Steadying the (global) ship

3 Mar 2023

- Peak global pessimism appears to be behind us, we chat about NZ implications

- Risks around global interest rates tilt higher-for-longer

- We’ve nudged up our own Official Cash Rate forecast

- Housing/mortgage rate views retained

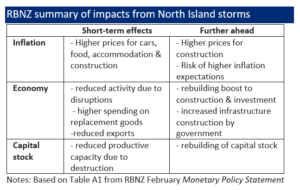

Last week the Reserve Bank met for the first time in three months. Plenty has happened in that time, most obviously the devastating weather events that have hit parts of the North Island. The Bank laid out some early thinking around the impacts of those events (summarised in the table below). We’ve made some tweaks to our forecasts along similar lines, but have also added a bit more employment into our numbers to reflect the huge labour resource required in the rebuild. As a result, we now see a more modest upturn in the unemployment rate this year.

Importantly, the RBNZ clarified that the flooding impacts “do not materially alter the outlook for monetary policy” at this (early) stage. In other words, there were no immediate changes to the plan for interest rates.

Inflation and labour market pressures are still uncomfortably strong. And the Bank is still reckoning on a peak cash rate of 5.50% to bring things to heel. This entails a further 0.75% of further hikes, following last week’s 0.5% adjustment.

All of this was broadly in line with our thinking. But we’ve still inserted an extra 25bps hike into our own OCR forecasts. We now see a peak OCR of 5.25% by May (from 5.00% prior).

That’s a smidge below the view enshrined in market pricing, but we’re loathe to split hairs. The more important point is that we’re now into the ‘fine-tuning’ part of the tightening cycle. There’s already a heap of tightening in the pipeline, so the risk of overdoing it becomes a little more pertinent from here. This necessitates a more cautious approach, more akin to feeling your way than blazing a trail. In the least, remaining OCR adjustments look set to be throttled back to the more regulation 25bps-per meeting pace.

More global good news (which is bad news)

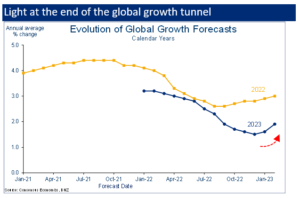

While the Reserve Bank meeting might have tipped the scales, recent global news was probably the bigger factor in nudging up our view on interest rates. We flagged last time that we may have rounded ‘peak pessimism’ on the global economy. And this increasingly looks to be the case.

To be clear, 2023 still looks like a slog in many parts of the world, as last year’s global scramble to get interest rates higher catches up with the global economy, particularly the interest rate sensitive bits like housing, spending, and construction. But it’s taking longer than many expected for this impact to be felt. Economic data for the month of January roared ahead of expectations almost everywhere (NZ included), leaving analysts scratching their heads. Genuine resilience, or dead cat bounce?

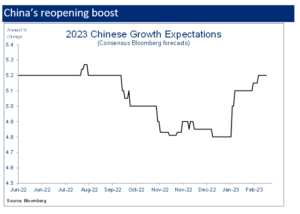

We suspect the pleasant data surprises may prove temporary. But, regardless, it’s clear that the odds of global recession have reduced. This thanks in large part to China’s reopening and Europe’s success in so far managing its way out of an energy crisis. Forecasts for China’s economy are now well north of 5% for calendar 2023 (chart below), nearly double the pace of growth recorded last year. This of course also benefits the wider Asian region.

Mixed implications

It’s ultimately a good news story. The implications, though, are a bit more mixed, depending on where you sit.

First, stronger (ok, less weak) global growth makes the process of bringing global inflation back down harder, meaning global interest rates will need to go higher. This is the ‘good news is bad news’ thematic global markets are grappling with at the moment.

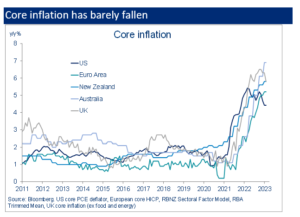

The quick wins of falling global goods prices have been effective in knocking the top off global inflation rates. But core inflation is proving frustratingly sticky everywhere as the inflationary impulse drips through to services prices. The latter is closely linked to wage inflation, and labour markets have yet to loosen much at all.

Second, a less wobbly picture for global demand will help shore up demand for our commodity exports. Particularly to the extent the better news has been centred on China, which takes around a third of our goods exports. We’ve seen some signs of this coming through, but it hasn’t been one-way traffic. For example, Fonterra recently downgraded its Milk Price forecast (to an $8.50 mid-point). We’re now on the lookout for a broader-based turn around in the downdrift we’ve seen in meat and dairy prices recently.

