Eco-Pulse: Anatomy of a Recession

7 Dec 2022

- Bracing for a “jobs-rich” slowdown

- As global and local indicators point to moderating inflation…

- …meaning the RBNZ may not have to hit a 5.5% OCR

- Upside on mortgage rates reduced

What have we learned over the past fortnight?

We’re seeing more evidence of the NZ economy holding up ok in the here and now, but with key indicators of future performance continuing to droop. That’s a theme we’ve been highlighting for a while, and reinforces health warnings about the outlook for next year.

Businesses are feeling the pinch. That came across loud and clear in last week’s ANZ business sentiment survey, one of the better gauges of future economic performance. Firms’ own output expectations slumped to a net 14% of those surveyed expecting things to deteriorate from here.

On past form, that’s a level more clearly consistent with the economy hitting stall speed next year (chart below). The same is true of firms’ profitability expectations which, outside of the short-lived 2020 dip, have crumbled to lows not seen since the 2008/09 Global Financial Crisis.

Crumbling

The sectoral details revealed a picture largely consistent with our expectation that household spending and the residential construction sector will be at the vanguard of the coming slowdown. The retail and construction sectors remain the most downbeat on their own growth prospects. Agriculture is (just) holding at the less negative end of the spectrum.

The sectoral view

A recession, but not as we know it

Against this backdrop, recession chat is unsurprisingly becoming more commonplace. A shallow recession has been baked into our projections for some time, and the Reserve Bank recently gave a few a fright by saying that it now needs one to get on top of inflation. This is obviously not a great spot to be finding ourselves in. Still, there are a couple of unique features of the coming slowdown worth pointing out.

First, restricted supply is, so far, doing more to slow the economy than ailing demand. It’s hard for firms to deliver on their expansion plans when they can’t find production inputs, be they goods or labour, for love nor money. Output that otherwise would have occurred has had to be curtailed. This imbalance will change next year though as the RBNZ batters demand in an effort to bring things back into alignment.

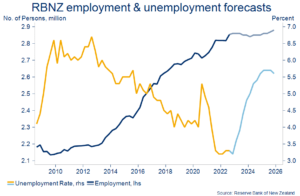

Second, most people, including the Reserve Bank, are talking about a “job-rich” slowdown. Part of the reason the mention of recession inspires dread is the association with, not just soft economic growth, but also heavy job losses. The chart below provides some historical context in this regard.

This time is different?

The Reserve Bank’s latest set of forecasts do include a nasty-looking rise in unemployment over the next few years. But it’s not necessarily a story of heavy layoffs. Instead, it’s hoped that firms shelve some of their hiring plans as demand wobbles, while, in the background, a recovery in net migration delivers a lump of extra labour supply. Numbers of employed people barely fall in RBNZ projections.

A job-rich slowdown

This might appear rose-tinted given the economic pressures in play, but our own view is similar. Many firms have been burned by the labour shortage and we suspect will be keen to hold onto staff despite the shakier economic picture.

Where we do quibble with the RBNZ is on the speed of the assumed labour supply response. We think it’s going to take longer. This being so, our projections for the unemployment rate are noticeably lower than the Bank’s. The implication is that labour shortages and peppy wage growth will continue into next year even as the headline economic growth numbers start to disappoint.

Should all this come to pass it would mark a reasonably constructive outcome under the circumstances, more akin to a ‘soft’ landing. But the uncertainties are considerable, and the risk of a harder landing continues to lurk in the background.

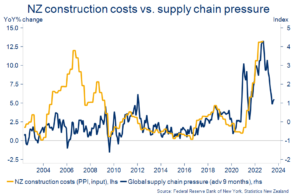

More evidence inflation is moderating…

The past few weeks of data have afforded us a little more comfort in our view inflation will moderate next year:

- Global transportation costs and supply chain frictions are loosening.

2. There are tentative signs that headline inflation might have peaked in a number of our trading partners.

3. Slightly fewer firms are planning on raising their prices, possibly a reflection of 1) and 2) above.

4. The NZ dollar has jumped about 8.5% from the October lows and is about 4% above the RBNZ’s 70.0 assumption for the trade-weighted index. Should this be sustained, it will help take some of the sting out of imported inflation.

None of this says anything about where inflation and expectations thereof will ultimately settle. That debate looks set to rage through all of next year, particularly with wage growth likely to remain strong. There’s also potential for positive inflation surprises over the next few months. On this, we’re getting more nervous that airfares and accommodation pricing could turn out higher than we’ve factored in.

Still, for now, the encouraging signs noted above support our view that we could see inflation relief sooner than RBNZ’s forecasts imply. Whereas the RBNZ expects inflation to rise to a new peak of 7.5% and stay there through Q1 of next year, we have it easing from around now.

…reducing upside risks for interest rates

This is important because, all else equal, if inflation does end up undershooting the Reserve Bank’s forecasts noticeably, it may not have to deliver on it’s projection for the Official Cash Rate to rise to 5.5% by autumn of next year (from 4.25% now).

At this point it’s worth reiterating that Reserve Bank interest rate forecasts (or any of their forecasts for that matter) are not a promise. They’re always conditional on things turning out roughly as it expects. If the outlook changes, so do the projections.

Our official forecast is for the OCR to reach a peak of 5.5%. But we’ve been regularly flagging the risk that the RBNZ might not have to go all the way on this. The tone of recent (global and local) data are currently tilting a little more in this direction, and this hasn’t been lost on wholesale interest rate markets.

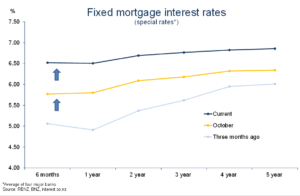

Wholesale interest rates fell about 20 bps last week, as expectations for the OCR peak were shaved to 5.3% from 5.5%. Fixed mortgage rates had been moving up steadily prior to this (chart below), but some of the short-term pressure on fixed rates to rise further has consequently been reduced.

Mortgage curve looking flatter

We still think it’s still too early to be contemplating the peak in mortgage rates. As we wrote last week, mortgage rates in general usually peak a little after the final OCR hike, which we currently have slated for April. However, the recent run of play does suggest the upside on some fixed rates, particularly longer-term 3-5 year rates, may not extend much beyond 7% this cycle. Again, there are caveats to bear in mind, particularly the risk inflation does prove stubbornly persistent, and the Reserve Bank ends up needing to go harder.

Shorter-term rates particularly are still biased higher, in line with the OCR and our forecasts for wholesale interest rates. Indeed, we’ve seen the mortgage rate curve flatten – short-term rates rising faster than long-term rates – as the rate hiking cycle has been ramped up, and we think this process has got further to run.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ).

This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed.

The information in this publication is provided for general information only, and is a summary based on selective information which may not be complete for your purposes. This publication does not constitute any advice or recommendation with respect to any matter discussed in it, and its contents should not be relied on or used as a basis for entering into any products described in it. BNZ recommends recipients seek independent advice prior to acting in relation to any of the matters discussed in this publication, including legal, financial and tax advice. This publication is intended only for the person in New Zealand to whom it is sent by BNZ, and must be treated as strictly confidential. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.