 2025?

With inflation showing signs of moderating in many major economies, we’re seeing a recalibration when it comes to interest rates, and this has an impact on financial markets. For example, fixed interest assets could continue to see improved valuations, and property-related investments may also benefit. While markets have shown resilience, there are ongoing risks to be aware of including market volatility, geopolitical tensions, and broader economic uncertainties.

With this year’s market returns exceeding long-term averages, we could see more moderate returns next year – however, time will tell. Volatility in markets is likely to continue as several key themes play out. The ongoing weakness in China’s economy, developments in artificial intelligence, and political uncertainties – including Donald Trump’s recent election victory – could all impact market movements in 2025.

In this environment, diversification remains crucial. Spreading investments across different sectors, regions and asset types helps protect portfolios from concentrated risks and helps to capture opportunities across markets. While markets have performed well overall, periods of uncertainty and price fluctuations are normal and should be expected. The key is understanding that volatility is a natural part of investing.

1 The returns are calculated on the change in the unit price of each fund over the period specified, adjusted for tax credits. Each BNZ KiwiSaver Scheme member’s return will vary based on the unit price applicable to each contribution or withdrawal that is made and how long they have been invested for. Returns represent historical performance only and are not an indication or guarantee of future performance. The value of a fund may rise or fall depending on market conditions. Returns are calculated after deducting management fees and before deducting tax in accordance with the Income Tax Act 2007. The returns for periods less than and including one year are not annualised.

BNZ Investment Services Limited, a wholly owned subsidiary of Harbour Asset Management Limited, is the issuer and manager of the BNZ KiwiSaver Scheme and YouWealth. Download a copy of the Product Disclosure Statements below:

– BNZ KiwiSaver Scheme Product Disclosure Statement (PDF 1.1MB)

– YouWealth Product Disclosure Statement (PDF 1.4MB)

Investments in the BNZ KiwiSaver Scheme and YouWealth are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, including possible delays in repayment. You could get back less than the total contributed. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or YouWealth, or the repayment of amounts contributed. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand but a licensed bank in Australia and is not authorised to offer the products and services mentioned on this webpage to customers in New Zealand.

BNZ Investment Services Limited (BNZISL) uses the BNZ brand under licence from Bank of New Zealand, whose ultimate parent company is National Australia Bank Limited. No member of the FirstCape group (including BNZISL) is a member of the NAB group of companies (NAB Group). No member of the NAB Group (including Bank of New Zealand) guarantees, or supports, the performance of any member of FirstCape group’s obligations to any party.

Any views expressed in this article are the personal views the author and do not necessarily represent the views of BNZ, or its related entities. The information contained in this article is provided for general information only and is a summary based on selective information (which may not be complete for your purposes and does not take into account your individual circumstances), and is not financial advice. Any statements as to future matters are inherently uncertain and are not guaranteed to be accurate or reliable. Neither Bank of New Zealand nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any opinion, information or representation contained in this article (or omission of any opinion, information or representation). Bank of New Zealand recommends that you seek independent financial, legal and other professional advice prior to acting in relation to any of the matters discussed in this article.