Finally, a less downbeat global outlook is usually with a higher exchange rate. Should the former be sustained, it risks lifting the NZ dollar back onto an appreciating trend in coming months. The Reserve Bank probably wouldn’t mind this, to the extent it would help in the inflation fight. The inflation-suppressing effects of a higher NZ dollar have been MIA to date – the trade-weighted index has been on a generally depreciating trend since the Reserve Bank began lifting interest rates in late 2021. That’s a little unusual from a historical perspective.

Revenge travel buffering the downturn

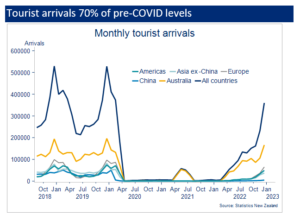

The soggy global backdrop certainly hasn’t deterred people from travelling. The trend towards so-called “revenge travel” is showing up in NZ both via higher short-term tourism arrivals and longer-term migration swinging back to net inflows. Both are running stronger and, in the latter’s case, quicker than anyone might have expected.

Tourism numbers for the December peak were back up to around 70% of pre-COVID levels. Further recovery looks likely as Chinese tourists – historically our 2nd largest source of tourism arrivals – start to hit our shores again.

The bottom line is that the tourism recovery, in tandem with parts of the goods exporting sector, is helping to buffer the NZ economy against increasingly recessionary domestic demand conditions. This was one of the key thematics we flagged in last year’s 2023 outlook piece.

The latest official retail spending figures were instructive in this regard. Overall spending volumes declined 0.6% for the quarter, but that hid an almost two-speed pattern of spending. Strength in the more tourist-orientated accommodation and food & beverage categories caught our eye (up 2.3% and 2.4% for the quarter, 31% and 15% for the year). By contrast, there was clear signs of weakness in housing and durable-related categories like furniture & houseware, recreational goods, and electronics. Increasing evidence that cost of living and mortgage rate pressures are taking a toll on discretionary spending.

Higher for longer?

The less gloomy global backdrop, a more upbeat data tempo, and the marginally firmer inflation outlook all fall on the ‘higher for longer’ side of the interest rate risk ledger.

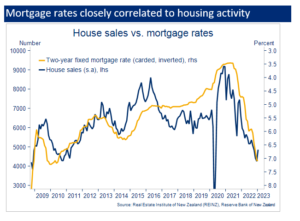

We’ve been highlighting that, even though mortgage rates for some (longer) terms may have peaked, significant mortgage rate relief is unlikely this year. Recent events play to the grain of this view. If anything, the risks are tilted towards further small gains in shorter-term (one and two year) mortgage rates.

Of relevance here has been the eye-catching jump in wholesale NZ interest rates through February. One and two-year rates rose 40-70bps to hit fresh 15-year highs. While it’s tempting to pin this on the Reserve Bank meeting, it’s mostly a story of rising offshore interest rates sweeping NZ rates higher. In the US, financial markets have reluctantly caved to the view of the US Federal Reserve that stubborn US inflation warrants at least another three rate hikes, and hopes for cuts this year are… just that.

Sticking to our housing market guns

Just when we were starting to think the housing market may turn a corner a little earlier than our roughly mid-year expectations, we’ve become cautious again. For one thing, there’s the firmer interest rate story noted above. We’re not confident that the housing market can right itself until it’s clear mortgage rates have stopped rising. We’re not quite at that point yet.

There’s also the disruption from the recent North Island weather disasters to factor into the mix. This will lower housing market activity relative to what we would otherwise see. We saw signs of this coming through in this week’s update on Auckland house sales from Barfoot & Thompson.

January REINZ (national) housing market data provided a few hints that the property market downturn might be easing. The pace of house price declines slowed to ‘just’ -0.6% for the month (seasonally adjusted) from the -1.2%/month average pace over the prior 13 months. Housing activity (sales), admittedly a highly volatile series, also bounced 14% from December levels (seasonally adjusted).

The reality is that it will be a few months before we can properly assess underlying trends but, for now, we remain okay with our views that: 1) house price declines are expected to bottom out around mid-year; 2) the total peak-to-trough correction will amount to roughly 20%, implying additional falls of around 5% from here; 3) the recovery out of the other side of the correction will be tepid. We’ll be back soon with our first stab at a new publication focused entirely on the housing market and mortgage rates.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ).

This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed.

The information in this publication is provided for general information only, and is a summary based on selective information which may not be complete for your purposes. This publication does not constitute any advice or recommendation with respect to any matter discussed in it, and its contents should not be relied on or used as a basis for entering into any products described in it. BNZ recommends recipients seek independent advice prior to acting in relation to any of the matters discussed in this publication, including legal, financial and tax advice. This publication is intended only for the person in New Zealand to whom it is sent by BNZ, and must be treated as strictly confidential. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.