Eco-Pulse: The worm turns

3 Feb 2023- Global gloom lifts, a little

- Evidence piling up to suggest the Reserve Bank can moderate its approach to interest rate hikes

- We lower our Official Cash Rate view accordingly, and now see a 5.00% peak (from 5.50%).

- Most longer-dated fixed mortgage rates have likely peaked, but we remain of the view that significant falls are unlikely this year

- Too early to gauge the impact of devastating North Island floods

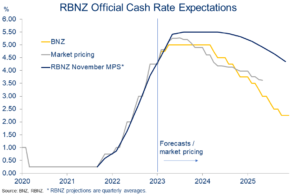

Stirring the latest two weeks’ worth of economic news into the pot leaves us more confident in our view inflation has peaked and labour market pressures are turning. This being so, we think the RBNZ can afford to put away the sledgehammer and pick up the scalpel. We now see ‘just’ 75bps worth of additional Official Cash Rate increases this year (OCR peak of 5.00%), down from 125bps previously.

That’s a little less than what is baked into market expectations, supporting the view that most wholesale and fixed mortgage rates might have peaked. However, further falls from here are likely to be modest given market expectations of OCR cuts later this year look wide of the mark to us.

Interest rate expectations nudged down

Another blow

The impacts of the devastating upper North Island floods will weigh heavily on those affected for some time to come. We’re somewhat loathe to comment on the economic impacts so early in the piece. But at a high level:

- The flooding involves a short-term hit to the economy given the disruption to hospitality, retail, tourism entertainment, logistics, and general mobility. It’s impossible to know how much though.

- The longer-term net impact from the clean-up and reconstructive effort will likely add to GDP growth. Only to the extent capacity constraints allow, that is. It’s likely that some existing construction projects will be paused to facilitate urgent repair work.

- The Auckland construction outlook had started to sag noticeably before the recent flooding. We’re now likely to see activity hold up for longer as order books fill out again.

- Housing market impacts are two-sided, but the net is unlikely to shift the existing trend for falling Auckland house prices. A chunk of housing activity that might have happened will at least be delayed. Prospective buyers will now be even more cautious, and undertake extra due diligence.

- The flooding is likely to add to overall cost and inflation pressures, in particular via higher food prices, construction costs, and supply chain disruptions.

- What about interest rates? There are overs and unders to balance, but we don’t think the storms will cause the Reserve Bank to change its plans (whatever they may be!). The broader economic picture will still carry the day and, as discussed below, that now calls for a less aggressive approach to interest rate hikes.

Labour market at a turning point

Wednesday’s labour market statistics confirmed what we all knew already – the labour market was extraordinarily tight through the final three months of 2022.

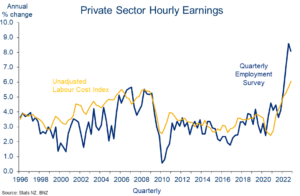

The unemployment rate was revealed to have increased a tenth, to 3.4%, but remains within spitting distance of the all-time low struck earlier in the year of 3.2%. Wage growth continued to accelerate as most expected, hitting all-time highs across a bunch of measures.

Depending on which measure you care to look at, raw wage growth is running at around 6-8% on an annual basis. There’s a good chance it pushes higher still through the early part of this year given the typical lags to labour market tightness and the economic cycle.

Earnings growth around record highs

Unemployment, though, has troughed. And, importantly, even though the labour market remains red hot, yesterday’s data weren’t as scorching as the Reserve Bank had factored in. Moreover, the forward indicators of labour demand – as we’ve noted before – are headed south and migration is lifting.

All of this, coupled with the fact inflation has likely peaked (discussed below), means the Reserve Bank will feel more confident it’s getting on top of things and can slow its work rate a little.

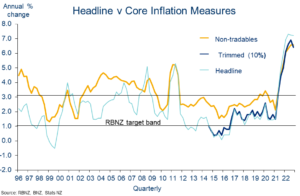

More confidence in peakflation

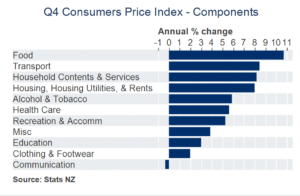

The December quarter Consumers Price Index released last week confirmed zero respite from cost-of-living pressures, but there were enough crumbs of comfort in the details to support our view that inflation has peaked.

