End of season stock-take

11 Mar 2025- Economy continues to slowly right itself

- But with a growing risk the investment cycle lags

- Labour market showing signs of stabilising

- Housing market forces colliding with little price impact

- No change to our interest rate views. Short-term mortgage rates still biased to head sub-5%.

Summer is behind us. Did it deliver on expectations for a turn in the economic cycle? Below, we run an end-of-season stock-take on recent economic happenings and how they measure up against some of our views:

- Growth restarts

- Exports do the heavy-lifting, investment to lag

- Unemployment to rise further

- Housing market to pick up

- Inflation to remain contained

- Short-term mortgage rates to keep falling

-

Growth restarts

Late last year there were concerns that the economic recovery existed in confidence measures and forecasts only. There were few signs of life in so-called hard data.

Over the past month or so we’ve seen broadening evidence of either stabilisation, or turning, in most measures of economic activity.

The worm is (still) turning

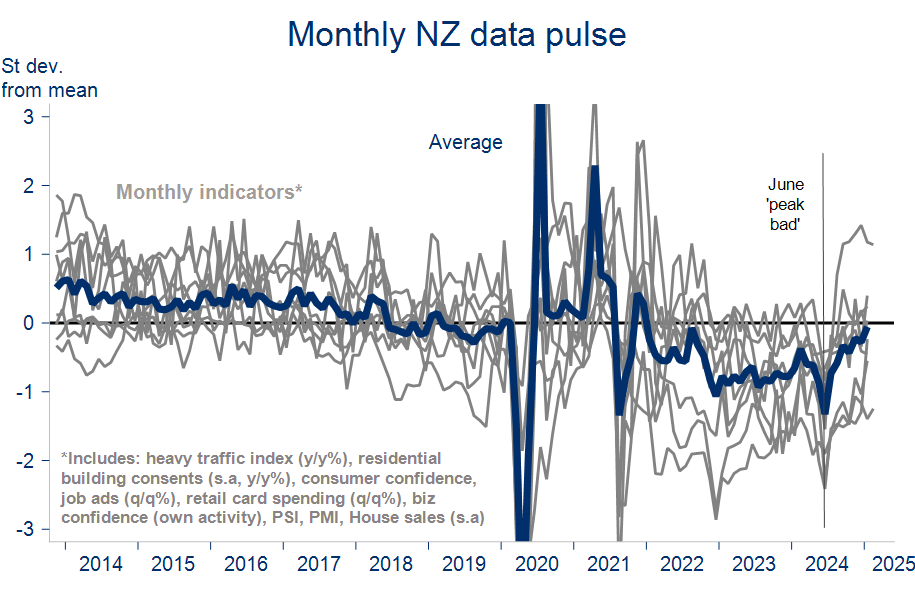

We’ll need to wait on always-dated GDP figures for official confirmation of such. Fourth quarter numbers will be released next Thursday. In the meantime, the chart summarises the improving pulse of higher frequency (monthly) indicators. That’s even if most are still south of average in an absolute sense.

Importantly, recovering consumer confidence does look like its being slowly followed with spending action. That’s despite a weak labour market and continued cost of living blowback. We expect an uptrend in retail activity to be maintained.

Also worthy of special mention is the fact both the Performance of Services (PSI) and Manufacturing (PMI) indices regained a foothold in expansionary territory in January, the latter for the first time in 22 months. We’ll see on Friday whether the PMI’s stronger footing was sustained in February.

In sum, there’s been a touch more vigour in the overall numbers than we’d allowed for. It looks as if the economy regained some forward momentum in the fourth quarter – we’ve today finalised a +0.2%q/q GDP forecast. For 2025, we’ve had no reason to alter our forecast for a trend-like 2½% expansion through the year.

-

Exports do the heavy-lifting, investment to lag

There are naturally overs and unders to this broad view. Exports, and the increasing health of the primary sector, stand out as the most important prop for the expected expansion.

