The risk to be aware of when spending your retirement money

13 Sep 2022

When you reach retirement age and start withdrawing from your KiwiSaver account, you enter what we call the decumulation phase. This is the opposite of when you’re building (or accumulating) your KiwiSaver savings. Having a sound plan for this phase will help you to strike the right balance between withdrawing enough each year to live the lifestyle you want and ensuring your savings last for as many years as you need them to. When you’re making your plan, a key risk to be aware of is sequencing risk.

What is sequencing risk?

Sequencing risk is all about timing – it’s the ’Murphy’s law’ of retirement savings. The risk itself is due to the order or sequence of the returns you experience in the early stages of the decumulation phase and can lead to your balance decreasing faster than you expect.

Sequencing risk exists because of volatility. Generally speaking, a more volatile fund generates a greater variation in returns than a less volatile fund does over the same time period. Funds that take more risk or have more volatility, are expected to return more on average over the long term, but can have a wider range of returns over the short term. On the other hand, funds that have less risk or have less volatility, tend to have less variation in returns over the short term, but generate a more modest return over the long term.

Investment markets usually work in cycles – periods of better-than-expected performance can be followed by periods of worse-than-expected performance, and vice versa. If a period of worse-than-expected performance comes in the early stages of the drawdown phase, your account balance can decrease much faster and run out sooner than you might need. But the good news is that there are a few steps you can take to manage sequencing risk.

What sequencing risk looks like

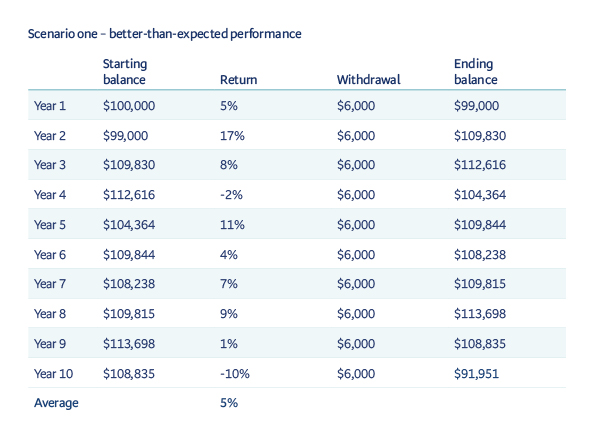

Let’s assume you’ve reached retirement age with a KiwiSaver balance of $100,000 and have stopped contributing. You plan to withdraw $6,000 at the end of each year.

The two tables below show the impact that the sequence of returns can make. The only difference in these scenarios is that in scenario one the better-than-expected performance comes first. Whereas in scenario two, the worse-than-expected performance comes first. However, if you weren’t making any withdrawals, you’d end up with the same account balance at the end of year 10 in both scenarios.

When you take into account withdrawals, the results are quite different. In scenario two the account balance is much lower after 10 years than in scenario one. This could lead to the balance running out much sooner in scenario two than it will in scenario one.

How you can manage sequence risk

There are three key things you can do to manage sequence risk.

1) Choose the right fund for you

Funds that take more risk tend to have more volatility. This means that sequence risk is lower when you invest in a less risky fund, with smaller ups and downs. If you’re worried about sequence risk then, depending on your goals, a lower risk fund might be a better fit.

2) Understand how much flexibility you have

You could consider reducing or pausing withdrawals in periods of worse-than-expected performance. To know if this is an option you need to work out if you have an alternative way of funding the withdrawals you’d normally make from your KiwiSaver account in these times.

3) Spread out your withdrawals

You can spread out your withdrawals, for example, by setting up a regular monthly withdrawal rather than making a withdrawal once a year. This is a way to reduce the timing risk when you’re making withdrawals, because you aren’t at the mercy of the market at a single point in time.

Any views expressed in this article are the personal views the author and do not necessarily represent the views of BNZ, or its related entities. This article is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser.

Neither Bank of New Zealand nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, information, representation or omission, whether negligent or otherwise, contained in this article.

BNZ Investment Services Limited, a wholly owned subsidiary of Bank of New Zealand (‘BNZ’), is the issuer and manager of the BNZ KiwiSaver Scheme. A copy of the BNZ KiwiSaver Scheme Product Disclosure Statement is available on bnz.co.nz. Investments made in the BNZ KiwiSaver Scheme do not represent deposits or other liabilities of BNZ or any other member of the National Australia Bank Limited group, and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of BNZ or any other member of the National Australia Bank Limited group, the Supervisor, and any other director of any of them, the Crown or any other person guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of capital.