Eco-Pulse: Clouds gather

22 Aug 2023

- Economic downturn broadening

- As cracks appear in previously sturdy sectors

- GDP double-dip likely, following Q2 lift

- No change to our (peaking) mortgage rate and (turning) house price messaging in the wake of RBNZ meeting

The southerly chill blowing through the economy has stiffened over the past couple of weeks. The downturn is broadening, greying the outlook for even some of our stronger-performing sectors like services and tourism.

Some of that has been expected as we slip into the tough part of the economic cycle. It was factored into our forecasts already, in other words. But that’s not true of the primary sector outlook. It’s deteriorated rapidly, and we’re not yet convinced the worst is over for China’s economy.

Against this backdrop, we remain of the view that additional interest rate hikes are not required. In turn, and assuming inflation withdraws, we’re continuing to pencil in some semblance of economic recovery in mid-2024. The cycle will turn as it always does. But, and as one punter sagely reminded us at an event last week: “we’ve got an election to get through first and you’ve no idea what’s going to happen.” Indeed.

What have we learned over the past fortnight?

We don’t normally examine the entrails of the monthly Performance of Manufacturing (PMI) and Performance of Services (PSI) indices here. But there were a couple of things that caught our eye in amongst the July figures.

Manufacturing weak, services (mostly) strong

First, the sharp fall in the PSI from 50.1 to 47.8 meant that both indices are now in contractionary territory (sub-50.0) for the first time since the 2008 financial crisis (outside of lockdowns). Bear

in mind the service sector accounts for around two thirds of the NZ economy and has been an important source of support to date. It remains so in many other parts of the world (chart opposite).

Second, the details looked weaker than the headline numbers. In particular, new orders fell sharply while inventories rose. It’s a clear signal that demand is starting to undershoot expectations and, consistent with some of the anecdote, there’s overstocking occurring in some quarters. If so, activity is likely to soften further in coming months as inventory levels are adjusted.

Overstocking?

We’re quick to add here that none of this is of any great surprise given the dour view we hold already. Indeed, mashing the PMI and PSI together produces a steer on future GDP growth that lies basically on top of our own forecasts (chart below).

It solidifies our expectation that, while the economy likely clawed its way out of ‘technical’ recession in the second quarter (we expect the 21 September figures to reveal a +0.3% q/q expansion), the respite is expected to be fleeting. A second half double-dip is likely.

Slowdown signal strong

Mortgage rate resets to maintain pressure on retail

Weak retail spending remains at the vanguard of the slowdown. A 0.9% m/m fall in the value of retail card spending in July confirmed that the belt tightening is continuing.

Yes, annual growth in the value of ‘core’ retail spending is running at 4.3%. But all of this growth, and then some, reflects higher prices – annual inflation is still around 6%. The volume of stuff leaving shop floors continues to go backwards, as it has since late 2021.

With 30% of all fixed-rate mortgage loans due to reset onto higher (average) rates over the coming six months, discretionary and durables spending, in particular, will remain under significant pressure.

This soft underbelly to spending is all the more notable given some of the supposed supports out there like record population growth, expansionary fiscal policy, the FIFA Women’s World Cup, and broader buoyancy in tourism numbers.

For tourism at least, a quick look at the other side of the ledger helps square the circle of the underwhelming spending pulse. In short, there’s been almost as many people headed offshore as there has been coming in. This is of course far from normal given NZ’s tourism-centric economy.

Inbound tourism numbers have recovered to around 65% of 2019 levels (12 month rolling sum). But that’s been eclipsed by NZ holiday-makers leaving our shores to spend offshore, the numbers of which are back to around 77% of 2019 levels.

Neck and neck

The most obvious missing link for NZ’s inbound tourism recovery is a more forceful return of Chinese tourists. These have historically been our second largest source of inbound arrivals but are currently mired at around a third of pre-COVID levels (chart below).

Chinese tourist arrivals still lagging

There have been some encouraging signs on this front, particularly around increased airline capacity. But we think there’s a heightened risk the leave of absence continues

given the crisis of confidence facing Chinese consumers more generally.

A crisis of (consumer) confidence

The Chinese property slump appears to be deepening and consumer confidence has slumped to near record lows. Rather than being spent, cash is being stock-piled as economic anxieties mount. Chinese retail sales growth was last week revealed to have slowed further to 2.8% in July (in volume terms).

Unless fiscal stimulus is urgently and aggressively applied, there’s a growing chance China will fall short of its 5% growth target. Five percent sounds like a strong number, but for China it may not be enough to soak up spare capacity and bring down high unemployment.

Ailing Chinese consumer demand has materially increased the headwinds buffeting NZ’s primary sector incomes. In the wake of another weak GDT dairy auction, we last week further trimmed our 2023/24 season Milk Price forecast to $6.70 kg/ms. Soon after, Fonterra lowered its own forecast midpoint to $6.75.

These numbers are well south of estimates of cash flow ‘breakeven’ of around $7.00-$8.00 and will thus see farmers aggressively pulling back on spending. With lamb and forestry returns also under pressure (40% of sheep meat exports go to China, and 60% of log exports) regional economies, in particular, are set to feel the pinch.

Interest rate message unchanged

Against a backdrop of a broadening domestic slowdown, accumulating downside risks in China, and the ongoing slow drip from mortgage rate resets, we remain of the view the Reserve Bank doesn’t need to lift interest rates any further.

There was nothing in last week’s RBNZ announcement to disavow us of this view. Despite the bank’s subtle nod to the risk of a higher cash rate, our central view is that it will remain where it is at 5.50% for some time.

This being so, our messaging on both mortgage rates and house prices hasn’t changed. Notably, the Reserve Bank’s own house price inflation forecasts were given a shunt up towards our own in last week’s Statement. We retain a stronger view overall (7% rise over calendar 2024).

Turning point reached

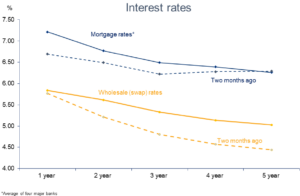

We think mortgage rates are in the process of peaking, but the timing of any meaningful falls is sufficiently distant (and uncertain) that it makes sense to budget on rates staying around current high levels well into next year.

Additional upward tweaks in mortgage rates can’t be ruled out should the recent lurch higher in wholesale interest rates continue (chart below). Since the Reserve Bank declared the tightening cycle over in May, two-year wholesale (swap) rates have risen a further 40bps.

Going (more) inverted

From early 2024, we should see mortgage rates start to nudge lower assuming our view of mid-year cuts in the official cash rate is close to the truth.

Declines are expected to be more pronounced in the shorter-term one- and two-year rates. For this reason, fixing at shorter terms, as appears to be the most popular strategy at present, continues to make sense to us. That’s even with three-year fixed rates being about 70bps lower than average one-year rates.

Slow to fall

Chart of the week

We were amazed by last week’s SEEK job ads figures. Job applications per ad soared to the highest level ever. Above previous recessions and the early fraught days of lockdown. Taken at face value, the implication is that the surge in migration inflows has delivered such a large increase in the pool of prospective workers that hiring managers are suddenly spoilt for choice. This likely overstates the case. But the direction of travel is clear. Extreme labour market tightness is a thing of the past and wage growth has peaked and is dissipating rapidly.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.