A bumpy ride for KiwiSaver investors

19 May 2022

The last financial year was full of ups and downs for the markets, which made for a turbulent ride for investors. Here’s a look back at how the markets performed, and what has been driving the volatility.

The financial year began in April 2021 on an optimistic note. The COVID-19 vaccine roll-out was underway and New Zealand was enjoying a high degree of freedom compared to the rest of the world. Interest rates were at all-time low levels, with New Zealand’s Official Cash Rate being held at 0.25% and the Reserve Bank was using plenty of tools (such as buying bonds) to support the economy through the pandemic.

Overseas, authorities were also focused on supporting economic growth and recovery. Share markets were performing well, having recovered strongly from the large falls of March 2020. They continued to rise until the end of 2021. However, fixed interest markets were weakening.

At the end of 2021 it became clear that tight labour markets and supply chain issues were causing the high levels of inflation to continue for longer than previously thought. This led to many central banks increasing interest rates and fixed interest markets falling in value. Share markets also responded negatively and were also affected by the Russian invasion of Ukraine. However, thanks to their strong performance in 2021, international share markets provided positive returns over the financial year. Australasian shares and fixed interest investments delivered negative returns.

Asset class performance

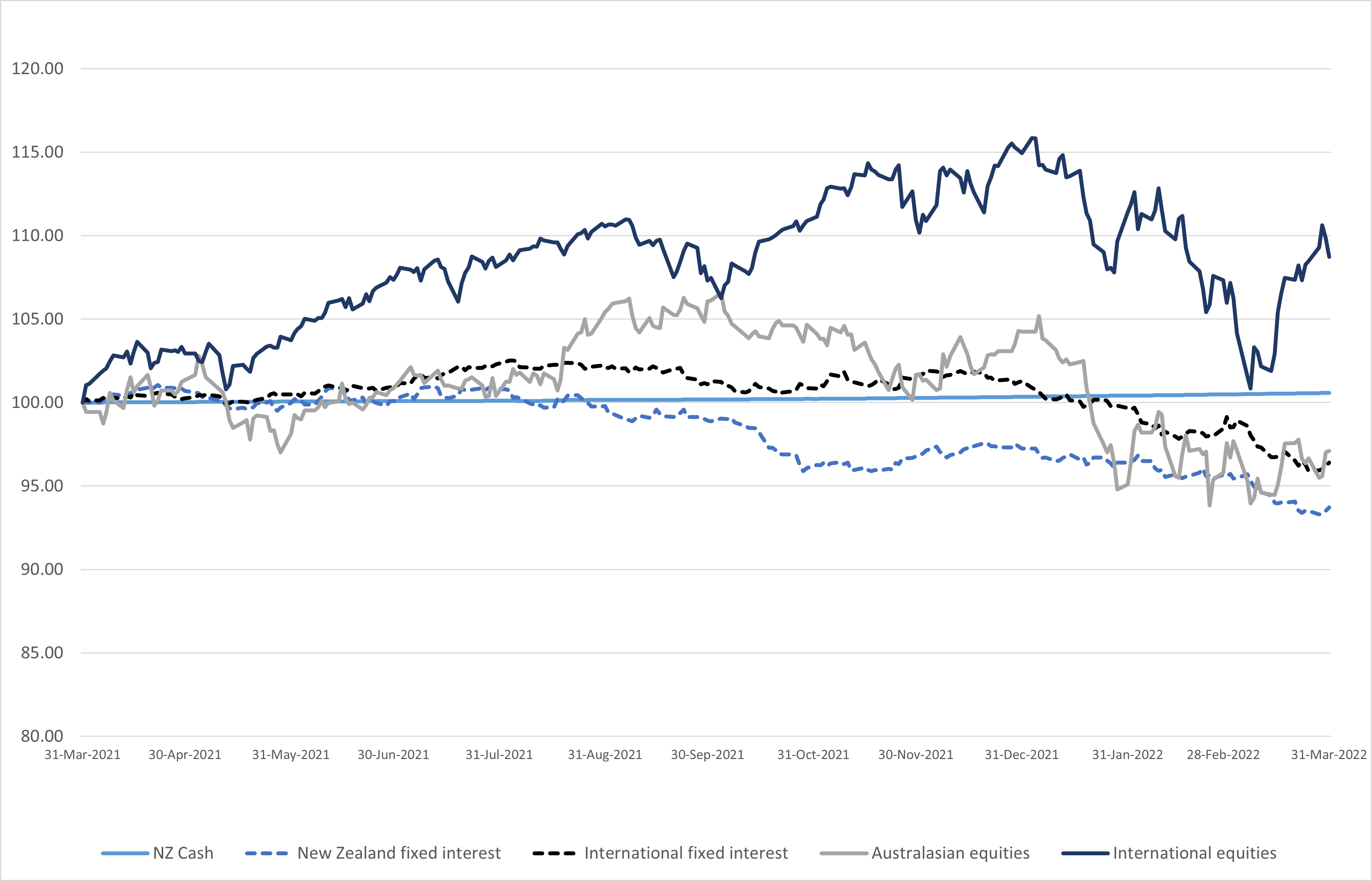

Source: BNZ, Bloomberg®*

When we look at the different asset classes using their benchmarks (above graph), we can clearly see the differences in performance over the financial year. International equities outperformed the other asset classes to deliver a positive return – but with some large dips and recoveries along the way. On the other hand, the other asset classes all provided a negative overall return with New Zealand fixed interest the worst performing.

The fact that performance was mixed across different investments for the year to 31 March 2022 means that performance across our funds was also mixed. Funds with a higher allocation to international shares (like our Growth Fund) generated positive returns, while funds with a higher allocation to fixed interest (such as our Conservative Fund) experienced negative returns.

It’s important to remember that KiwiSaver members have experienced relatively favourable investment conditions over the past few years. Ups and downs along the way are to be expected, so investment performance should be considered over the long term. Short-term movements in financial markets should not influence the decisions you make around your investments.

Important information:

* The following indices have been used as a benchmark for each asset class – Bloomberg NZBond Bank Bill Index; Bloomberg NZBond Composite 0+Years Index; Bloomberg Global Aggregate Index (100% hedged to NZD); S&P/NZX 50 Index (including imputation credits) and FTSE All World Index (60% hedged to NZD) (this index has been created from a composite of the FTSE All-World 100% hedged NZD index and the FTSE All-World unhedged NZD index). All indices have been rebased to 100 as at 31 March 2021 for comparison purposes.

Bloomberg® is the service mark of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and has been licensed for use for certain purposes by BNZ Investment Services Limited (BNZISL). Bloomberg is not affiliated with BNZISL, and Bloomberg does not approve, endorse, review, or recommend, nor guarantee the timeliness, accurateness, or completeness of any data or information relating to, this article.

Small print:

This article is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Neither BNZ nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any information, representation, or omission, whether negligent or otherwise, contained in this publication.

BNZ Investment Services Limited, a wholly owned subsidiary of BNZ, is the Issuer and Manager of the BNZ KiwiSaver Scheme. Download a copy of the BNZ KiwiSaver Scheme Product Disclosure Statement, or pick up a copy from a BNZ branch.

Investments in the BNZ KiwiSaver Scheme are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, possible delays in repayment, possible loss of income and possible loss of principal invested. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of capital. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand and is not authorised to offer the products mentioned in this email to New Zealand customers.