Get to know your KiwiSaver account

8 May 2020

BNZ’s General Manager of Wealth, Peter Forster, shares some tips to get to know and make the most of your KiwiSaver account.

There’s a lot happening in the world right now, but it’s still important to keep track of how your KiwiSaver account is going. As life changes, your approach to your KiwiSaver account may need to be adjusted too. Or maybe you want some reassurance that you’re on the right track to meet your retirement goals.

The BNZ KiwiSaver Scheme offers award-winning value with its strong returns, low fees, and excellent customer service. We can help you build for a better future.

Review your KiwiSaver Scheme provider

It’s a good idea to review how your KiwiSaver Scheme provider’s funds have been performing. Some things to look out for are:

- membership fees and management fees

- how your provider’s funds are set up to handle the ups and downs that come with investing

- what your provider invests in and whether this aligns with your personal views.

The impact of COVID-19 is affecting returns across all KiwiSaver scheme funds and investments in general. However, our expertise, people, and proven approach are helping our customers weather the storm.

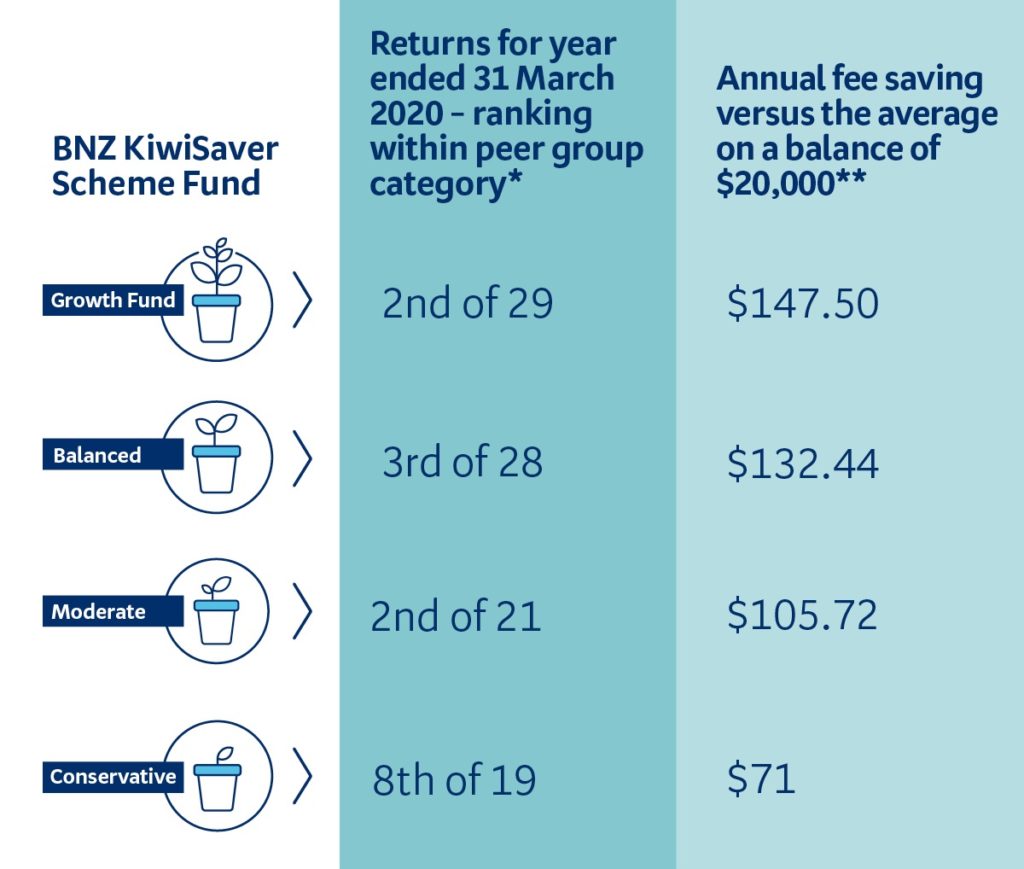

Some people mistakenly believe that to get higher returns you need to pay higher fees. We know that’s not true. The BNZ KiwiSaver Scheme funds have some of the lowest fees in the market and our performance has been strong when compared to other providers. We have no monthly member fee and low percentage-based management fees. And, we’re honoured to have won the 2019 Canstar Outstanding Value award for our KiwiSaver Scheme.

