Looking back at 2023: Here’s what investors need to know

30 Nov 2023

Investment markets have showed signs of resilience this year. We sat down with Peter Forster, General Manager – Wealth, to talk about this year’s investment performance, and the big investment themes we can expect for 2024.

How’s performance looking this year for BNZ investment portfolios?

We’re proud of our solid investment performance, which has been particularly strong in our more growth-orientated funds. This has been driven in part by a rally in global share markets which have delivered stronger returns this year – although it’s worth noting that this came with lots of ups and downs along the way. Some additional factors that have contributed to our performance this year are:

- Our active managers have added value by outperforming their benchmarks (this means delivering a higher return than their benchmark index). Investors are benefiting from both our passively-managed and actively-managed strategies.

- Our returns have been supported by the strategic allocation tilts we’ve selected – towards global equities and investment-grade credit. We’ve chosen these tilts because we believe this will deliver better outcomes for investors at this point in the market cycle, and this has delivered good results.

- Our focus is on keeping fees low. This means you get to keep more of your money.

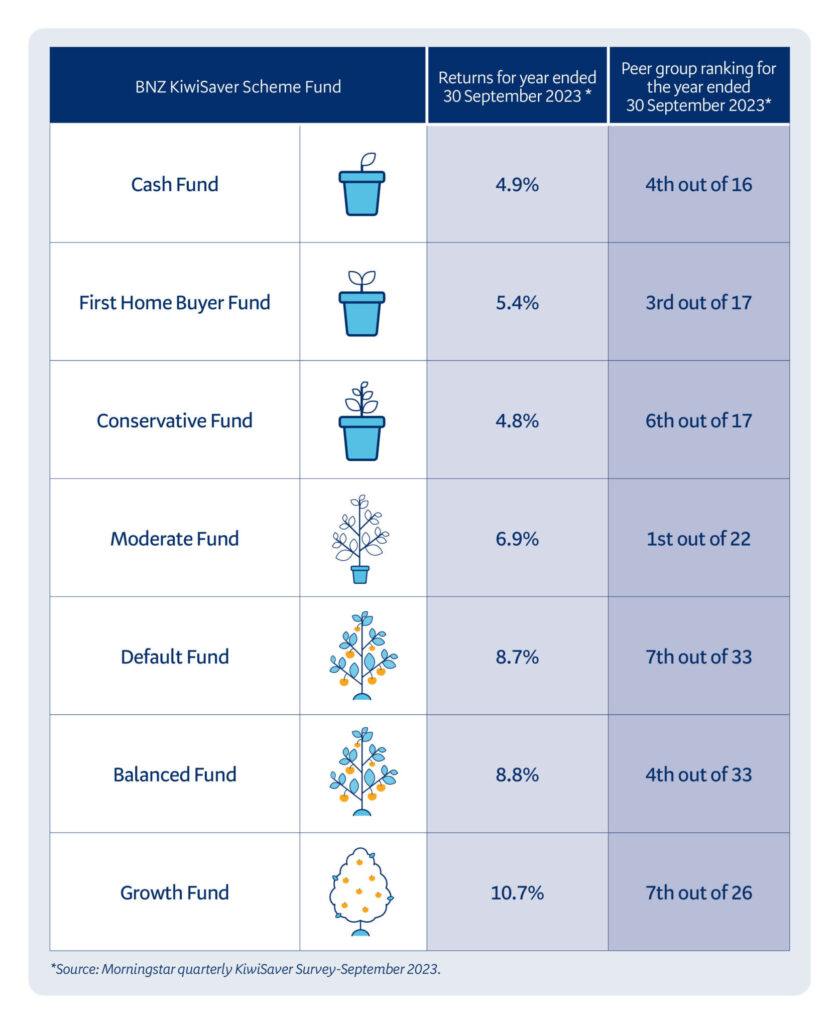

All of these factors play out in the latest KiwiSaver Morningstar rankings, which compare returns across a range of different providers after fees. All funds in the BNZ KiwiSaver Scheme delivered solid performance, ranked in the top seven for their fund type (see below), with the Moderate Fund coming first in its category, which is a great result.

What’s been happening in global financial markets this year?

While it’s been a much stronger year for financial markets, it’s still been a turbulent one. We’ve seen sticky inflation and geopolitical uncertainty continue to impact markets. If we look simply at investment returns, it looks like a good year overall. But this masks some of the instability that’s still lurking in the background.

