Real wage squeeze reinforces spending headwinds

8 Aug 2025- Labour market imbalance widens

- Squeeze on real wage growth not (quite) done

- Adds to retail headwinds

- Or maybe consumers saw it coming?

- More help from interest rates required

Wednesday’s smaller-than-expected Q2 lift in the unemployment rate to 5.2% was, on the face of it, better news. But you didn’t have to scratch too far below the surface to reach the opposite conclusion.

Chiefly, unemployment would have lifted by more were it not for discouraged workers leaving the labour force. The labour force participation rate fell to a four-year low.

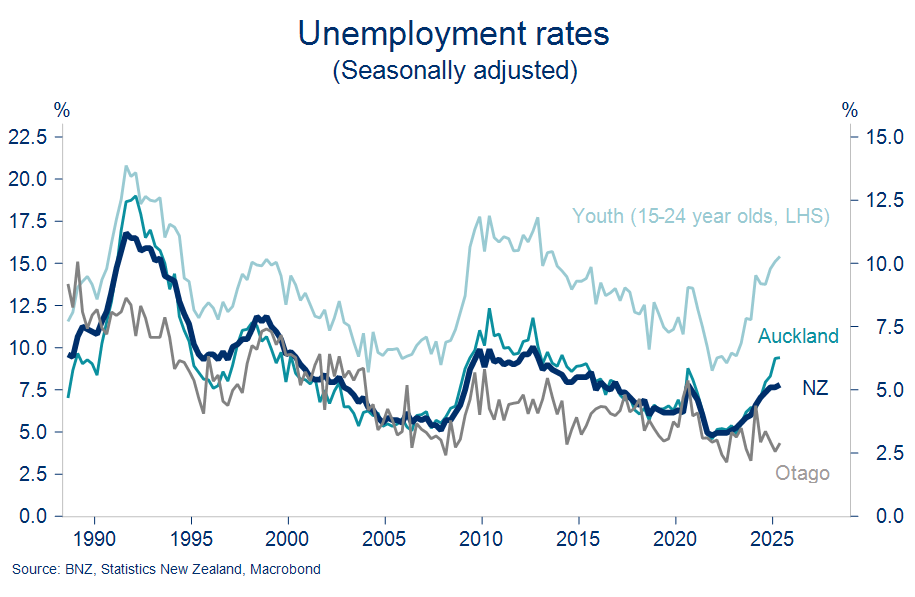

Unemployment rates rise, at different rates

Youth unemployment and that of our largest city both hit highs not seen for more than 10 years. That’s even as Otago printed a jobless rate of 2.9% (all rates seasonally adjusted). It’s but the latest example of the southern outperformance story we’ve been running with for 18 months now.

One of the more obscure stats we’re still digesting is the fact average hours worked per person, per week fell to the lowest level on record, excluding COVID-era volatility. It’s not necessarily an ominous sign as it could reflect a whole bunch of goings on. But it adds to the sense from other indicators that there’s heightened capacity even within the employed labour force. It could force additional layoffs should the work not start rolling in soon.

Fewer hours

We think we’re edging towards the top of the unemployment cycle, but it still risks nudging a little higher yet. We’ve pencilled in a peak rate of 5.3%. A return to economic growth over the second half of this year, if realised, should bring some additional jobs with it, but probably not enough in our view to soak up expected growth in the population.

The key takeaway is that prospects for a sustained labour market recovery still look like a story for next year not this. That’s one of a few factors casting a pall over on the long-awaited lift in retail spending activity required to kick the broader recovery into gear.

Worth highlighting in this regard is that wage growth is coming off the boil at a time short-term inflation is going in the other direction. It’s eco-chat for the cost-of-living strains being widely felt. Most of the wage measures released in Q2 (and there are lots), showed the gap between wage growth and inflation being squeezed further.

Two of the better wage growth measures we’ll focus on here are, first, the Labour Cost Index (LCI), which is adjusted to reflect the cost of labour to complete a certain job to a consistent standard. It controls for the impact of the likes of promotions and productivity that are present in the second measure – the ‘unadjusted’ LCI. Basically, the first is a pure wage inflation measure, the second a closer approximation to the wage adjustments the average worker receives.

Changing of the guard

The decline in June quarter LCI wage inflation, to 2.4%y/y, means it is now back below the 2.7% annual inflation reported for the same quarter. That ends five quarters’ worth of modest inflation-adjusted wage gains.

The ‘unadjusted’ LCI suggests growth in worker compensation is still running ahead of inflation. Although, perhaps tellingly, not so a simple measure of ‘essentials’ inflation. Our approximation of the latter is based on petrol, energy, food, and rates.

