What’s ailing NZ consumers? And will tariffs make it worse?

8 Apr 2025- We already harboured concerns about fragile consumer sentiment

- Trade war fallout risks making it worse

- Our consumer spending forecasts are thus on notice

- Lower interest rates needed, RBNZ to deliver another 25bps cut tomorrow

- Tweaks to fixed mortgage rates possible

Consumers just aren’t feeling it. It’s been clear enough in the anecdote. But, over the past couple of weeks, we’ve seen an unsettling sputtering in a broadening suite of retail spending indicators as well.

It started with a sharp and unexpected drop in Westpac’s consumer confidence index for the March quarter. A few days later the ANZ (monthly) measure did the same. Surveys of spending plans have also depicted a climb-down in sentiment. And this is all coming hot on the heels of generally downbeat earnings announcements from some of the country’s largest retailers.

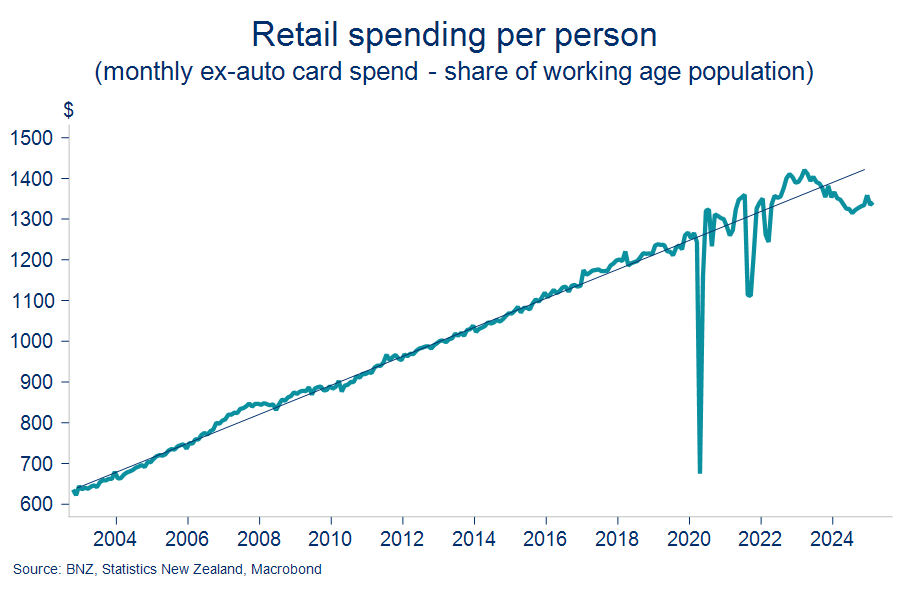

These wobbles have arrived relatively early in retail’s tentative revival. The value of retail card spending, in per-capita terms, is still 6% below the March 2023 peak and barely 2% above the lows of mid-2024. Bear in mind higher prices will account for a chunk of the recent gains.