The future is no more certain today than it was a year ago, and this is reflected in the current levels of market volatility (i.e., how much the market is moving up and down). Most investors will have seen their investment balances jumping around throughout the year as a result.

While inflation is slowly falling, and most central banks have reached the peak of their rate-hiking cycle, the inflation story is still weighing heavily over financial markets. On a day-to-day basis, it’s inflation-related news driving market uncertainty.

We’ve also seen the economy in China slow down dramatically this year. As the world’s second largest economy, any signs of instability will have an impact on global markets. And here in New Zealand, a weak Chinese economy could put added pressure on New Zealand businesses, given China is our largest trading partner.

What’s on the horizon for investment portfolios?

The higher inflation and interest rate environment has put a lot of pressure on households, with increasing mortgage and rental payments along with higher day-to-day living costs. Concerns around the cost of living and future unemployment indicators could see the Reserve Bank of New Zealand reduce interest rates sooner than expected – potentially around the middle of next year.

When we look at investment portfolios, the higher interest rate market has created short-term pressure on asset prices, such as shares and bonds. One positive for investors is that higher interest rates have seen bond yields increase, providing a structural tail wind that could support bond portfolios over the medium term. This sets the stage for higher returns over the next few years.

Global economic factors will be a major determinate of how equity markets perform next year. We’re still facing the potential for a global recession, particularly considering the conflict in the Middle East, and the ongoing conflict in the Ukraine.

It’s worth noting that we’ve seen more divergence in global equity markets, and we expect this to continue into 2024. The US market has performed particularly well, compared with the rest of the world. Almost all of the gains have been from the so-called ‘Magnificent Seven’, a group of huge technology companies carrying the US share market. However, there is also heightened scrutiny on this group of tech companies and their ability to perform, considering how much they dominate equity markets.

What are the big investment themes going to be in 2024?

This year New Zealand has seen first-hand impacts of climate change. The financial and economic impact of climate change is something that the world is still coming to grips with. From an investors point of view, there are a number of climate-related risks to portfolios. For example, there are risks for businesses that are heavy polluters, especially those that don’t have a well-developed plan to reduce their greenhouse gas emissions. When you have companies like this in your investment portfolio, you’d want to make sure that these companies have a plan to move towards renewables, so they aren’t left behind in the energy transition.

There are also opportunities for companies that are ahead of the curve. Encouragingly, we’re seeing a lot of innovation both domestically and abroad, including clean tech and sustainable infrastructure that will support the global shift to a lower-emissions future.

What investment approach should people be thinking about for the year ahead?

As we approach the end of the year, this is a good time to check in with your investments and with your KiwiSaver account, and make sure you’re on track.

You could ask yourself questions like: what is my investment timeframe, what is my risk appetite, am I in the right fund, and am I contributing at the right rate to achieve my goals.

There are a range of BNZ KiwiSaver Scheme funds and YouWealth funds, each with their own investment mix so there’s a fund to suit pretty much everyone. We’ve recently added High Growth Funds to our refreshed line up of investment options. High growth funds have the potential to deliver higher returns and are suitable for longer-term investors that have more tolerance to ride out the ups and down. Our High Growth Funds have 100% exposure to equity markets, which have the highest expected returns over the long term of our funds, but you need to be willing and able to accept a higher level of risk to achieve this.

Learn more about our High Growth Funds here.

BNZ Investment Services Limited, a wholly owned subsidiary of BNZ, is the Issuer and Manager of the BNZ KiwiSaver Scheme and YouWealth. Download a copy of the relevant Product Disclosure Statement from bnz.co.nz/kiwisaver or bnz.co.nz/youwealth.

Investments made in the BNZ KiwiSaver Scheme or in YouWealth are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, including possible delays in repayment. You could get back less than the total contributed. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or YouWealth, or the repayment of amounts contributed. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand but a licensed bank in Australia and is not authorised to offer the products referred to in this article to customers in New Zealand.

Any views expressed in this article are the personal views the author and do not necessarily represent the views of BNZ, or its related entities. This article is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser.

Neither Bank of New Zealand nor any person involved in this article accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, information, representation or omission, whether negligent or otherwise, contained in this article.