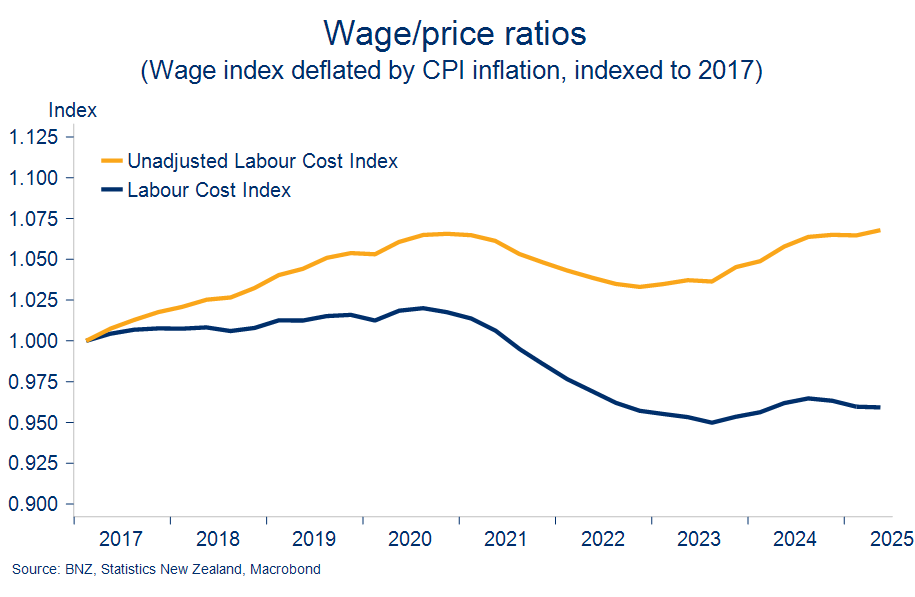

Quarterly rates of change in prices and wages are one thing, but for the average consumer, the cumulative change over time probably matters more. The purchasing power lost in a bout of inflation can be felt long after said inflation has subsided.

Looking at ratios of wages to prices gives a sense of how the relativities have travelled over the past few years. The chart below indexes wage/price ratios back to 2017 levels.

Battling to recover

The inflation-adjusted (i.e. ‘real’) LCI wage index remains below where it was prior to the inflation spike of 2021/22. As noted earlier, this measure is more reflective of wage growth for a standardised job than that of an individual. The real ‘unadjusted’ LCI index – a measure more closely aligned to growth in labour earnings – has only just clawed its way back to where it was five years ago.

The flattish picture for aggregate real wage growth of course just formalises what’s been clear for consumers in the supermarket aisles or paying the bills for some time. There will also be a lot of demographic variation around these numbers. Such are the masking effects of top-line macro statistics.

Wages are not the only way households can earn income or accumulate wealth. But when we pull in some of the broader trackers of such the above “flat” conclusion remains.

Stats NZ’s comprehensive but admittedly dated household disposable income figures show inflation-adjusted growth in all household income sources dipped back into the negative in March. We’d be surprised if the June quarter was any different. Meanwhile, household net wealth has flat-lined since late 2021 as the uplift from financial assets has been offset by non-financial (read: housing) assets.

Flat

Pulling all the threads together, it’s not hard to see why household spending remains under strain. But what of the outlook?

In the short-term, it’s difficult to foresee much in the way of relief. Our forecasts are for wage growth to ease a little further, and for CPI inflation to rise to a peak of 3.0% in the third quarter. Combined, that’s clearly directionally unhelpful for inflation-adjusted incomes. It’s another headwind in behind the many others bearing down on retail spending.

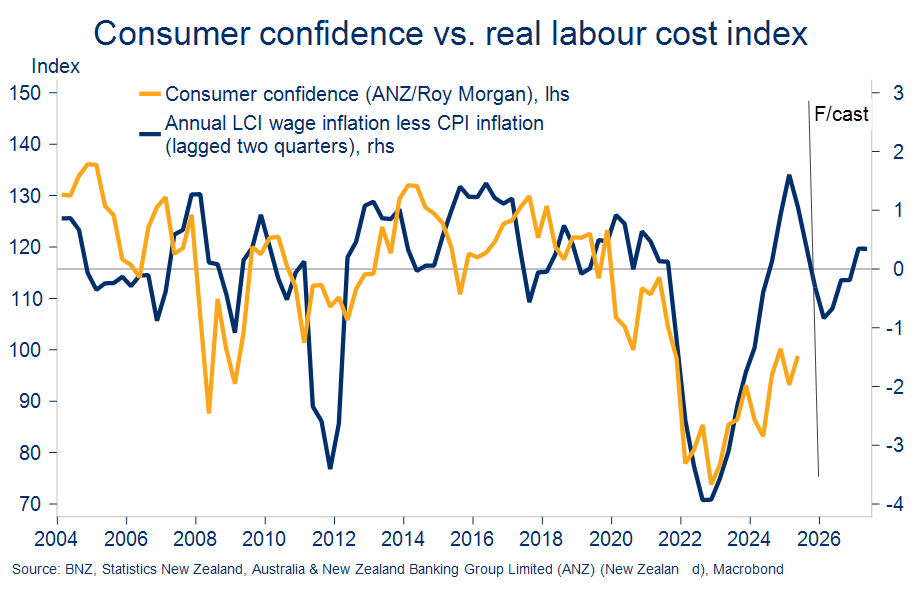

The ‘good’ news, perhaps, is that consumer confidence is already so supressed that additional compression in real wage growth may not impose any additional weight on spending appetites. That is, maybe consumers saw it coming? There’s a hint of this in the loose correlations in the chart below.

From the final quarter of this year some improvement in real wages is anticipated as the short-term spike up in inflation starts to unwind. The long-await cash release from the current period of mortgage re-fixing will also be providing some assistance.

Consumers don’t like inflation

But we’re still left nursing continued downside risk on the lift in household spending that we (and others like the Reserve Bank) are forecasting for the coming 12 months (forecast tables at back). Certainly, consumer confidence needs to lift a long way from here for these forecasts to have any hope of panning out. The analysis above suggests that might take some time.

It’s increasingly clear that the wobbling economic upturn needs a little more help from interest rates. We thus maintain our view that the Official Cash Rate will head sub-3% this year with 25bps cuts seen in both August and October. Markets are increasingly coming around to this view boosting the odds we see additional falls in short-term retail interest rates.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.