When investing for the long term, take the ups and downs in your stride.

10 Dec 2020

The global pandemic, and the US elections are two recent events that have led to financial market instability, which can be unsettling for investors. Mac Dalton, Head of Investment Communications at BNZ, compares the investment outcomes of two investors who took different approaches during a time of market volatility.

Should you react, and change your investment approach during periods of financial market instability? The answer is no. When investing for a long-term goal such as retirement, remember that while there’ll be periods when your investment may fall significantly in value, there’ll also be times of strong recovery and gains. You can’t control the markets, but you can control how you react to them.

“Time in the market is more important than timing the market”.

It’s an oft-repeated phrase, but with good reason. While investment markets rarely move in a straight line, over the long-term they tend to rise. Picking when to buy into and sell out of the market can be fraught with challenges.

We still see evidence of investors attempting to ‘time the market’ by switching their fund choice in times of market volatility, such as earlier this year when the COVID-19 pandemic took hold.

A tale of two savers

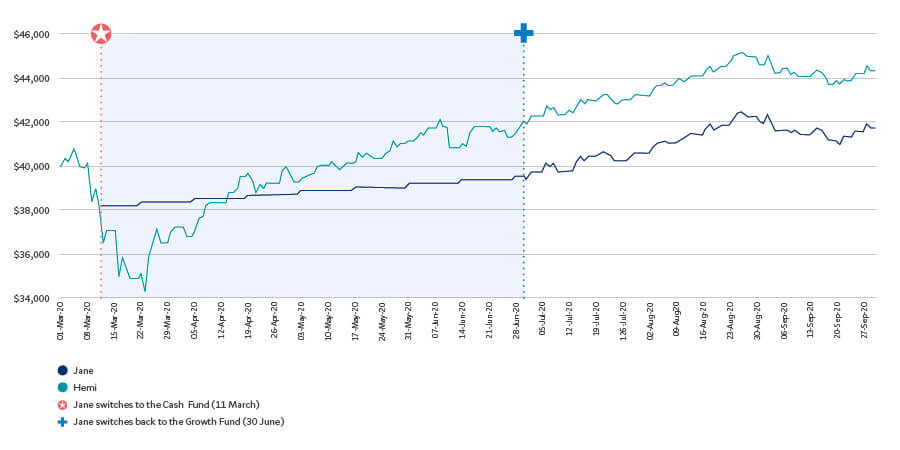

Let’s look at two hypothetical (but based on actual behavior) members of the BNZ KiwiSaver Scheme, Jane and Hemi. Both had an account balance of $40,000 on 1 March 2020, were invested in the Growth Fund and making regular fortnightly contributions of $150. Both also had more than 10 years until retirement.

Jane sees the impact that COVID-19 is having on financial markets and panics. She knows her KiwiSaver is invested mainly in shares, so moves it somewhere safer, with the intention of moving back once there’s more certainty. On 11 March she switches her investments into the Cash Fund.

Hemi knows being invested in the Growth Fund means he’ll likely see more ups and downs in the value of his investments, doesn’t react to the media reports of doom and gloom, and leaves his money where it is.

The market turbulence continues and, a few days later on 23 March, Jane’s account is more than $4,000 better off than Hemi’s. She’s thinking she’s avoided the worst of the market’s woes. But history tells us markets can bounce back quickly.

The recovery begins the very next day, but it’s far from a smooth ride. Jane sees the ongoing market volatility and is pleased she’s not on this rollercoaster ride. Her account balance remains relatively stable, moving slightly higher each fortnight as her $150 contributions come in. In contrast, Hemi’s account balance benefits fully from the market’s rebound, although it does move up and down significantly as the volatility continues. But soon there are more ‘up’ days than ‘down’, and his balance is growing steadily, boosted by his contributions.

Jane knows she’s not seeing the benefit of the market’s recovery. She’s sure markets have calmed down, and switches her investments back to the Growth Fund in late June.

However, by the end of September, the difference is clear. The two members who started with the same balance and who had been making the same contributions have very different outcomes.

The lesson

Consider your investment timeframe and choose a fund that’s best for you. Review your choice whenever circumstances change, or if you’re close to needing your money.

Try not to react to events along the way. Events such as the US and New Zealand elections, terrorist attacks, and other one-off news events can put investors on edge. Panicking could cause you to make decisions that might cost you in the longer term. Here are a few thoughts to help you deal with future market turmoil:

Our team of investment experts are looking after your investments

When markets get choppy, our team works hard to reduce the negative impacts on your investments, while still looking to take advantage of opportunities which present themselves.

There are some good bargains out there

By keeping up regular contributions – even during a downturn – you’re buying more investments at knock-down prices, and can benefit as they recover.

Fund choice is the most important thing

If you’re in the right fund for you, day-to-day market movements shouldn’t be a reason to worry. However, if you’re close to retirement, or need your savings for a first home, perhaps choose a fund that invests in lower-risk assets, such as cash and fixed interest.

BNZ Investment Services Limited, a wholly owned subsidiary of Bank of New Zealand, is the issuer and manager of the BNZ KiwiSaver Scheme. A product disclosure statement is available at bnz.co.nz or at any BNZ branch.

The information in this article is provided for general purposes only, and is a summary based on selective information which may not be complete for your purpose. To the extent that any information or recommendations in this article constitute financial advice, they do not take into account your financial situation or goals and is not intended as personalised financial advice. While BNZ has made every effort to ensure that the information provided is accurate, you should not rely on this information to make any financial decision without first having sought advice specific to your circumstances from an authorised financial adviser. Neither BNZ nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this article.