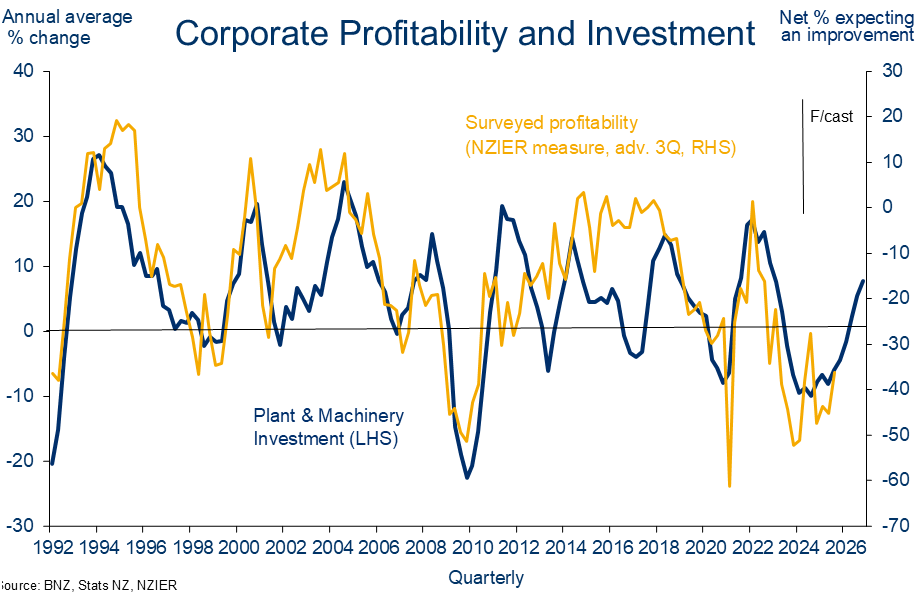

Corporates are gonna need some time

At the same time, the risk the investment cycle lags the broader economic cycle is growing. Admittedly, the indicators on this front are far from aligned. Business investment cycles tend to follow profitability. Expectations of such are now riding high according to some business surveys, but current reality presents an uncomfortable contrast.

Similarly, firms’ surveyed investment intentions are back at, or above, average levels but evidence of this being acted on so far appears scant. For example, imports of capital equipment have yet to show any persistent signs of recovery.

Falling interest rates will help the cause. But increasingly problematic for investment plans is the almost daily back and forth on US trade policy and, in turn, financial market conditions and growth sentiment.

There’s always fog shrouding the outlook but at the moment it’s pea soup, making it extraordinarily difficult for firms to plan and allocate capital. Evidence of US firms rowing back on capex and hiring plans is already gathering.

Some impact is to be expected in NZ as well, with a low NZ dollar and spare capacity adding to the business investment headwinds. On our forecasts we don’t have business investment cycle picking up until the second half of the year.

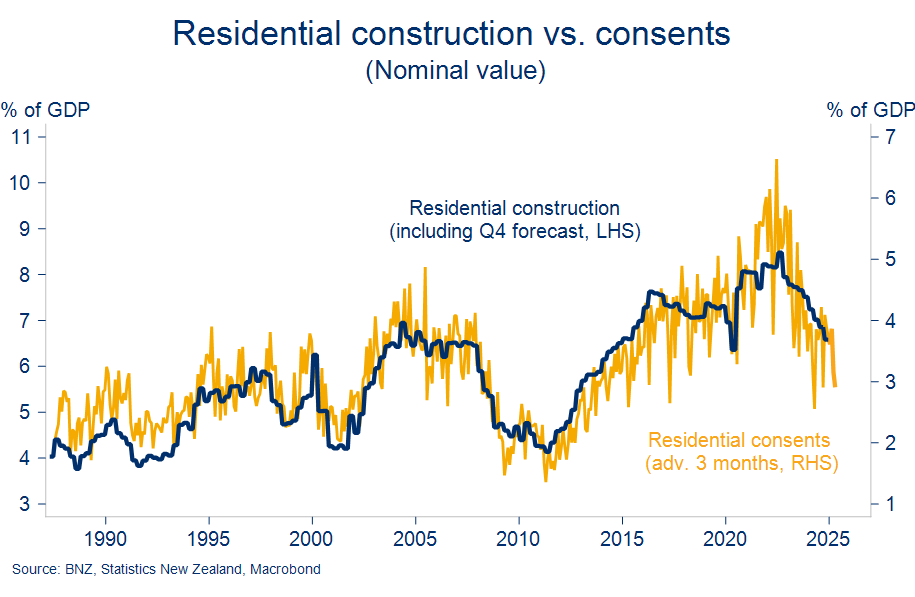

Downtrend continues

We remain hopeful that residential investment activity starts to lift a little earlier, as currently baked into our forecasts. But this may also be a story for the second half based on what we’re seeing from flat, at best, consenting activity (chart above), reports of continued oversupply in some parts of the market, yet-to-ease build costs and the still large gap to existing home prices.