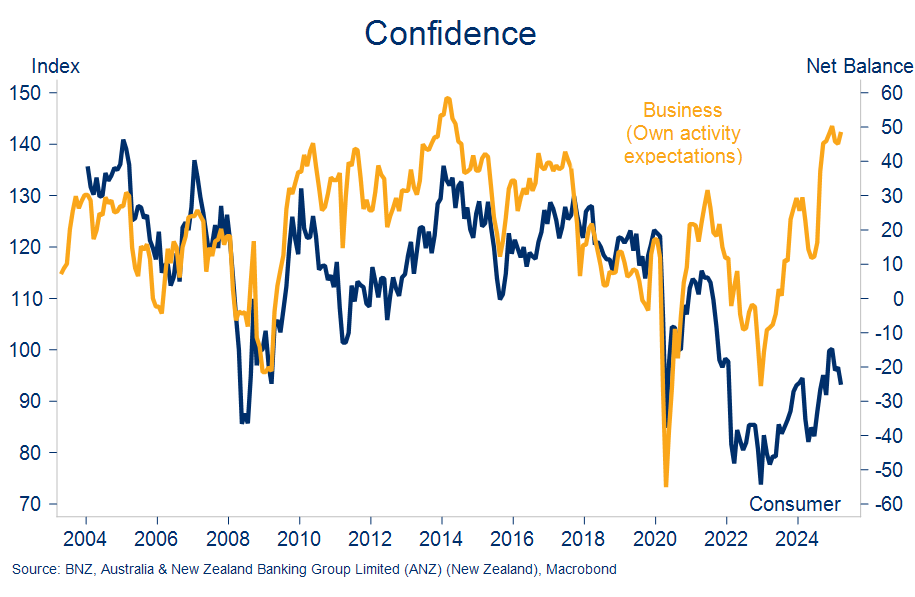

Broader economic indicators, most notably business confidence, have displayed a little more lift. The consumer is clearly lagging. Highlighting the point, the gap between business and consumer spirits has never been wider, according to the ANZ indices which date back to the early 2000s.

A couple of obvious questions arise. First, what has been ailing consumers? Second, will the fallout from Trump’s trade war make things even worse? The answers to these questions are a key part of the interest rate outlook, which we’ll touch on as well. In order then…

-

What’s been ailing consumers?

A quick look across the usual suspects driving spending behaviour provides a sense of the major plusses and minuses.

Mortgage rates: Carded one and two-year fixed mortgage rates are now around 200bps below last year’s high. However, yesterday’s RBNZ figures show the average mortgage rate actually being paid is, as at February, only 21bps below the 2024 high of 6.39%. In other words, the vast majority of the cash flow impact of lower mortgage rates has yet to flow through. But it will. Our estimates put this average paid mortgage rate closer to 5.6% in six months’ time. On $370b of housing debt, that’s a positive cash flow of around $2.1b, equivalent to 0.5% of nominal GDP.

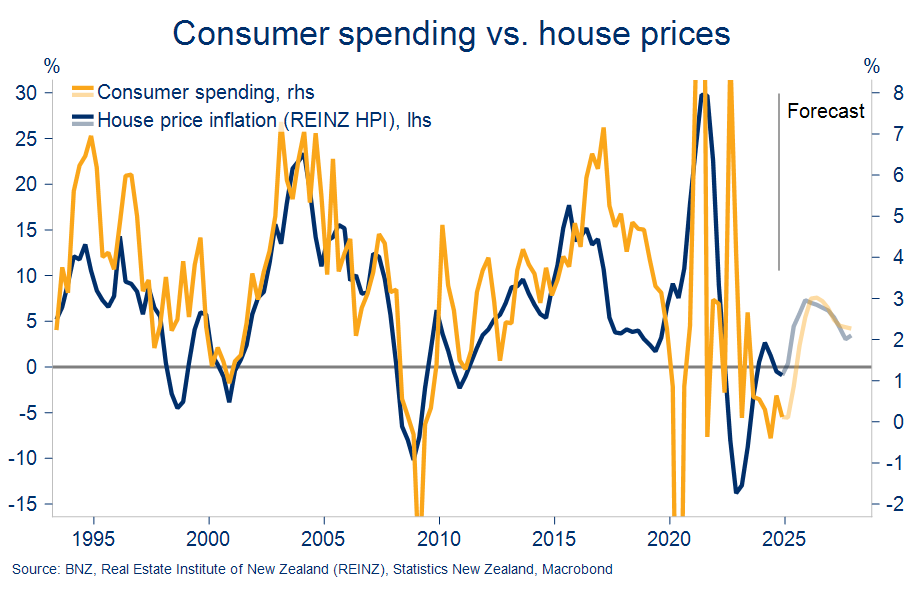

Housing market: Housing activity is stirring, as we and others have reported. But not so much house prices. And it’s rising house prices that tend to generate the so-called ‘wealth effect’ that gets people in the mood to spend. For better or worse, the correlation between house prices and spending in NZ is tight (chart below).

Stats NZ reported last week that households’ net equity in housing edged lower over the second half of 2024 and is still some 14% below the $1.1 trillion December 2021 peak. Not only are house prices yet to rise, but the shock value of big falls in council property valuations in some parts, like Wellington, may have even thrown the wealth effect into reverse.

