New Year Pulse Check

26 Jan 2023

- RBNZ shock tactics are working. Activity/labour demand/housing indicators all looking weaker

- But hard evidence of falling inflation the missing ingredient

- Longer-dated fixed mortgage rates may have peaked, but too early to be definitive given important upcoming data

And we’re back – Happy New Year. In thinking about the economy in 2023, a beat-up old station wagon comes to mind. It was plied with high-octane, stimulatory fuel to get us through COVID, and it valiantly rumbled on longer than anyone expected. But the engine has now overheated, having been pushed harder than it was capable. And with the RBNZ planting both feet on the brakes, an outright stalling appears inevitable. Meanwhile, the bill has come due in the form of sky-high inflation.

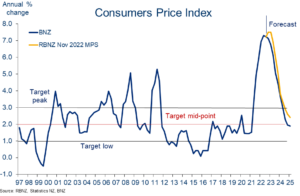

This year should bring some respite from the 32-year inflation highs of 7.3% struck in 2022. But the costs of achieving that inflation reduction, in the form of increased pressure on household finances and crumbling demand, will become more obvious as the year progresses.

What have we learned over the “summer” break?

1, The Reserve Bank’s shock tactics are working. The big uplift in RBNZ interest rate forecasts at its November meeting appears to have dealt a hammer blow to confidence. Both business and consumer confidence have hit all-time lows, and this week’s NZIER business opinion laid bare the risk that the recession we have long expected could turn out to be deeper than anyone is forecasting.

Expected trading conditions crumble

Retail spending looks to be finally rolling over too. Spending on electronic cards fell 1.2% in December (seasonally adjusted), following a 0.6% fall in November. Dire consumer confidence portends additional belt tightening ahead. The jets are cooling.

2, No signs of life from the housing market. December REINZ housing data were more consistent with the housing correction accelerating than any signs of stabilisation. House sales (adjusted for seasonality) are now running at the weakest pace in 15 years. The median time taken to sell a house continues to lengthen and a further 1.2% seasonally adjusted fall in the REINZ House Price Index brought the peak-to-trough decline to 15%.

Prospective buyers have no doubt been further spooked by the late 2022 round of fixed mortgage rate rises. But so too sellers. Indeed, restricted supply in the form of very low levels of new listings (a record low in fact) is likely to be preventing larger falls in house prices.

Interest rates battering housing activity

We continue to expect the downturn to extend to a roughly 20% peak-to-trough decline over the first half of this year. There are risks on both sides of this. Key is whether we see fixed mortgage rates stabilise over coming months. Overall, the correction remains orderly in nature and unlikely to throw the Reserve Bank off its stride.

3, Evidence of labour demand being curtailed is gathering. Employment intentions from both the ANZ and NZIER business surveys have fallen to levels consistent with (at least) a stalling in hiring. Job ads published by SEEK have also fallen 20% in four months (adjusted for seasonality). Admittedly, we don’t know if all of this is genuine, or some of it reflects recruitment fatigue. “Staff wanted” signs are still everywhere after all. But, at least directionally, there’s enough evidence to suggest a modicum of balance is returning to the labour market, something the Reserve Bank desperately wants to see.

Employment intentions consistent with a stalling in hiring

4, Still, constrained labour supply will likely keep the labour market tight for some time. Stats NZ revealed NZ’s population grew just 0.2% in the December quarter. This means the unemployment rate in Q4 might drop below the 3.2% (equal) record low we already expect. Net migration is now rising but constrained labour supply means we continue to expect only a mild increase in the unemployment rate this year (3.8% by year-end).

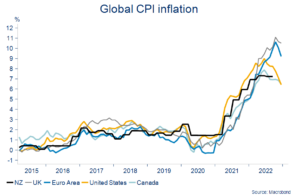

5, Global inflation good news. Last week’s 6th consecutive monthly decline in US annual inflation (now 6.5%, from a peak of 9.1% in June) has helped markets start the year on a chirpy note. Further declines look very likely in coming months.

Global inflation cresting

The inflation outlook has also improved in Europe courtesy of a warmer-than-expected winter and an associated collapse in natural gas prices. They’re now back to levels prevailing prior to Russia’s invasion of Ukraine.

For us down in NZ, all of this is encouraging given the degree of global inflation synchronicity seen through the up part of the cycle (chart above). It affords us more confidence in our view NZ inflation will soon follow suit.

6, Local developments, on net, still suggest NZ inflation has peaked. The trade-weighted NZ dollar is about 8% above its October lows which will be helping to supress the cost of imported goods. Petrol prices are almost $1/litre below levels in July, shipping costs have eased a little, and global supply chain dynamics continue to heal. Offsetting these disinflationary impacts are huge increases in airfares and accommodation costs, and food prices continuing to run ahead of expectations.

The net, though, still adds up to an inflation forecast slightly less problematic than that assumed by the RBNZ. Still, knocking the top off inflation is not the same as taming the beast. The burning inflationary ember that is the labour market means the risk of high inflation hanging around longer than anyone would like is real. Chatter about cuts in the official cash rate this year still feels premature.

Peaky

7, China offers some rare good news on global growth. The faster-than-expected dismantling of China’s COVID-restrictions has seen COVID cases skyrocket, more people off work, and will cause yet more supply disruptions. But the reduction in movement restrictions and release of pent-up savings (estimated by one US investment bank at US$830b) will feed through to higher consumption and an improved growth outlook in time. Ditto increased support for China’s property sector. This might help head off some of the broader downward pressure on NZ’s commodity export (particularly dairy) prices from the weaker outlook in other parts of the world.

8, NZ’s tourism recovery is continuing, helping to buffer the broader economic hit. It’s mostly been about Aussie tourists to date. The return of Chinese tourists, previously NZ’s second-largest tourism source by number (chart below), will provide another leg-up, although we’d suggest this is still some months away given spiralling Chinese COVID numbers and stretched airline capacity.

China 2nd largest source of tourism, pre-COVID

What does it all mean for NZ interest rates?

The closer we get to the end of the Reserve Bank’s interest rate tightening cycle, the more nuanced interest rate discussions become. Debate about where to from here will increase and we’ll see greater variation in forecasters’ expectations.

Added to this is the fact the cross currents in the data are becoming more powerful. Collapsing forward indicators are cause for concern, but hard data on the labour market and inflation – the RBNZ’s KPIs in other words – are yet to show sufficient signs of moderation.

The theory suggests monetary policy works with a lag, and inflation pressures and labour demand will soon follow the growth indicators downward. But the theory is just that, uncertainty is rife, and the Reserve Bank has no tolerance left for surprises.

Still, in our estimation, the recent run of economic play is an overall negative for interest rates. We think the case for the RBNZ to be able to moderate the approach it laid out in November (125bps of further cash rate hikes through to mid-year) is growing. If this is on the money it would suggest we’re closer to the peak in wholesale interest rates, and hence fixed mortgage rates, than we thought at the end of last year. It may even be that longer-dated fixed mortgage rates – those for terms of 3-year or longer – have already peaked.

Wholesale interest rates a little lower in 2023

However, it’s difficult to be definitive on this, given:

- The fact the Reserve Bank might be weighing up the cross currents differently to us. That is, it might want to see hard evidence of falling inflation and inflation expectations before considering dialling back the pace of interest rate increases. And fair enough, inflation surprised forecasters on the strong side all the way through 2022.

- Two hugely important (and volatile) upcoming data releases – fourth quarter inflation figures out next week, and labour market data the week following – have the potential to completely change the picture.

For now at least, early 2023 falls in wholesale interest rates (chart above) have reduced any immediate upward pressure on fixed mortgage rates to rise.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ).

This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed.

The information in this publication is provided for general information only, and is a summary based on selective information which may not be complete for your purposes. This publication does not constitute any advice or recommendation with respect to any matter discussed in it, and its contents should not be relied on or used as a basis for entering into any products described in it. BNZ recommends recipients seek independent advice prior to acting in relation to any of the matters discussed in this publication, including legal, financial and tax advice. This publication is intended only for the person in New Zealand to whom it is sent by BNZ, and must be treated as strictly confidential. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.