Eco-Pulse: The economy in (nine) pictures

12 May 2023

- A lop-sided economic slowdown

- With plenty of policy tightening still in the pipeline

- Inflation to keep falling, but how far?

- Housing market finding its feet

- OCR approaching a peak, but will be slow to fall

For something different, we’ve (mostly) parked the keyboard this week, and tried to let the pictures do the talking. They’ve got plenty to say!

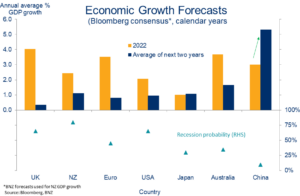

Chart 1: A fragile global backdrop

Peak pessimism about the global economy is behind us, largely thanks to China’s rapid reopening.

But a decent come-down is still in the offing for most of NZ’s trading partner economies over the next couple of years, with the obvious exception of China. Forecasters still see a better than even chance of recession for the UK, US, and NZ.

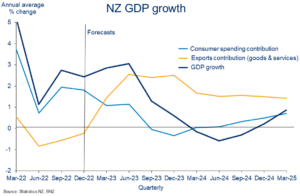

Chart 2: A lop-sided NZ slowdown

Our forecasts still flash ‘recession ahead’, even if the recent economic data pulse has been far from terrible. Importantly, the impacts and ‘feel’ of the slowdown will be very mixed across sectors and regions.

A strong recovery in exports (read: tourism) will blunt some of the economic downforce from the RBNZ’s war on consumer spending. The economy is rebalancing, slowly.

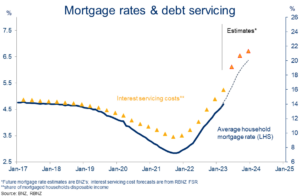

Chart 3: Pipeline pressure

A pipeline chocka with interest rate pressure is the main factor weighing down the economic outlook.

The average mortgage rate being paid by households has now risen to 4.7% but there’s plenty more to go; 50% of fixed-rate loans are due to reset over the coming year. Interest payments will soon soak up more than 20% of mortgaged households’ disposable incomes (in aggregate).

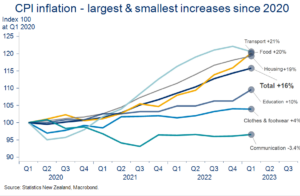

Chart 4: No one’s friend

The latter has now peaked but, at an annual 6.7%, is still way too high.

Moreover, the cumulative impact on household budgets of several years of strong price increases is stark. According to the CPI, housing, transport, and food costs – that is, the essentials – are all around 20% higher than pre-COVID levels.

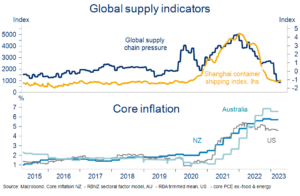

Chart 5: How far will inflation fall?

The global supply shock that propelled inflation to 30-year highs is now correcting. That’s good news, and is part of the reason we see NZ inflation continuing to fall this year (4.5% forecast by year-end).

But core inflation is yet to roll over. It’s being held up globally by tight labour markets and a burst of services inflation. It’s migraine-inducing stuff for central bankers, and a key reason we think interest rates will ultimately be slower to fall than some are suggesting.

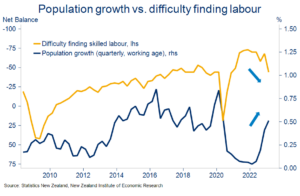

Chart 6: Migration-induced pressure release

We’ve already covered it plenty (see here and here) but the boom in inward migration could be a game-changing development for the NZ economy.

It’s already lifting labour supply, easing skill shortages, boosting spending, and adding to housing demand. What we don’t know is what the net impact of all this will be on inflation and, thus, interest rates.

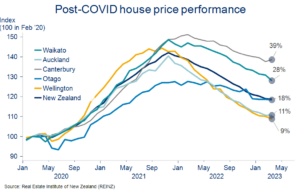

Chart 7: Boom, bust

House prices have been through a sharp correction, but the extent of the 2021 run-up means they’re still well ahead of pre-COVID levels. About 19% ahead in fact.

That’s a NZ-wide national average. It’s been a mixed bag amongst the regions reflecting, we think, relative affordability constraints biting.

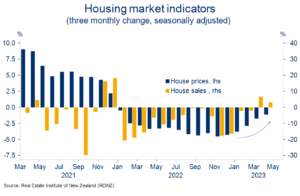

Chart 8: Turning point

The latest indicators suggest house prices may no longer be falling. If so, that would round off a marginally smaller peak-to-trough correction than the 20% forecast we’ve had on the board.

Where to from here? There’s still plenty of headwinds for house prices out there. Our view is more in keeping with a stabilising/flat-lining than any sort of upwards acceleration.

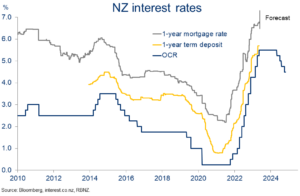

Chart 9: Interest rates close to peak but slow to fall

Historically, interest rates tend to peak a little after the last Official Cash Rate (OCR) hike of the cycle. On our forecasts, this will come in a few weeks, with the Reserve Bank (RBNZ) expected to push the OCR up a final 25bps to 5.50%.

Uncertainty abounds though. The OCR could go higher still, if (core) inflation proves sticky. In the least, we think it will be some time (well into 2024 on our numbers) before the RBNZ can consider lowering interest rates.

To subscribe to Mike’s updates click here

________________________________________________________________________________________________________________________________

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. T Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.