Should we see a bump in house prices over the second half of the year, as we currently expect, it would likely bring with it an extra dollop of spending activity. Of course, there are no guarantees this will occur given the usual vagaries of house price forecasting, not to mention renewed uncertainty about the outlook generally.

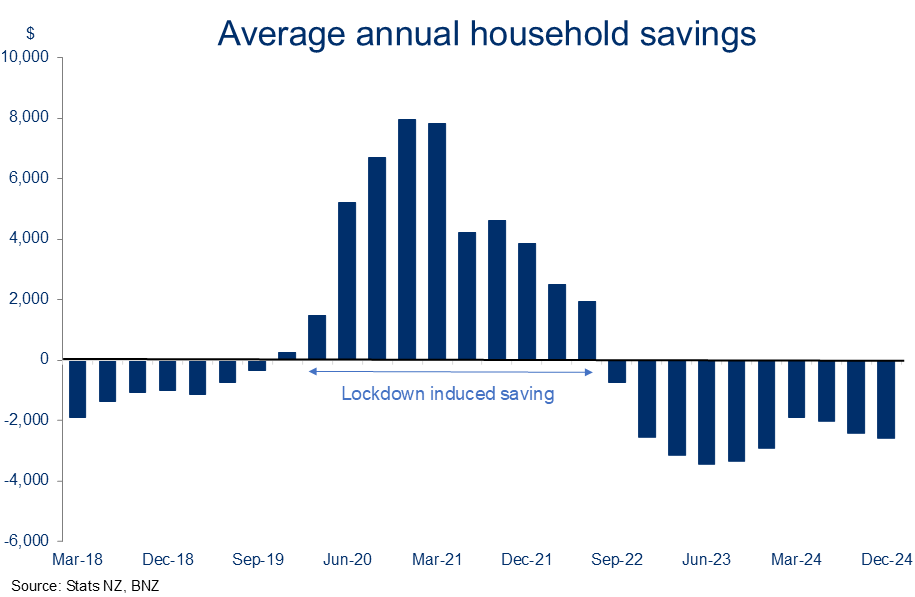

Household savings: Data out last week showed household outgoings exceeding incomings for the 12th quarter in a row. The pent-up savings of the lockdown era are a distant memory. Our high-level calculations suggest households have been dissaving (essentially spending borrowed money) at an average annual rate of 2-3k for the past two years.

Cost of living: Headline CPI inflation is back under control. But the ghost of inflation past has left prices 22% higher than four years ago, an ongoing thorn in the side of discretionary spending.