-

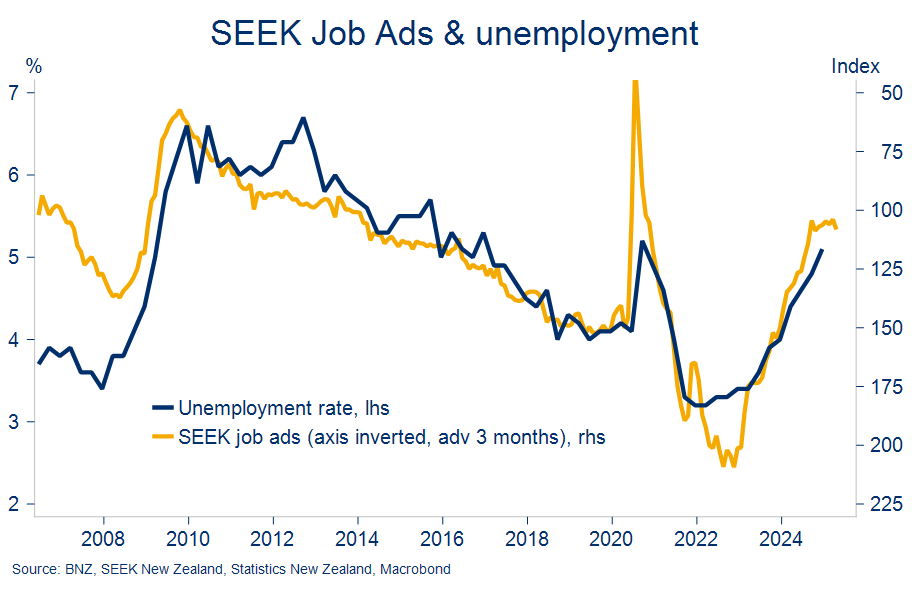

Unemployment yet to peak

Current labour market conditions are weak and the unemployment rate has further to rise. The latest spray of employment indicators are not out of line with this view. They do, however, lean in the direction of a potentially lower peak in the unemployment rate than the 5.5% forecast we’ve got on the board.

January’s filled jobs rose 0.3%m/m, adding to the sense the trend decline is over. SEEK job ads likewise seem to have stabilised at a low level (inverted in chart). And firms’ employment intentions are now well ensconced in net positive territory. In the least, there’s support in all this for the view that outright falls in aggregate employment won’t continue into 2025.

Jobs market stabilising

-

Housing market to pick up

Familiar themes pervade NZ’s housing market. It’s gently thawing but hardly racing away. New lending flows are picking up, sales turnover is grinding back to average, and auction clearance rates are rising. The general anecdote has also clearly perked up in the wake of the Reserve Bank’s most recent 50bps cash rate cut.

Nonetheless, for the moment this extra demand continues to be readily absorbed by chunky growth in new listings. Last week’s February realestate.co.nz data showed the stock of unsold homes hitting a fresh 10-year high of 36k. That’s equivalent to 5½ months’ worth of sales.

This excess of supply is sticking around for a bit longer than we might have expected, and it continues to keep tabs on any house price gains. Yes, we’ve now seen three (small) consecutive monthly increases. But to say prices are back in growth mode, as in some of the commentary, is a stretch.

We think there will be a lift, such has been the cyclical decline in mortgage rates. But it will take a little longer to arrive. Our expectation is still for a 5-7% bump in prices through calendar 2025. Couched within typical house price uncertainty, that’s still best viewed as in the upper reaches of a wide range of potential outcomes.

Two years of meh

-

Inflation well contained

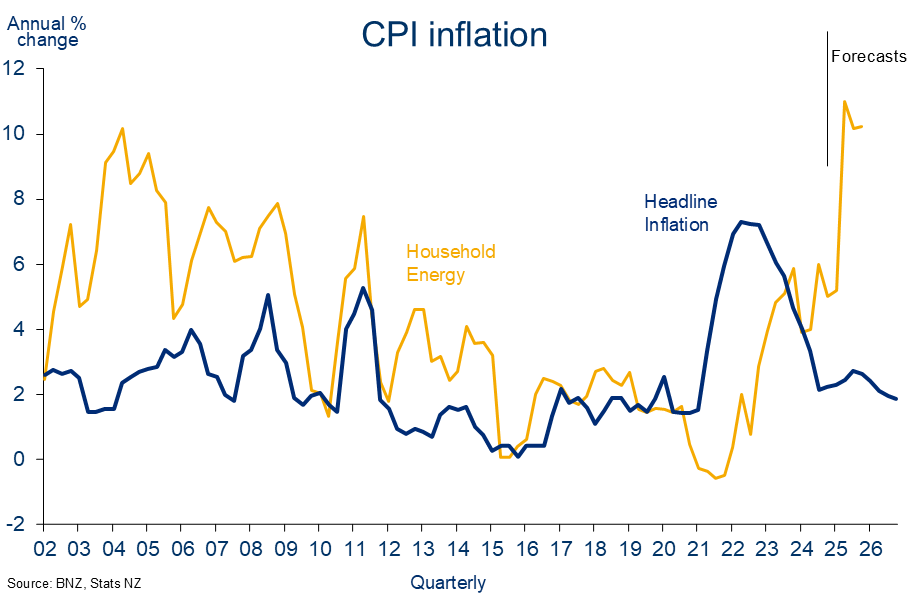

Inflation remains contained overall, but that’s not to say cost of living pressures are receding. The latest of these due to come through is the expected big increases in retail energy prices.

