How to give your KiwiSaver account a boost

1 May 2024

It can be hard to save for retirement when there are so many other things competing for your hard-earned money. How can you make the most from the money you put into your KiwiSaver account for retirement? The annual KiwiSaver government contribution can help. Here’s an example of how it works.

Meet Kahu, a 25-year-old baker. Kahu’s KiwiSaver goal is to build a secure nest egg for her future. Kahu doesn’t have to make compulsory KiwiSaver contributions from her income because she’s self-employed. But she’s keen to make the most of KiwiSaver and receive the full amount of her annual government contribution.

Kahu knows that the Government contributes 50 cents for every dollar she contributes to her KiwiSaver account (subject to eligibility criteria), up to $521.43. This means that if Kahu adds $1,042.86 to her KiwiSaver account between 1 July – 30 June, she can get $521.43 from the Government each year. This is why Kahu plans to add at least $1,042.86 (an average of $21 per week) so she can get the full government contribution.

Last year was tough, so Kahu could only add $300 to her KiwiSaver account. That’s okay – as an eligible KiwiSaver member, the Government still contributed $150 towards her retirement savings. So even though she couldn’t contribute the full $1,042.86 this time, she still made the effort to contribute what she could, so that she’d get as much ‘free money’ as possible.

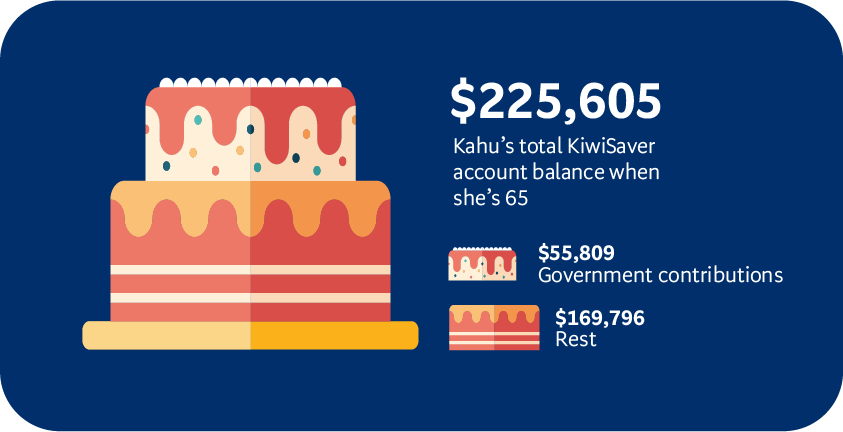

Kahu currently has $10,000 in a Growth Fund. If Kahu continues to receive the maximum annual government contribution from age 25 until her chosen retirement age of 65, the total government contributions in her KiwiSaver account could add up to $55,808.82* at her retirement age. That’s one of the great benefits of KiwiSaver – Kahu could have an extra $55,808.82* when she’s 65, simply through getting her full government contributions each year.

So, with her own contributions plus the government contributions and investment returns, Kahu will have an estimated $225.605.09* saved by the time she’s 65 – that’s not bad for contributing around $21 per week from age 25.

Eligibility criteria

To be eligible for the government contribution, you must be:

- 18 years or older; and

- Not yet eligible for retirement withdrawals; and

- Mainly living in New Zealand (you may also qualify if you are a government worker, charity worker or volunteer working outside of New Zealand).

If you don’t meet the eligibility requirements for the full year (1 July – 30 June) but you do for part of it, the maximum government contribution you receive will be based on the length of time you were eligible for it – with the Government putting in 50 cents for every dollar you put in up to that maximum amount. For instance, if you join KiwiSaver, or turn 18 part-way through the year, your government contribution will be calculated in proportion to how many days in the year you were eligible.

Voluntary contributions

If your regular contributions don’t add up to at least $1,042.86 in a year (1 July to 30 June), you can also make voluntary contributions into your KiwiSaver account to make sure you reach $1,042.86. With the BNZ KiwiSaver Scheme you can top up any time, in two ways:

- Simply transfer money from your bank account to your BNZ KiwiSaver Scheme account through Internet Banking or the BNZ app or

- Set up regular automatic payments, so you don’t have to remember to contribute.

For more information on the government contribution, visit the Government’s KiwiSaver website. Try out our KiwiSaver calculator to explore how a little extra now could make a big difference to your potential savings at 65.

See our website for more information about the BNZ KiwiSaver Scheme or if you’d like to talk about KiwiSaver, you can call us on 0800 275 269.

*For this fictional case study, we’ve assumed that Kahu:

- Has a starting KiwiSaver balance $10,000

- Is 25 years old (i.e., has 40 years until the current KiwiSaver retirement age)

- Is self-employed (and so not regularly contributing from salary)

- Makes $1,043 in voluntary contributions annually to meet the government contribution entitlement (for this purpose we have ignored Kahu’s difficult year where she only contributed $300, and instead assumed she made the full $1,043 voluntary contribution that year)

- Is in the BNZ KiwiSaver Scheme Growth Fund (which we have assumed earns 4.5% p.a.)

The figures used for Kahu’s fictional case study are for illustrative purposes only and may not reflect actual returns. The calculations have been made using the BNZ KiwiSaver Scheme calculator based on the following assumptions, excluding the voluntary contribution growth assumption:

- The final balance of $225.605.09 is in today’s dollars so you can compare with the cost of living today.

- The result is not guaranteed to occur, and is simply to help you understand how choices you make may affect the value of your KiwiSaver savings.

- The result is not intended to provide financial advice. Accordingly, the result should be treated as a guide only and not as financial advice.

- To the extent permitted by law, neither BNZ nor any of its related parties accept any responsibility or liability arising from the use of this fictional case study.

The final balances are based on the following assumptions:

- Kahu’s contribution to her KiwiSaver account each year is $1,043 and solely to meet the government contribution entitlement. The contribution amount does not increase each year

- Contributions will continue to be made each year until the age of 65

- No savings suspensions are taken

- No amounts are withdrawn

- Kahu receives an annual government contribution of 50c for each dollar she contributes, up to a maximum of $521.43 a year (from 1 July to 30 June)

- Kahu remains in the BNZ KiwiSaver Scheme Growth Fund until age 65

- The rate of return for the BNZ KiwiSaver Scheme Growth Fund is 4.5% p.a. (after tax and after fees)

BNZ Investment Services Limited, a wholly owned subsidiary of Harbour Asset Management Limited, is the Issuer and Manager of the BNZ KiwiSaver Scheme. Download a copy of the BNZ KiwiSaver Scheme Product Disclosure Statement PDF 1.1MB, or pick up a copy from a BNZ branch.

Investments in the BNZ KiwiSaver Scheme are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, including possible delays in repayment. You could get back less than the total contributed. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of amounts contributed. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand but a licensed bank in Australia and is not authorised to offer the products and services mentioned on this webpage to customers in New Zealand.

BNZ Investment Services Limited (BNZISL) uses the BNZ brand under licence from Bank of New Zealand, whose ultimate parent company is National Australia Bank Limited. No member of the FirstCape group (including BNZISL) is a member of the NAB group of companies (NAB Group). No member of the NAB Group (including Bank of New Zealand) guarantees, or supports, the performance of any member of FirstCape group’s obligations to any party.