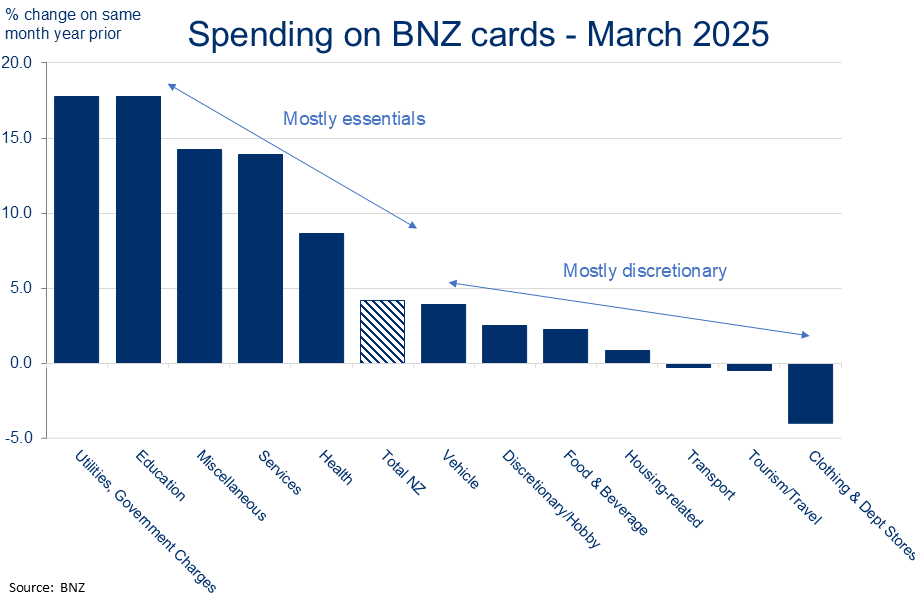

So too is the composition of recent and forthcoming price increases. Households have few options other than to stump up for the higher cost of the likes of insurance, energy, and rates, with the hit to spending power being reflected in supressed spending in more discretionary categories. This is something we see clearly in BNZ’s own card spending patterns.

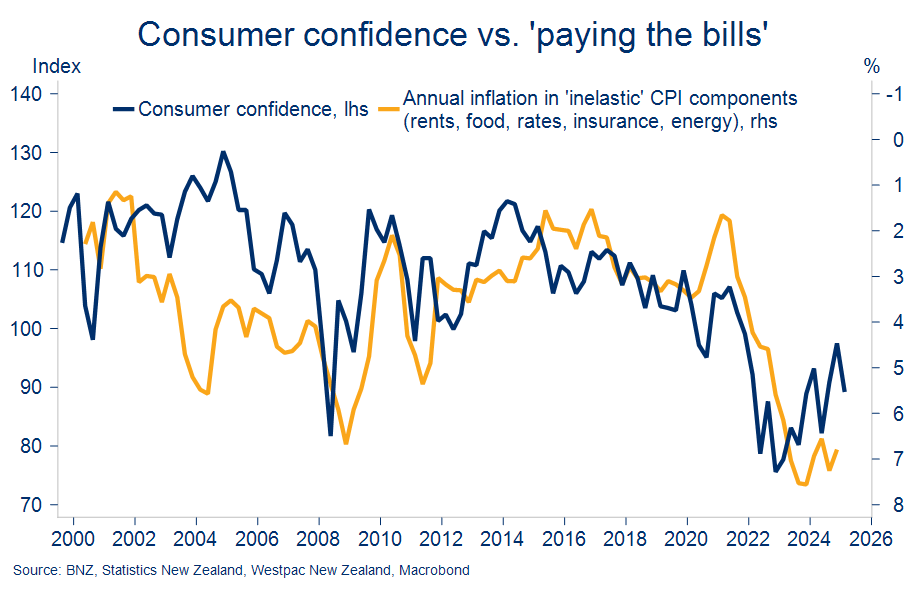

A simple average of the annual inflation rates of a selection of CPI components with these inelastic demand characteristics – food, rent, rates, insurance, and household energy – is running at 6.8%y/y. That compares to headline CPI of 2.2%y/y.

The inelastic measure, charted below, unsurprisingly has a clear inverse relationship to consumer confidence. Little relief is anticipated in the short-term, with household energy hikes the latest cab off the rank.

Labour market: There have been some straws in the wind to suggest the employment market is starting to stabilise. That’s encouraging, but overall labour market conditions remain soft, reflecting past weakness in the economy. Labour earnings growth continues to slow, unemployment has further to rise, and job security – according to Westpac’s index – declined in the first quarter back to the equal lowest (ex-COVID) level on record. We expect conditions to improve a little as we move into the second half of the year.