*Source: Morningstar KiwiSaver Survey March Quarter 2020.

**See below for more information on how these savings have been calculated.

We’re also proud that our Scheme is committed to a responsible investment policy that excludes companies involved in the production of cluster munitions, anti-personnel mines, nuclear weapons, and tobacco or tobacco products. We’ve also recently excluded some oil and gas companies, some companies that extract thermal coal and stated that we won’t invest in businesses that are involved in whaling. Learn more about our approach to responsible investing.

Are you getting $521 free from the Government?

We know that with the impact of COVID-19 this year might be financially difficult for some people. If you can afford it, it makes sense to get as much of the Government’s contribution as you can by putting a little more into your KiwiSaver account if required.

The Government contributes $0.50 for every $1 you contribute to your KiwiSaver account to a maximum of $521.43. So, if you’re in a position to contribute at least $1,042.86 during the year (1 July to 30 June), and you’re eligible for the full year, you’ll receive the full amount. Find out more about how the government contribution works.

The right fund for you can change over time

Which KiwiSaver fund is right for you can change depending on where you’re at in life. Your risk appetite may have changed recently, you may be nearing retirement, or maybe you’re looking to buy your first home. When your circumstances change, your fund choice could too. Use our tool to check if the fund you’re in is still right for you.

KiwiSaver significant financial hardship withdrawal

Withdrawing money from your KiwiSaver account could be an option if you’re finding things tough right now, but only if you’re suffering or likely to suffer from significant financial hardship and you’ve exhausted all other avenues of financial support. Remember, your KiwiSaver account is intended to support you in your retirement and any withdrawal now could affect how much you have when you retire. Learn more about KiwiSaver significant financial hardship withdrawals.

To find out more about KiwiSaver, and the BNZ KiwiSaver Scheme, in the current environment, BNZ’s General Manager of Wealth, Peter Forster, answers the most frequently asked questions we’ve received in response to COVID-19.

If you‘re interested in the BNZ KiwiSaver Scheme it’s easy to join or transfer online.

**Annual fee saving has been calculated using the average dollar-based and asset-based fees for each applicable multi-sector fund peer group category and comparing to the relevant BNZ KiwiSaver Scheme fund. The table is intended for illustrative purposes only. Fee savings assume the account balance remains static throughout the year. Fees may be more or less depending on whether an account balance increases or decreases over the year. The BNZ KiwiSaver Scheme First Home Buyer Fund has been excluded from this table because as a specific-purpose fund it is not directly comparable to others in its peer group category. The BNZ KiwiSaver Scheme Cash Fund has also been excluded as Morningstar does not provide peer group averages for single sector funds.

BNZ Investment Services Limited, a wholly owned subsidiary of Bank of New Zealand, is the issuer and manager of the BNZ KiwiSaver Scheme. A product disclosure statement is available at bnz.co.nz or at any BNZ branch.

Investments made in the BNZ KiwiSaver Scheme do not represent deposits or other liabilities of BNZ or any other member of the National Australia Bank Limited group, and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of BNZ, any other member of the National Australia Bank Limited group, the Supervisor, any director of any of them, the Crown or any other person guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of capital.

The information in this article is provided for general purposes only, and is a summary based on selective information which may not be complete for your purpose. To the extent that any information or recommendations in this article constitute financial advice, they do not take into account your financial situation or goals and is not intended as personalised financial advice. While BNZ has made every effort to ensure that the information provided is accurate, you should not rely on this information to make any financial decision without first having sought advice specific to your circumstances from an authorised financial adviser. Neither BNZ nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this article.

References to third party websites are provided for your convenience only. BNZ accepts no responsibility for the availability or content of such websites.