Navigating choppy waters – a look back at the past financial year

8 May 2023

Reflecting on the past financial year, it has clearly been a challenging one for investors. Despite markets remaining below their 2021 highs, they’ve managed to bounce back from their lows during the year. Overall market performance has been disappointing this year, and significant uncertainty remains. However, there are some positive signs that could support better performance in the future.

A stormy start

The financial year kicked off in April 2022 during turbulent times around the world. Russia had invaded Ukraine, the era of ultra-low interest rates was coming to an end, and supply chain issues were still causing disruptions. Concerns over energy prices and energy supply – especially in Europe – and the rate of inflation around the world was regularly making headlines. Central banks responded by increasing the pace of their interest rate hikes, which had a negative impact on the performance of both equities and fixed interest.

Easing pressures

Thankfully, as the year progressed some of these pressures started to ease. Inflation peaked in the United States in June 2022, and has since trended lower. A mild winter in Europe and energy saving measures led to higher gas storage levels, easing fears of energy shortages. The price of oil also started to trend lower in July and has continued to do so.

A break in the cycle

There is a belief in financial markets, that when the Federal Reserve (the central bank in the US) starts raising interest rates, it will keep doing so until something breaks. In March 2023, something broke. Silicon Valley Bank and Signature Bank were caught in a bank run, as a result both were closed by regulators. Fortunately, the actions that central banks and regulators have taken seem to have contained this event and have calmed the market’s nerves.

Positive signs on the horizon

Following this event, most central banks are still expected to raise rates further, but at a slower pace. It also looks like many central banks are nearing the end of their rate-hiking cycle. Despite a tough year, fixed interest now offers higher yields – making it more likely to deliver stronger returns. Following their fall, equities also look more attractive from a valuation perspective.

How our funds performed

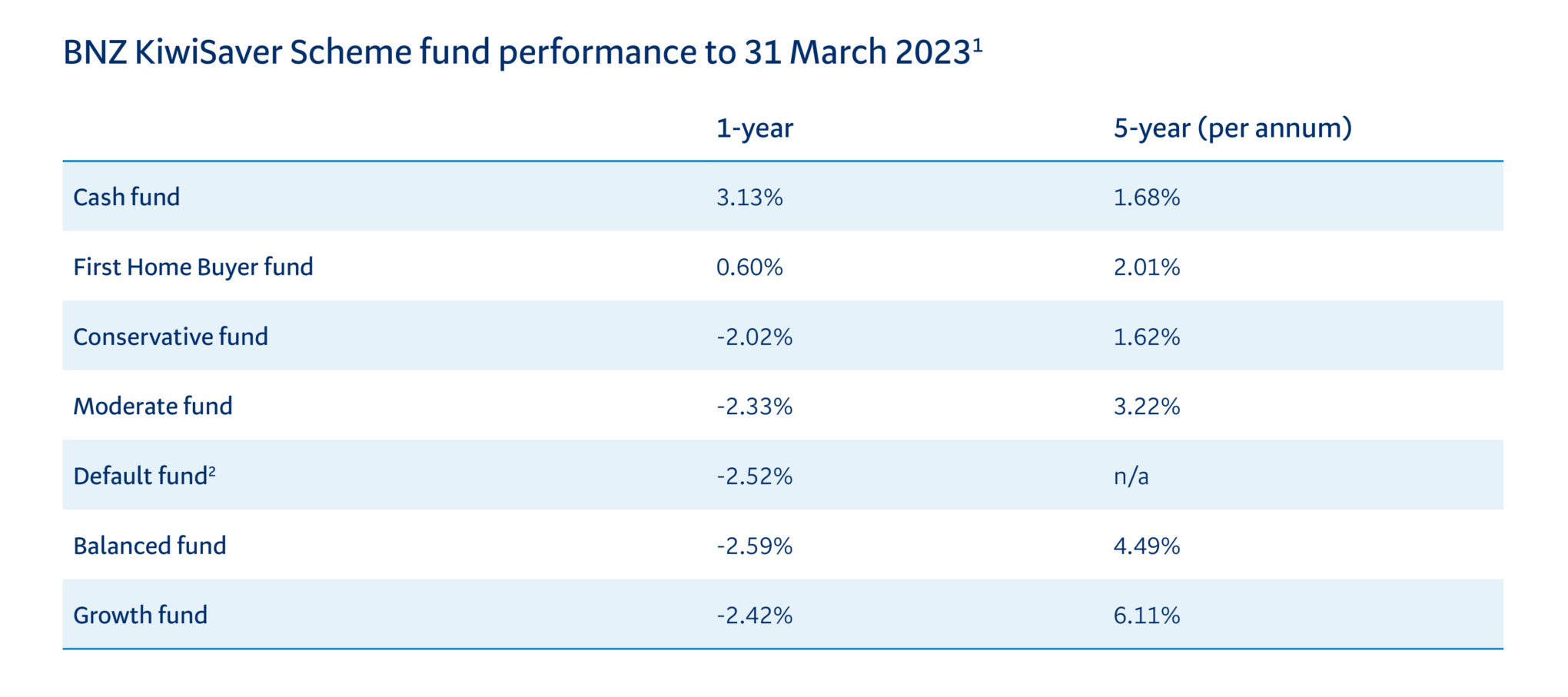

Funds with a higher allocation to cash, like our Cash fund and First Home Buyer fund, generated positive returns during the year, while funds with a higher allocation to international fixed interest and shares, like our Balanced fund and Growth fund, generated negative returns. Returns are calculated before deducting tax and after deducting Management Fees. Past performance is no guarantee or indication of future performance.

Staying disciplined in bumpy markets

As we move forward, it’s important to remember that investing requires riding out the ups and downs. Although it’s concerning for investors when markets fall, it’s all part of the investment journey, and performance should be considered over the long term.

Investing in higher quality assets has proved to be a sound strategy over time, and it can be particularly effective during periods of market uncertainty. Despite the challenges faced during the past year, investors can be reassured that we have a well-diversified, disciplined investment approach with a focus on quality. This should place investors well to weather future challenges as well as participate in a rising market.

1. The returns are calculated on the change in the unit price of each fund over the period specified, adjusted for tax credits. Each BNZ KiwiSaver Scheme member’s return will vary based on the unit price applicable to each contribution or withdrawal that is made and how long they have been invested for. Returns represent historical performance only and are not an indication or guarantee of future performance. The value of a fund may rise or fall depending on market conditions. Returns are calculated after deducting management fees and before deducting tax in accordance with the Income Tax Act 2007. The returns for periods less than and including one year are not annualised. The returns for periods more than one year and since inception are annualised.

2. The Default fund started accepting contributions on 1 December 2021.

Important information:

This article is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Neither BNZ nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any information, representation, or omission, whether negligent or otherwise, contained in this publication.

BNZ Investment Services Limited, a wholly owned subsidiary of BNZ, is the Issuer and Manager of the BNZ KiwiSaver Scheme. Download a copy of the BNZ KiwiSaver Scheme Product Disclosure Statement, or pick up a copy from a BNZ branch.

Investments in the BNZ KiwiSaver Scheme are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, possible delays in repayment, possible loss of income and possible loss of principal invested. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of capital. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand and is not authorised to offer the products mentioned in this email to New Zealand customers.