KiwiSaver annual wrap up: Steady year with major global shifts to come

7 May 2025

Global share markets showed resilience over the year (ending 31 March 2025), navigating a complex environment marked by ongoing uncertainty. Inflation has continued to ease, and central banks in most major economies have begun cutting interest rates. It has not all been smooth sailing, with markets experiencing some significant periods of volatility in August 2024 and again in March 2025.

It’s important to note that since year end on 31 March, markets have shifted – with new US tariff announcements and rising global trade tensions leading to a bumpier ride for investors.

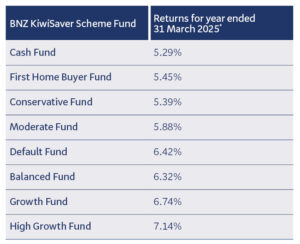

All funds in the BNZ KiwiSaver Scheme have delivered positive returns in the year ending 31 March 2025.

Returns are calculated after deducting Management Fees but before deducting tax.

Inflation moving in the right direction

During the year, markets generally responded well to promising signs that inflation was getting under control. A key theme globally has been the possibility of a “soft landing” – with inflation falling while economic growth remains resilient. This helped support investor confidence, even in the face of persistent geopolitical tensions and cost-of-living pressures.

In New Zealand, inflation also cooled allowing the Reserve Bank to cut the official cash rate from 5.5% in August 2024 to 3.5% in April 2025. This has helped to ease mortgage rates and lift the local share market.

Big tech’s shifting landscape

In the US, share markets had another strong year in 2024, largely driven by big technology names like Apple, Microsoft and Nvidia. However, sentiment shifted in early 2025 after Chinese firm, DeepSeek, released a new open-source AI model with lower energy and processing demands. Investors grew concerned that large tech firms may have over-invested in data centers and high-end chips, prompting a sharp sell-off in the sector.

Trade tensions fuel renewed volatility

Global policy shifts have also contributed to market uncertainty. Donald Trump’s return to the US presidency, alongside a Republican-controlled Congress, raised the prospect of new tariffs on global trade. Markets have responded cautiously, with US shares underperforming in the first quarter of 2025. Since 31 March 2025, markets have shown increased volatility as a result of new tariff announcements, and this volatility is expected to continue.

Investment returns broaden

By contrast, European and Asian markets performed well during the period. Europe’s recovery was supported by investor inflows and optimism around potential fiscal stimulus. In China, equities benefited from interest rate cuts, continued government stimulus, and growing enthusiasm around the country’s AI sector. However, escalating trade tensions between China and the US cast a shadow over the outlook, with retaliatory tariffs fuelling uncertainty.

More volatility on the horizon

For BNZ KiwiSaver Scheme members, the past year has highlighted the importance of staying focused on your investment goals – whether short or long term – even as markets shift and evolve. Market volatility is expected to continue as a result of ongoing global uncertainties. Geopolitical tensions, shifting economic policies, and unpredictable market responses to inflation and interest rates will continue to create instability. While periods of volatility are unsettling for investors, they are part of the process. In most cases, these kinds of movements shouldn’t influence the decisions you make about investments. Instead of focusing on the turbulence, take a few minutes to check you’re in the right investment fund for you.

*The returns are calculated on the change in the unit price of each fund over the period specified, adjusted for tax credits. Each BNZ KiwiSaver Scheme member’s return will vary based on the unit price applicable to each contribution or withdrawal that is made and how long they have been invested for. Returns represent historical performance only and are not an indication or guarantee of future performance. The value of a fund may rise or fall depending on market conditions. Returns are calculated after deducting management fees and before deducting tax in accordance with the Income Tax Act 2007.

BNZ Investment Services Limited, a wholly owned subsidiary of Harbour Asset Management Limited, is the Issuer and Manager of the BNZ KiwiSaver Scheme. Download a copy of the BNZ KiwiSaver Scheme Product Disclosure Statement PDF 1.1MB, or pick up a copy from a BNZ branch.

Investments in the BNZ KiwiSaver Scheme are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, including possible delays in repayment. You could get back less than the total contributed. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of amounts contributed. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand but a licensed bank in Australia and is not authorised to offer the products and services mentioned on this webpage to customers in New Zealand.

BNZ Investment Services Limited (BNZISL) uses the BNZ brand under licence from Bank of New Zealand, whose ultimate parent company is National Australia Bank Limited. No member of the FirstCape group (including BNZISL) is a member of the NAB group of companies (NAB Group). No member of the NAB Group (including Bank of New Zealand) guarantees, or supports, the performance of any member of FirstCape group’s obligations to any party.

Any views expressed in this article are the personal views the author and do not necessarily represent the views of BNZ, or its related entities. The information contained in this article is provided for general information only and is a summary based on selective information (which may not be complete for your purposes and does not take into account your individual circumstances), and is not financial advice. Any statements as to future matters are inherently uncertain and are not guaranteed to be accurate or reliable. If you need help, please contact BNZ or your financial adviser.

Neither Bank of New Zealand nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, information, representation or omission, whether negligent or otherwise, contained in this article.