Eco-Pulse: Six takeaways from the Budget & Reserve Bank meetings

26 May 2023

- OCR hits the peak

- Despite a more expansionary Budget

- Past hikes still to work their way through

- Housing correction winding up

The dust has settled on one and is still swirling on the other. But here’s our quick take on the key implications from the Budget and Reserve Bank (RBNZ) announcements.

- “That’s all folks!” RBNZ declares an interest rate peak

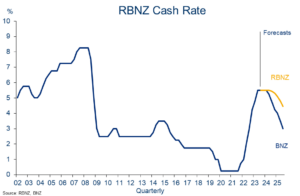

The RBNZ reckons it’s done enough to beat inflation. According to its forecasts and commentary, Wednesday’s 0.25% increase in the Official Cash Rate (OCR), taking it to 5.50%, was the last.

We’ve been in the camp suggesting the Bank had probably done enough even prior to Wednesday. As such, we’ve gladly taken the RBNZ at its word and formalised a 5.50% OCR as our forecast peak as well. The standard caveat/get-out-of-jail-free card remains – the RBNZ’s forecasts are “conditional.” They can change if/when the facts change. The Bank was curiously relaxed about the demand implications of some extra fiscal spending (see below) and the migration boom. Nonetheless, we reckon the hurdle to lifting the OCR further from here is now very high.

It’s worth noting that both wholesale interest rates and the NZ dollar had risen noticeably this week as expectations of an OCR peak near 6% had been factored in. By serving up a large surprise to the market, the RBNZ sent both screaming back down again. This effectively delivered an immediate easing in financial conditions and may well have headed off further increases in retail interest rates.

The debate will now shift from “how high the peak” to “how long the peak”. The Reserve Bank was at pains to point out rate cuts are a distant prospect. We agree but have retained our forecast for a May 2024 start to the easing cycle, roughly six months earlier than the Bank’s projections (chart below).

All of this means our expectation for a peak in short-term fixed mortgage rates around mid-year remains broadly intact. Historically, mortgage rates tend to peak a little after the final OCR hike of the cycle. We continue to believe shorter-term rates will be slow to fall given the still-worrisome inflation outlook.

That’ll do

But the Bank’s announcement does pave the way for earlier falls should economic and inflation conditions allow. There’s still a lot of balls in the air.

It’s also worth repeating that while the OCR has likely peaked, the process of past interest rate increases working their way through the economy will continue for some time. The average mortgage rate actually paid by mortgage holders across the economy is still ‘only’ around 4.7%. We expect this to rise above 6% by year-end.

- A little more fiscal juice

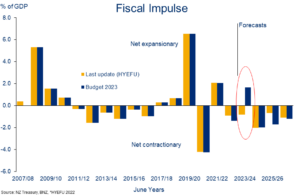

It’s easy to get lost in the sea of numbers and reckons that pour out of Budget day. The one summary statistic we like for its (relative) simplicity is the “fiscal impulse”. It gets at the (change in) the all-told fiscal impact on the economy. Essentially, is fiscal stimulus being added in or dragged out?

Spot the difference

Relative to the last update, there’s an eye-catching swing into net stimulatory territory projected for 2023/24. It’s a flip-around equivalent to 2.4% of GDP. That wasn’t expected.

There was some concern the extra juice might warrant a more aggressive interest rate response from the Reserve Bank. But, in the event, the Bank seemed happy enough that fiscal policy remains net contractionary over the entirety of the forecast horizon (2024/25 onwards).

- There is no recession in New Zealand. Or is there?

The ‘will we/won’t we’ recession debate has been revived with the news the Treasury no longer expects the economy to slip into recession this year.

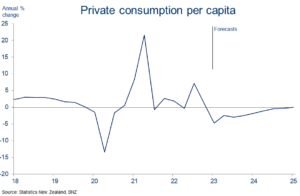

Not to immediately downplay the more positive vibes, but we haven’t altered our fundamental assessment of the NZ economy. As we’ve been arguing, recessionary conditions are already here.[1] Yes, there is a chance we can avoid a ‘technical’ recession, but only because there’s a whole bunch of extra people in the country courtesy of the migration boom. On a per-capita basis, we’re still likely to see a period of contraction in consumer spending and GDP growth this year.

Spending recession

Inflation chewing up spending power

March quarter retail spending figures, out this week, highlighted the challenge confronting interest-rate sensitive sectors of the economy. Adjusted for inflation, spending volumes tumbled 1.4% q/q. That’s the fourth quarter of the last five to record a contraction. As the chart below shows, sky-high retail price inflation (currently running at 9.1% y/y) has driven an obvious wedge between what we’re spending in dollar terms, and the volume of goods/services that spending gets us. Inflation is a silent thief, as they say.

- Weight(s) coming off house prices

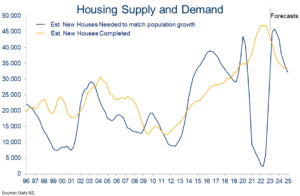

We’ve been flagging the fact that the house price cycle appears to have shifted from the correction phase of the past 16 months, to one of stabilisation. There remain risks on both sides of this, but it’s fair to say dial has swung a little further to the ‘correction done’ side of things over the past fortnight.

On interest rates, we’d characterise the RBNZ’s tools down as removing a source of downside pressure rather than something likely to provide a strong boost to house prices. After all, RBNZ data shows the major banks are testing new borrowers on 8.5-9.0% mortgage rates, and rates don’t look like they’re going to come down anytime soon.

Booming migration numbers may prove more significant. Huge uncertainty remains as to the ultimate size and sustainability of the boom. But, whatever your prior estimate of new houses required to satisfy population growth – and these numbers are always tenuous at best – it’s now likely to be higher than it was. Importantly, this is occurring at a time when construction activity is slowing.

As the chart shows, our rough projections now have incremental housing demand exceeding changes in supply for a time. From this perspective, Budget 2023 funding for 3000 extra public houses, to the extent they can be delivered, may provide a useful offset.

Closing the gap

- Deficit(s) raising eyebrows

Credit rating agencies are having a closer look at NZ thanks to our whopping current account deficit. Think of it as NZ’s transactional account with the rest of the world. It’s in the red to the tune of 8.9% of GDP, the largest since the 1970s, and indicative of an economy still feeling the effects from the post-COVID overheat.

Deficit doldrums

The general expectation is that the deficit will become less problematic in future, mainly as the extra tourist income the country is now receiving helps pay off more of our import bill. But a more expansionary fiscal setting, as flagged last week, implies a slower rate of current account repair, amid a host of other influences.

It’s more a risk to be managed than something to be immediately worried about. There’s less of a buffer to accommodate any future shocks and surprises, without putting pressure on NZ’s strong sovereign credit rating (pressure which would risk higher interest rates).

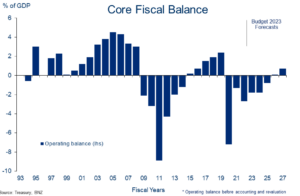

- Less wiggle room

Not only did the Budget delay the expected return to surplus by a year, but there’s a reasonable chance in our view that the (slim) surplus projected for the 2025/26 fiscal year will not be achieved. The Treasury’s economic forecasts look a tad optimistic in our view and we suspect the economy may undershoot.

It adds up to a picture of reduced fiscal wiggle room. This limits potential for any future fiscal easing without a cut in spending and/or hike in taxes.

Surplus delayed

[1] And, in fact, there’s a strong chance a recession has already occurred – Q1 GDP figures out on June 15 will reveal all.

Subscribe to Mike’s updates here

_________________________________________________________________________________________________________________________________

This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication