Eco-Pulse: Less peak, more plateau

9 Oct 2023

- QSBO business survey underlines labour market shift

- Reinforcing our view OCR doesn’t need to go higher

- But prospect of mortgage rate declines shifts later

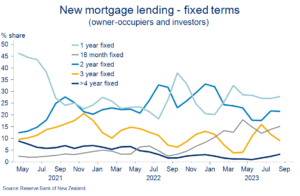

- Even as RBNZ data highlights ongoing preference for shorter fixed terms

In brief

To our minds, the big changes in the econosphere over the past few weeks have been: (1) a renewed surge in interest rates; (2) more inflation niggles; and (3) confirmation a labour market backflip is underway.

The net of it all has us holding the line on our view the Reserve Bank doesn’t need to lift the Official Cash Rate (OCR) any further. Our labour market (unemployment to 5.1% by end 2024) and house price (+7% over calendar 2024) views are similarly unchanged.

But, with an eye on wholesale funding costs, the risk profile for mortgage rates has shifted higher for longer. The “peaking” narrative could usefully be replaced with more of a “plateau”. And the short-term risk is for additional upward tweaks to longer-term rates, unless wholesale rates soon ease off.

At the same time, new RBNZ data on mortgage fixing shows that borrowers continue to strongly favour shorter terms, increasing sensitivities to higher-for-longer mortgage rates.

What’s up with interest rates?

The Reserve Bank continues to stand by its ‘tools down’ pledge. But that hasn’t stopped wholesale interest rates marking all sorts of fresh records over the past few weeks.

Wholesale (swap) yields – upon which retail interest rates are based have, depending on which term you look at, jumped to highs not seen in 12-15 years.

Interest rate curves grind upwards

As the chart shows some, but not all, of these increases have filtered through to retail interest rates. One-to-three-year fixed rates are up 5-10bps over the past month, with 12-month term deposit rates rising a similar amount.

What’s behind these moves in wholesale rates? Some combination of:

- Offshore markets begrudgingly accepting the vibe the US Federal Reserve has been laying out for months. Namely, a soft landing for the US economy is great news but it also entails US interest rates staying higher for longer. Global bond yields have jumped as this messaging has been baked in. NZ yields, as ever, have been caught in the updraft.

Caught in the updraft

- Inflation niggles. Some of the recent spike in oil/petrol prices has reversed over the past few days but we’ve still had to put some extra juice into short-term inflation forecasts. That’s still within the context of an expected strong inflation downtrend (to 4.7% y/y by June, 2.5% by Dec ’24), but it’s testing stuff given sticky domestic inflation and the Reserve Bank’s finely balanced interest rate outlook.

Against this backdrop, nervousness about the RBNZ having to resume rate hikes at some stage remains. Market pricing fully factors in an additional 25bps hike. While this can’t be ruled out, we still don’t sign up to this view. In particular, we remain concerned about the growing (and disinflationary) weight on the economy from:

- Fragile Chinese demand and the negative implications for our commodity prices, rural incomes and spending. A 12% bounce in dairy auction prices from the August lows provides hope we may be past the worst on that front. But the arrival of El Niño adds to the headwinds facing NZ agriculture (see our latest Rural Wrap for more).

- The fact late-cycle pressures on households will intensify next year. The average mortgage rate being paid will be closer to 6.5% from 5% currently. It’s also increasingly clear labour market dynamics will look quite different.

On the latter, the anecdote from business for some time has been that the labour market turned on a dime once migration inflows began to ramp up. This is yet to really show up in official stats. But it’s only a matter of time now given that it’s come through, in spades, in our most reliable business survey – the NZIER’s Quarterly Survey of Business Opinion (QSBO). The latest (third quarter) edition was released last week.

QSBO confirms labour market sea change

The QSBO’s myriad indicators neatly encapsulate the current climate: little to no top-line growth, below average but improving profitability, parked investment intentions, and falling but still uncomfortably high cost and inflation pressures.

Still, the survey’s labour market barometers were the most eye-catching. Difficulty finding labour metrics, both skilled and unskilled, tumbled back to 2011/2012 levels (excluding the COVID-related saw-tooth). And that’s from outrageously tight levels as recently as December. Yes we’re only back to roughly ‘average’ levels now, but the speed at which difficulty sourcing skilled labour has reduced over the past nine months is unmatched in 48 years of survey history.

The implications are:

- It’s clear that a sizeable lift in unemployment is on the way, even if firms deliver on the modest jobs growth they’ve got planned. We continue to expect a lift in the unemployment rate from 3.6% into the low ‘5’s.

Sure to rise

- The associated reduction in job security and wage growth/expectations will provide another hit to households already under pressure from high inflation and debt servicing costs. Remember retail spending volumes have already been in trend decline for seven quarters, and that’s a period characterised by an extraordinarily strong labour market.

- The number one challenge for firms has definitively reverted from securing production inputs – chiefly labour but also, to a lesser extent, materials – back to chasing sales. To frame the shift in econo-speak, we’ve emerged from the big negative supply shock of 2021/22. As the chart shows, the reduced pressure on (labour) resources helps pave the way for an eventual reversal in core inflation.

Reduced capacity pressures lead to reduced inflation

The latter is important. In tandem with the intensifying pressures on economic activity, it leaves us with a picture of the Reserve Bank gritting its teeth through short-term inflation niggles, and waiting things out.

The waiting is the hardest part

That was the message we took from last week’s (unchanged) OCR announcement. High interest rates are doing the job. It’s about patience rather than giving the economy another kicking.

We do acknowledge though that, relative to the picture a few months ago, additional patience may be required. Our formal view is that the Reserve Bank will be in a position to lower the OCR in May of next year. But the risks to this are shifting later. Further, retail interest rates – the rates that actually matter for most – also depend on what wholesale rates (global and local) are doing. Even if we think the latest jump in the latter is overdone, at least some of it is likely to stick around given a more resilient global economic backdrop.

Retail rates higher for longer

Putting all this together, prospects for early declines in mortgage rates have dimmed further. We said in August that “the timing of any meaningful falls is sufficiently distant (and uncertain) that it makes sense to budget on rates staying around current high levels well into next year.” Our best guess is now mid next year.

We also said at the time that “additional upward tweaks in mortgage rates can’t be ruled out should the recent lurch higher in wholesale interest rates continue.” It did, and the tweaks came through. Given developments since, this risk remains pronounced, particularly for longer-term mortgage rates.

None of this has altered our housing views. Booming migration coupled with a likely residential construction under-build (more on this soon) means we continue to expect a 7%-odd lift in house prices through calendar 2024. We’re loathe to fine-tune this forecast this side of the election in any case.

Borrowers still favour shorter mortgage terms

New data from the Reserve Bank released last week shows new mortgage borrowers continue to opt for shorter-fixed terms.

The share of new residential borrowing on floating terms fell to 18% in August – the lowest in the short history of the series (April 2021). The 82% share of new borrowing on fixed terms consequently hit new highs.

But, of this fixed-rate lending, shorter terms of 18 months or less remain overwhelmingly favoured (66% of the August new lending flows – chart below). Fixing for a one-year term remains the most popular strategy amongst both owner-occupiers (28% of August lending flows) and investors (32%).

Shorter terms en vogue

This ongoing preference to ‘go short’ is reflected in the overall stock of mortgage borrowing.

The share of fixed-rate borrowing with remaining terms of 1-year or less has quietly crept up to 60%, the highest in just under two years. About a third of the book will roll over in the next six months. You’d have to argue, then, that overall sensitivities to higher-for-longer interest rates have gone up amongst mortgage borrowers.

60% of fixed rate borrowers rolling over in next 12 months

Subscribe to Mike’s updates here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.