How our investors are weathering the storm of COVID-19

2 Jun 2020

What a rollercoaster ride the 2019-20 year has been. Strong market gains made way for a period of volatility, brought on by the global COVID-19 pandemic. You can read more about the market activity in our detailed commentary. While this impacted returns across our BNZ KiwiSaver Scheme and YouWealth funds, our expertise, people, and proven investment approach have helped our investors to weather the storm.

We work hard to be responsible stewards of your money. We have a rigorous investment process to ensure that our funds are well-equipped to deal with periods of volatility when they happen. This has proven particuarly beneficial in recent times and is reflected in the recent performance of our BNZ KiwiSaver Scheme and YouWealth funds.

Sticking to our core investment principles has served our investors well

Our investment process focuses on three key things: quality, diversification, and liquidity. Holding high quality investments was especially important. When markets fall, these tend to hold their value better, and they bounce back faster when things improve again.

Having well-diversified funds also helped to smooth-out the returns for our investors. During a crisis, share markets tend to fall the hardest, whereas cash and fixed interest (bond) investments offer a ‘safe haven’ – thereby cushioning the overall falls for investors. What’s more, holding investments across different geographic regions, sectors and industries also helped. While the general direction of share markets during the sell-off was down, some companies did really well – take for example the likes of Netflix or Amazon, whose share prices have hit record highs recently.

Finally, having liquid investments (ones that we’re able to buy and sell quickly) also worked in our favour. This is mainly reflected in our funds through the types of companies we hold; typically, larger more reputable names, rather than smaller, more-speculative ones. It means we can easily exit an investment if our views on it change.

