How does a possible $55,000* boost to your KiwiSaver account sound?

5 Dec 2024

Did you know the Government contributes up to $521.43 each year to eligible KiwiSaver accounts? It’s an incentive to encourage people to contribute – think of it like a bonus for your KiwiSaver account. It can really add a boost over time. For many, retirement seems so far away. But making some small changes to your finances now could mean you end up thousands of dollars better off when it comes time to retire.

How does it work?

Each year (in mid-July) the Government contributes 50 cents for every dollar contributed to eligible KiwiSaver accounts that year, up to $521.43. So, if you add $1,042.86 to your KiwiSaver account between 1 July – 30 June, you could get $521.43 from the government for that year.

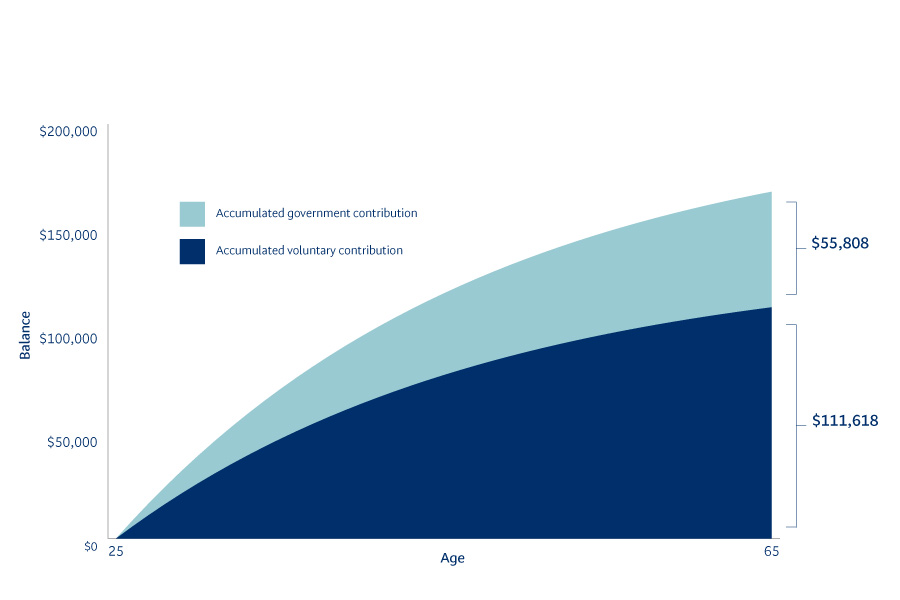

The magic of compounding returns

The best thing about the government contribution is that it has the potential to earn you thousands of dollars over the long term. That’s the beauty of compounding returns. For example, if you received the government contribution for your KiwiSaver account each year from the age of 25, that could be an additional $55,000* added to your KiwiSaver balance by the time you turned 65. Please see the assumptions behind this projection at the bottom of the page.

Start chipping away early

To receive the maximum government contribution each year, it’s important to have a plan. If you’re on an annual salary or wages of $35,000 or more and contributing 3 percent of your income to KiwiSaver, you should be contributing enough across the year to get the maximum government contribution. If you’re not working or you’re self-employed, you’ll need to make voluntary contributions of at least $21 per week or more (for the whole KiwiSaver year) to hit the annual target of $1,042.86 (which makes you potentially eligible for the maximum government contribution). If you want to contribute funds each week to stay on track, you could consider setting up an automatic payment into your KiwiSaver account. It’s a good idea to start planning your payments well in advance of the 30 June cut off, so you’re in a better position to receive the maximum government contribution for that year.

TIP: Break it down to a weekly payment so you can work towards the annual amount: $21 per week x 52 weeks = $1,092. Remember the year period is 1 July – 30 June, so if you are starting your payments part way through this period, you’ll need to pay a bit more each week to reach a total of $1,042.86.

It’s not all or nothing

Even if you don’t contribute the full $1,042.86 by 30 June each year, the Government will still match 50% of whatever you do contribute (if you’re eligible). So, if you manage to contribute $500, you’ll potentially get an extra $250 from the Government. That’s free money in your KiwiSaver account.

Check if you’re eligible

To be eligible for the government contribution, you must be:

- 18 years or older; and

- not yet eligible for retirement withdrawals; and

- mainly living in New Zealand (although you may also qualify if you are a government worker, charity worker or volunteer working outside of New Zealand).