The annual inflation rate held at 7.2% in Q4. Even this probably feels like an undercount for many given some of the biggest price increases over the past year have been in essential categories like food, transport, and housing (chart below). By contrast, some of the key downward influences on the CPI – phones, cars, and computers – are hardly everyday purchases.

Inflation pressures widespread

There was some relief though, in that it wasn’t any worse. Inflation didn’t accelerate further to 7.5% y/y as the Reserve Bank had assumed. And the key non-tradables measure of domestically-orientated inflation noticeably undershot RBNZ expectations. As with the labour market figures, this removes some of the urgency to get interest rates higher, faster.

Peaked

We remain of the view inflation is on the way down. The latest extension to public transport and fuel excise subsidies doesn’t change the broader path for inflation that we envisage. However, it will knock around 0.8 percentage points off our Q2 estimate, such that it slips below 6% y/y. This “headline” effect could assist in bringing inflation expectations down, and sooner.

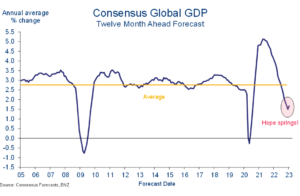

Global gloom lifts, a bit

Staying with the theme of ‘less-bad’ news, we noted with interest that, for the first time in 21 months, Consensus year-ahead global growth forecasts increased in January.

Admittedly, the move was from an annual growth rate of 1.5%, to 1.7%. So not exactly something to crow about. The long-run average is 2.8%.

Global growth expectations revised up

It’s way too early to start talking about any sort of global upturn. But it does hint that we may be close to ‘peak pessimism’ about the outlook.

As we discussed last time, China is opening up again and forecasters have already lifted projections for 2023 Chinese GDP from 4.8% at the end of last year to 5.1% (Bloomberg consensus). Even this may prove too low given the reopening precedent seen elsewhere and Chinese consumers’ massive pent-up savings.

At the same time, prior expectations of a deep, energy-crisis-driven recession in Europe have rapidly flipped into basically flat GDP growth expectations for this year. Alongside the warmer European winter and lower gas prices, there are also undoubtedly some positive trade impacts from China’s reopening. The EU is China’s second largest source of export demand (after the US), and the largest source of China’s imports.

The prospect of these encouraging trends continuing, thus providing a bit of extra demand for our tourism, education, and goods exports, might help moderate the recessionary winds blowing in NZ.

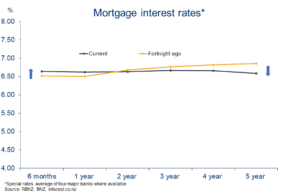

Mortgage curve inverts

One of the more interesting developments in interest rate markets of late has been the ‘inversion’ of the mortgage curve. Short-term mortgage rates have nudged a little higher over the past fortnight, alongside small falls in longer-term rates. We consequently now have a (slightly) downward-sloping (inverted) mortgage rate curve.

Mortgage curve inverts, risk is for a little more

This doesn’t happen that often, having last occurred prior to the 2008 Global Financial Crisis.

However, it’s far from unexpected. Rather than anything ‘odd’, the inversion reflects the similarly-inverted wholesale interest rate curve which, itself, has been driven by market participants’ belief short-term interest rates will be lowered over the next few years.

Looking ahead, we might see a little more inversion in the short-term as mortgage rates reflect some of these recent changes in wholesale interest rates. But, this aside, the bigger picture is one where most fixed rates have likely peaked.

In our last missive we suggested “longer-dated fixed mortgage rates may have peaked, but its too early to be definitive giving important upcoming data.” With that data under our belts (as discussed earlier), we can be a little more confident in the above.

It’s nevertheless worth repeating that there are still risks on both sides – the most obvious upside one being that the Reserve Bank itself sees things differently to the market when it makes its next policy announcement on 22 February.

We remain of the view that significant mortgage rate relief is unlikely this year. Market expectations that the Reserve Bank might be able to lower the OCR late this year still look wide of the mark given the continued stretch in the labour market and sticky core inflation.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ).

This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed.

The information in this publication is provided for general information only, and is a summary based on selective information which may not be complete for your purposes. This publication does not constitute any advice or recommendation with respect to any matter discussed in it, and its contents should not be relied on or used as a basis for entering into any products described in it. BNZ recommends recipients seek independent advice prior to acting in relation to any of the matters discussed in this publication, including legal, financial and tax advice. This publication is intended only for the person in New Zealand to whom it is sent by BNZ, and must be treated as strictly confidential. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.