BNZ research identifies key drivers of NZ business growth – and the untapped opportunities

6 Aug 2025

New Zealand businesses excel at operational fundamentals, but many are missing strategic opportunities that could accelerate growth, new research from Bank of New Zealand reveals.

“We’re at a pivotal moment for New Zealand business,” says Brandon Jackson, GM Growth Sectors at BNZ.

“The economic headwinds are slowly easing, and the enterprises that will truly thrive in the next phase won’t just be those that successfully managed to weather the storm – they’ll be the businesses that use this recovery period to make bold strategic choices that set them apart and give them a competitive edge.”

BNZ’s Growth Levers Insight Report, based on a survey of over 1,000 businesses across the country and in-depth case studies of six high growth companies, reveals what drives sustained business expansion and where the biggest gaps exist.

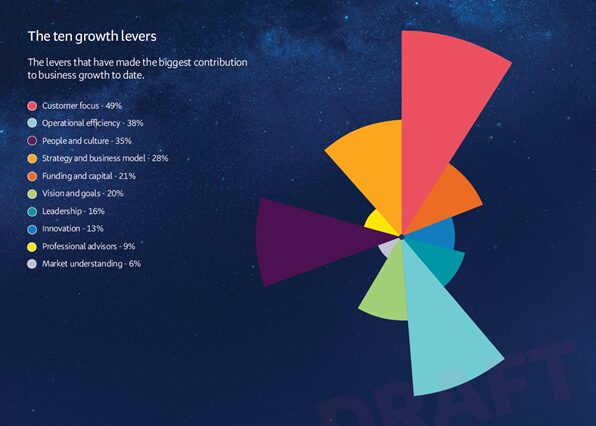

The research tested a framework of 10 key factors – called “growth levers” – that BNZ’s Growth Sectors team developed from years of working alongside leading New Zealand businesses. Businesses were surveyed on which levers have contributed most to their success so far, and which they believe will matter most looking ahead.

Strong foundations, untapped potential

Customer focus dominates as the top growth lever, with 49% of businesses identifying it as critical to their success to date, followed by operational efficiency (38%) and people and culture (35%).

“These results show New Zealand businesses have built strong foundations,” says Jackson.

“Customer focus and operational efficiency are genuine strengths that have served companies well through challenging times.”

Yet the research also uncovered significant untapped potential. Notably, only 13% of businesses cited innovation as a primary driver of growth to date, while even fewer – just 9% and 6% – highlighted professional advisors and market understanding, respectively – areas that can help businesses move beyond operational focus to strategic thinking.

“Many business owners find themselves working ‘in’ their business rather than ‘on’ it – getting caught up in daily firefighting and not having time for the strategic thinking that delivers sustainable competitive advantage,” Jackson says.

“As New Zealand’s largest business bank, we see time and again that businesses that are able to break free to focus on strategy, innovation, and long-term planning consistently outperform.”

Jackson says this operational focus might help explain New Zealand’s broader productivity challenge.

“New Zealand’s productivity growth has been stalled for years, averaging just 0.2% annually over the last decade, and we can’t just recruit more staff or optimise processes to fix the underlying issues.

“While our businesses may run efficiently by local standards, we’re competing globally against companies with access to deeper pools of capital and larger market scale. We need to be more strategic about innovation, which increasingly means technology and automation investment, to compete on the global stage.

“While structural factors like government policy and investment settings play a role, businesses can focus on what they can control. This means bringing in expert advice when needed, investing time in understanding their competitive landscape, and making deliberate choices about where to allocate resources. In our experience this helps businesses move from incremental growth to more transformational results.”

When businesses get it right, results follow

The companies profiled in the report demonstrated what’s possible when businesses combine strong fundamentals with more strategic decision-making.

Spring Sheep identified a global opportunity by recognising that dairy intolerance affected 68% of people worldwide, then innovated to solve it. They created a new breed of sheep that increased milk production from 60L to over 300L annually, making sheep milk commercially viable, and conducted clinical trials that showed their product is more digestible than cow milk.

Auckland-based Independent Traffic Control enlisted professional advisors to improve their people and culture systems, improving their operational structure and boosting productivity through new reward initiatives. They also leveraged market intelligence to adapt, shifting focus from a contracting Auckland market to emerging regional growth.

The path forward

While the research reveals room for improvement in strategic areas, there are encouraging signals. When asked which levers will drive future growth, businesses showed growing appetite for investment, with more than a quarter (28%) now prioritising funding and capital as a key growth lever, up from 21%, suggesting companies are preparing to move beyond survival mode.

For the businesses ready to seize this moment, BNZ has developed a practical five-step framework to help leaders assess and prioritise which growth levers could drive their next phase of expansion. BNZ is also scaling up its Growth Academy programme nationwide to help businesses develop these strategic capabilities through hands-on workshops and AI-powered planning tools.

“The fundamentals are strong, but sustaining resilient growth requires broader capabilities,” says Jackson. “The businesses that combine operational excellence with the strategic levers will be the ones that truly thrive.”

The complete Growth Levers Insight Report, including detailed business case studies and practical implementation tips, is available here.

Survey responses were received from n=1,005 participants. The sample was not controlled. Our survey results are indicative, collected using a sample of convenience including BNZ business customers who span various industries, business sizes, and stages.