If you don’t meet the eligibility requirements for the full year (1 July – 30 June) but you do for part of it, the maximum government contribution you could receive will be based on the length of time you were eligible. The Government then puts in 50 cents for every dollar you contribute up to the pro-rated maximum amount. For instance, if you join KiwiSaver, or turn 18 half-way through the year, your government contribution will be calculated in proportion to how many days in the year you were eligible – 182 days. In this scenario, the maximum you could receive would be $521.43 x 0.5 = $260.72 (based on being eligible for 182 days in the period).

TIP: Your KiwiSaver contributions require at least three business days to process. Please note that weekends and public holidays do not count as business days, so allow plenty of time to hit the 30 June deadline.

Every little bit helps

You can check how much you‘ve contributed to see if you’re on track to achieve the maximum government contribution. Just log in to Inland Revenue’s MyIR service https://myir.ird.govt.nz and view your ‘Contribution summary’. This will then display your summary for the ‘Government contribution year’ (1 July to 30 June). You can register for MyIR at ird.govt.nz/kiwisaver.

Note that voluntary contributions are not included on Inland Revenue’s MyIR contributions summary. BNZ KiwiSaver Scheme members can check this in the BNZ app or Internet Banking.

*Assumptions for the projection:

The KiwiSaver account projection shown is for the purposes of illustrating the impact the government contributions can have on a KiwiSaver account balance over the long term and are based on several assumptions which are set out below in more detail. This hypothetical KiwiSaver account projection is therefore unlikely to reflect an actual KiwiSaver account balance at retirement. For example, actual investment returns are likely to move up and down due to investment and other risks. Returns may be negative over some time periods. The projection is not guaranteed to occur and is simply to help you understand how choices you make may affect the value of your KiwiSaver savings. This information is not intended to provide financial advice, and the result should be treated as a guide only.

- You are 25 years old (i.e. you have 40 years until the current KiwiSaver retirement age)

- You are not making regular salary contributions to KiwiSaver, only voluntary contributions (see bullet point 3 below).

- You make $1,043 in voluntary contributions annually to meet the government contribution entitlement. The contribution amount does not increase each year

- The additional amount of $55,000 is adjusted for inflation at 2% per annum so you can see what this would look like in today’s money.

- You are in the BNZ KiwiSaver Scheme Growth Fund, and remain in this Fund until age 65

- The BNZ KiwiSaver Scheme Growth Fund is assumed to return 4.5% per annum after fees and tax at the highest tax rate. This rate is the assumption set by the Government for Growth funds generally; further details about the Government assumptions for retirement projections can be found on the Financial Markets Authority website.

- Contributions will continue to be made each year until the age of 65

- No savings suspensions are taken

- No amounts are withdrawn

- You receive an annual government contribution of 50c for each dollar you contribute, up to a maximum of $521.43 each year (from 1 July to 30 June).

Disclaimers:

BNZ Investment Services Limited, a wholly owned subsidiary of Harbour Asset Management Limited, is the Issuer and Manager of the BNZ KiwiSaver Scheme. Download a copy of the BNZ KiwiSaver Scheme Product Disclosure Statement PDF 1.1MB, or pick up a copy from a BNZ branch.

Investments in the BNZ KiwiSaver Scheme are not bank deposits or other liabilities of Bank of New Zealand (BNZ) or any other member of the National Australia Bank Limited group. They are subject to investment risk, including possible delays in repayment. You could get back less than the total contributed. No person (including the New Zealand Government) guarantees (either fully or in part) the performance or returns of the BNZ KiwiSaver Scheme or the repayment of amounts contributed. National Australia Bank Limited, the ultimate owner of BNZ, is not a registered bank in New Zealand but a licensed bank in Australia and is not authorised to offer the products and services mentioned on this webpage to customers in New Zealand.

BNZ Investment Services Limited (BNZISL) uses the BNZ brand under licence from Bank of New Zealand, whose ultimate parent company is National Australia Bank Limited. No member of the FirstCape group (including BNZISL) is a member of the NAB group of companies (NAB Group). No member of the NAB Group (including Bank of New Zealand) guarantees, or supports, the performance of any member of FirstCape group’s obligations to any party.

Internet access required for online banking and the BNZ app. Internet Banking T&Cs apply. Maintenance sometimes required.

This article is solely for information purposes. It’s not financial or other professional advice. For help, please contact BNZ or your professional adviser. No party, including BNZ, is liable for direct or indirect loss or damage resulting from the content of this article.

References to third party websites are provided for your convenience only. BNZ accepts no responsibility for the availability or content of such websites.