Tallying up: just enough positives, but…

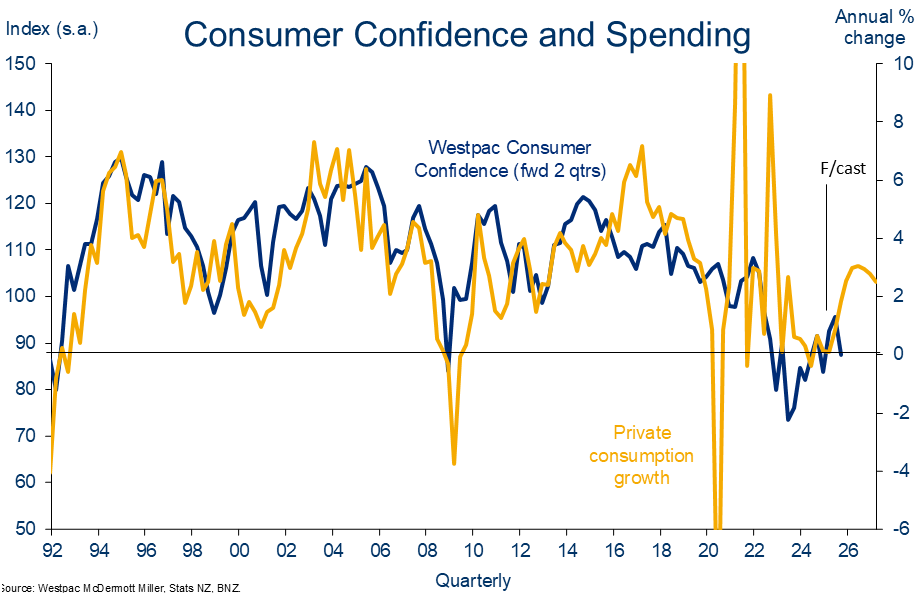

Putting all of the above together leaves us with a view that there are enough inbound positives for retail spending (mainly from lower mortgage rates and housing) to offset the current restraints. That means our forecasts for a clear recovery in consumption growth are on notice rather than the scrapheap.

But then there’s the trade war and the 10% slump in global equity markets…

-

Will global uncertainty make things worse?

Some of the possible channels include:

Wealth impacts Global equity markets are in freefall and even a cursory look at KiwiSaver balances in this environment will be dread-inducing, potentially curtailing spending appetites. Last week’s household balance sheet data shows that listed equities, managed funds, and superannuation (including KiwiSaver) combined comprise 29% of household financial assets.

Uncertainty/confidence No one knows what the end-game is for the tradewar, nor how or when the current financial market turmoil will end. There remain far more questions than answers at this point, meaning uncertainty looks set to drag on for potentially months, bringing with it ongoing media coverage and angst. It’s likely both business and consumer confidence take a knock, the question is by how much.

Impact on business, hiring plans, and the labour market Uncertainty can be a major constraint for business capex and hiring plans as firms opt to sit and wait rather than act. We’ve been flagging the risks to business investment for a while. Firm’s employment intentions have moved into net positive territory recently. These may be tempered in response to the weakening outlook for growth, but probably not right away.

Price impacts Tariffs will cause prices to rise in the US, but the inflation implications are more two-sided in NZ. Prices for some goods could fall, with petrol prices already in focus. And even if some prices rise, because of the lower NZ dollar for example, we doubt (at this early stage!) this would reawaken a generalised inflationary impulse given the negative impacts on NZ and global growth.

All up, it’s impossible to know at this point how much of an impact these factors might have on NZ spending appetites. It seems likely to have some sort of negative impact though and that’s problematic given our forecasts were already looking a tad strong even at current levels of consumer confidence. We fear that our current forecast pick-up in economic activity may yet be further delayed.

-

Implications for interest rates?

An ongoing soggy environment for retail spending is part of the reason we’ve maintained a below-consensus view on interest rates. Another is the likely negative impacts on global growth from the trade war.

It’s also worth noting that the turn-up in retail, and broader, economic indicators has been built on an expectation the Reserve Bank cuts the cash rate all the way to ‘neutral’ (thought to be around 3%). So it needs to, at least, deliver on those expectations to keep the music playing. Our view has been that a cash rate below neutral may ultimately be required, hence our long-held forecast for a 2.75% low point in the cash rate cycle. Things are moving around fast, but market pricing now largely aligns with this view.

For tomorrow’s decision, we expect the Reserve Bank to stick to the plan and deliver the 25bps cut it has been signalling, taking the cash rate to 3.50%. The Bank will probably also acknowledge heightened uncertainty and its readiness to respond to whatever market conditions may lay ahead. Should such open-ended guidance be delivered, and wholesale interest rates continue to fall, we could see some downward tweaks to shorter-term fixed mortgage rates in coming weeks.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.