Our funds performed well despite trying times

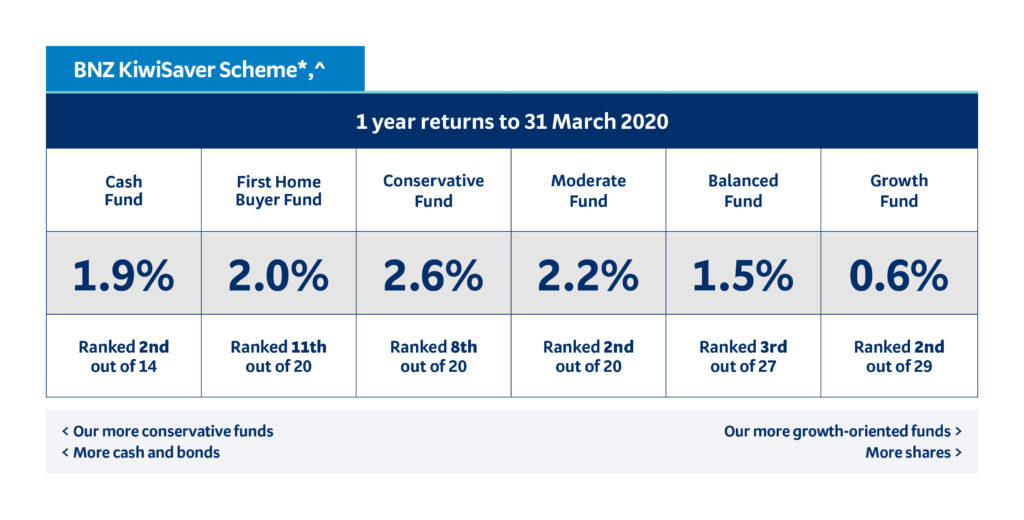

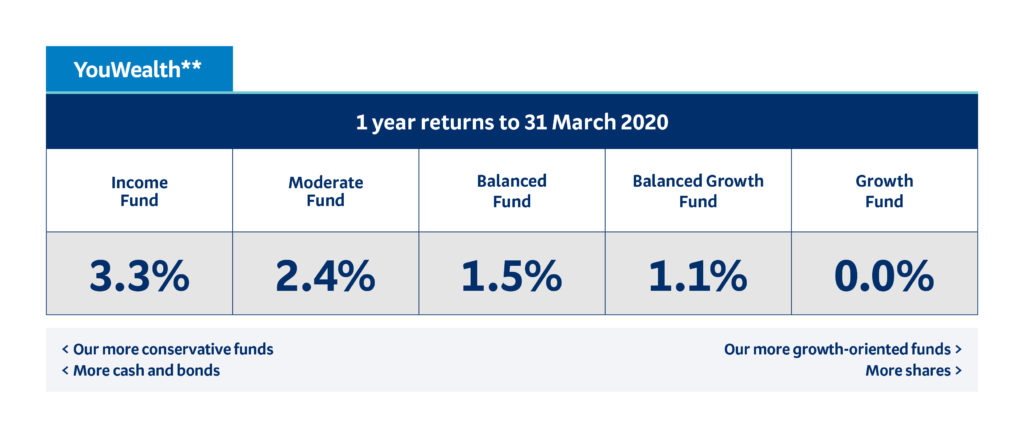

While it was a challenging time for investors, all of our funds in both the BNZ KiwiSaver Scheme and YouWealth finished the year higher (or flat). Despite this, there’s a chance some members may see a negative return on their annual statement, which can be put down to the timing of contributions into your account.

Our more conservative funds, which have a higher weighting to bond and cash investments, performed the best over the year. Our more growth-orientated funds also delivered gains (with the exception of the YouWealth Growth Fund, which finished flat), but were unable to match the returns of our more conservative funds because of their higher weighting to weaker-performing share investments.

Members of the BNZ KiwiSaver Scheme will be delighted to hear that it was one of the better-performing schemes for the year to 31 March 2020, with three out of our six funds ranked 2nd in terms of their performance relative to other funds in their respective peer group*. Not only that, despite the challenging time for investors with share market exposure, the BNZ KiwiSaver Scheme Growth Fund was one of only two funds in its peer group to deliver a positive return – albeit modest – over the year.

While you may think that low absolute returns is nothing to shout about, remember that an important part of investing is being able to minimise losses when markets are falling. In this regard, our funds have performed exceptionally well in trying circumstances.

Check out the performance of all of our funds below.

Our low fees also meant that you got to keep more of your money

Not only did our investment approach serve you well, but our BNZ KiwiSaver Scheme and YouWealth funds have some of the lowest fees in their respective markets. High fees can eat into your investment returns.

For our members in the BNZ KiwiSaver Scheme, in May last year, we removed the monthly member fee and dropped our percentage-based management fees to be amongst the lowest in the industry. It was partly in recognition of this that we were named Canstar 2019 Outstanding Value KiwiSaver Provider and won the Financial Services Council Improving Consumer Outcomes award last year. Similarly we dropped the percentage-based management fees for our investors in YouWealth.

We hope this update has given you some certainty around how we manage your investments. Remember that markets do, from time to time, go through periods of volatility. However, history tells us markets generally recover from short-term downturns and that the best thing to do is stay the course. Of course, if you’re not comfortable then take a moment to check you’re in the right fund for your current situation.

* March Quarter 2020 Morningstar KiwiSaver Survey. Performance for the year to 31 March 2020.

^ BNZ KiwiSaver Scheme returns are sourced from the March Quarter 2020 Morningstar KiwiSaver Survey.

** YouWealth returns are calculated on the change in the unit price of each fund. Performance shown is for the year to 31 March 2020. Each investor’s return will vary based on the unit price applicable to each contribution or withdrawal that is made and how long they’ve been invested for. Returns are calculated after deducting management fees (excluding any member fees) and before deducting tax. Returns represent historical performance and are not an indication or guarantee of future performance. The value of a fund may rise or fall depending on market conditions.

BNZ Investment Services Limited, a wholly owned subsidiary of Bank of New Zealand, is the issuer and manager of YouWealth and the BNZ KiwiSaver Scheme. Product disclosure statements for both products are available at bnz.co.nz or at any BNZ branch.

Investments in YouWealth and BNZ KiwiSaver Scheme are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, possible delays in repayment, possible loss of income and possible loss of principal invested. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of YouWealth or BNZ KiwiSaver Scheme or the repayment of capital. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand but a licensed bank in Australia and is subject to the supervision of the Australian Prudential Regulation Authority.

The information in this article is provided for general purposes only, and is a summary based on selective information which may not be complete for your purpose. To the extent that any information or recommendations in this article constitute financial advice, they do not take into account your financial situation or goals and is not intended as personalised financial advice. While BNZ has made every effort to ensure that the information provided is accurate, you should not rely on this information to make any financial decision without first having sought advice specific to your circumstances from an authorised financial adviser. Neither BNZ nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from this article.