These were anticipated following Commerce Commission changes to Transpower’s revenue limit last year, but that doesn’t mean they won’t be biting. Food prices are also expected to rise from here reflecting the strong gains already seen offshore. There may at least be some relief courtesy of lower petrol prices should recent declines in oil prices stick around.

We’re left with a view that, from the perspective of the Reserve Bank’s 1-3% target, the inflation outlook remains okay and won’t stand in the way of further interest rate cuts. Annual CPI inflation is forecast to climb from 2.2% currently to 2.7% in Q3 before receding again.

Power up

But from a spending and budgeting perspective, higher food and energy costs are difficult for households to avoid and may thus draw spending away from other, more discretionary, areas. The psychology of inflation having stopped falling and starting to rise again, albeit at only modest rates, might impact too. These are factors likely to slow but not stall the return to growth in retail spending activity we expect.

-

Short-term mortgage rates to keep falling

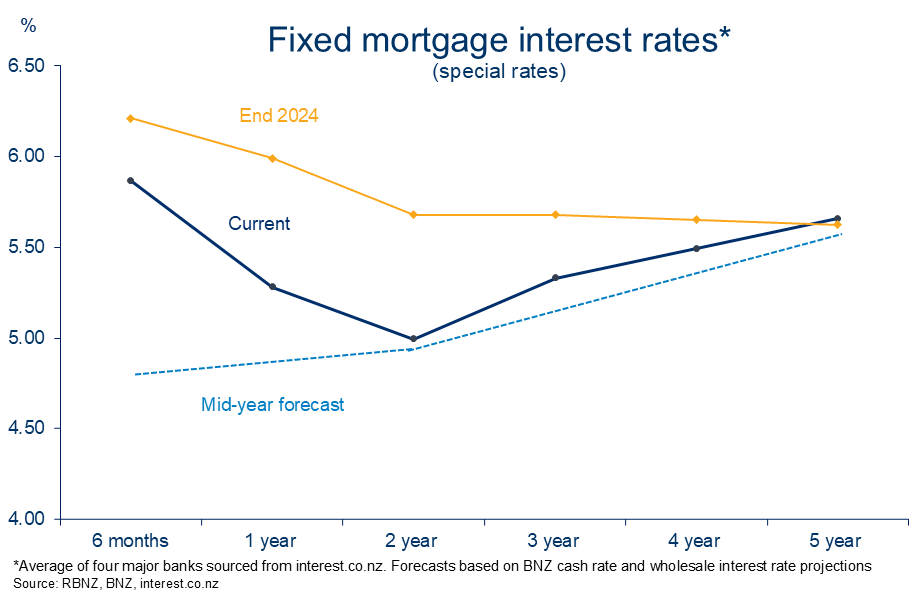

Mortgage rates for most terms continue to grind their way lower, particularly those for one- and two-year terms. They’re both down about 50bps so far this year. There’s now a slightly odd-looking kink in the mortgage curve.

The two-year being both a historically popular fixing term, and the lowest point on the mortgage curve, suggests we might see increased demand for this fixing term as the heavy schedule of mortgage rollovers rolls through. Friday’s RBNZ data shows 57% of all mortgage borrowings (including floating) will experience a reset over the next six months.

Two-year pivot point

What impacts have the latest ins and outs in local economic data, North American tariff jostling, and the change in Governorship at the Reserve Bank had on our interest rate view? The short answer is that our forecasts haven’t changed.

The slightly longer answer is that the risks have tilted marginally in the direction of less downside on the cash rate than previously. There’s a touch of upside risk on our view of a 2.75% low point in the cash rate cycle.

The short-term outlook remains largely unchanged. The continuity provided by the Reserve Bank’s Committee structure means there’s little to threaten the Bank’s intention to keeping cutting the OCR towards a ‘neutral’ rate, thought to be around 3%.

An anticipated bottom of the OCR cycle around 3% has long been enshrined in market pricing. This hasn’t changed, so we still don’t see a heap of room for term mortgage rates (two years and longer) to fall much farther from here (forecast in chart above). But our OCR view still implies six-month and one-year rates can fall below 5.00% from around mid-year.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.