Eco-Pulse: The Waiting is the Hardest Part

27 Jun 2023

- Economy in a sideways crawl

- China wobbles underscore cautious export outlook

- But inflation indicators going the right way

- And interest rate views unchanged, despite skittish offshore markets

It feels like the NZ economy has entered a new phase. The escalating inflation and interest rate cat and mouse phase is over. Cost and inflation pressures have now crested the peak and are receding, and interest rates have probably peaked too. But the cost of halting the inflation dragon (it’s yet to be slayed) is becoming more evident. Economic momentum has ground to a halt.

It looks as if this broad state of affairs will be with us until at least the end of the year as we wait, effectively, for inflation to come down as we all forecast, election uncertainty to come and go, and interest rates to start falling next year as currently expected. There’s a heap of balls in the air, but our best guess is that the recovery phase won’t turn up until the middle of next year.

Bouncing along the bottom

As expected, first quarter GDP figures confirmed a technical recession occurred in the six months to March 2023. Overall output contracted 0.8% over this period, with the largest sectoral declines in manufacturing (-3.1%), retail (-2.9%), and transport (-5.0%) activity. Strong positive contributions from construction (+2.3%) and mining (+3.9%) cushioned the blow a little.

Bouncing along the bottom

As expected, first quarter GDP figures confirmed a technical recession occurred in the six months to March 2023. Overall output contracted 0.8% over this period, with the largest sectoral declines in manufacturing (-3.1%), retail (-2.9%), and transport (-5.0%) activity. Strong positive contributions from construction (+2.3%) and mining (+3.9%) cushioned the blow a little.

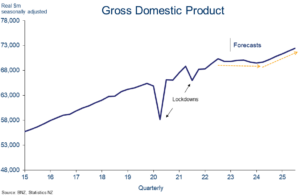

Flat patch

The general message from more timely activity indicators – things like consumer and business confidence – is that things aren’t getting any worse, but nor are they racing away. In other words, we’re likely to bounce along the bottom for a while. That’s a theme that accords with the broad thrust of our forecasts, which have economic activity shuffling sideways, at best, from here until early next year (chart opposite).

Case in point was Westpac’s consumer confidence measure, released last week. It edged up a little, but remains in the doldrums and indicative of ongoing retrenchment in per-capita spending growth (chart below). And while most ANZ business survey confidence metrics have bounced off their (March) lows, investment, output, and profitability expectations all remain mired at levels miles below average and, on past form, consistent with flat-to-falling economic growth.

Per-capita consumer spending to remain negative

Looking ahead, a turning in the housing market and peaking interest rates may help brighten the mood a little, but rising election uncertainty and the ongoing drip through of impacts from higher mortgage rates will be working in the other direction.

Perceptions around the labour market remain a relative point of strength. Firms’ employment intentions are holding at levels consistent with slow, but positive, employment growth. And monthly indicators like Stats NZ’s filled jobs series and SEEK job ads speak of continued robust jobs growth, for now, as surging migration flows allow firms to backfill existing vacancies.

Against this background, we’ve nudged our labour market forecasts in a slightly firmer direction. The unemployment rate is still seen slowly drifting up to 5.0%, but not until mid-2024.

China wobbles underscore cautious export outlook

Slowing global growth is one of many headwinds the economy is facing into. A strong, post lockdown bounce in China’s economy was expected to cut through some of this gloom from a NZ perspective, but this view is now being severely tested.

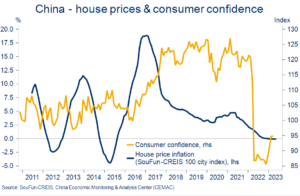

The anticipated rebound in Chinese consumer spending is yet to materialise amid ongoing caution, weak consumer confidence, and a sagging property market. Earlier calls for a doubling in Chinese GDP growth this year (to 6% from 3% in 2022) are now being rowed back. We haven’t yet changed our own forecasts (5.6% for 2023, 4.5% 2024 – courtesy of NAB economics), with the likely deployment of fiscal stimulus expected to exert a steadying influence. Still, downside risks are growing.

Confidence lost

This underscores the relatively cautious outlook we’ve been running with in respect of NZ’s commodity export returns. At $7.60, our 2023/24 Fonterra Milk Price assumption is slightly south of the consensus and the $8.00 forecast midpoint Fonterra recently opened with.

Beef and lamb prices have also been affected by reduced Chinese demand, alongside some extra global supply. Forestry returns even more so given the Chinese property market has been at the centre of its issues. We expect beef and lamb prices for next season to average close to this season’s already reduced levels while, for forestry, the risk is for further declines.

Inflation indicators going the right way

The silver lining to the lacklustre global growth pulse is that global inflation indicators continue to move in the right direction. Higher interest rates appear to be working, although normalising supply conditions have been just as important.

Headline rates of inflation in the developed world have continued to fall. Forward-looking indicators suggest this will continue. Indeed, there’s a strong chance annual US inflation, for example, will be back to around 2% in the next 2-3 months. That would mark quite a turn around from the almost 9% peak in June last year. Admittedly, the outlook elsewhere, most notably the UK, is not as positive.

On the descent

Fears about sticky ‘core’ inflation certainly haven’t gone away. But falling global headline inflation in concert with the rapid easing in supply constraints – for both materials and labour – allows us at least to be more confident in our forecasts for NZ inflation to fall to around 4.5% by year end, from 6.7% currently.

We’re hopeful that food price inflation will soon normalise, prices for some building materials are stabilising or falling, freight costs have reversed most of 2021’s explosion, airfares will soon fall, and the migration bulge is expected to take the edge off wage inflation.

Supply-side pressure released

Interest rates going nowhere

With the economy running on empty and inflation poised to keep falling, we remain of the view no further Reserve Bank cash rate increases are needed. Indeed, the debate in our mind is more about when the Reserve Bank (RBNZ) can begin lowering the Official Cash Rate, and by how much. We remain comfortable with our May 2024 call for the first easing.

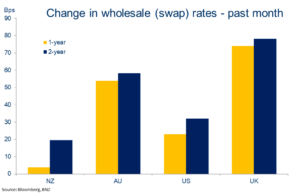

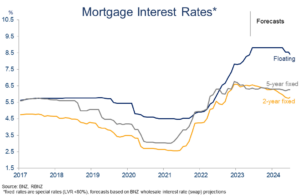

So why, then, are wholesale and retail rates rising? Both have nudged a touch higher over the past month (we actually did flag this likelihood in our recent Property Pulse).

In short, global factors.

Interest rates in most developed markets have lurched higher over the past month as offshore central banks have either continued to hike policy rates, or speculation of such has been fanned by stubbornly persistent core inflation and/or wage data. This has exerted the usual tractor beam-like pull on NZ wholesale rates which, were it not for the outlook described earlier, would probably be even higher (chart below).

NZ wholesale rates (semi) resistant to global lifts

This does beg the question – could we see the RBNZ succumb to the global tilt towards even higher cash rates?

It’s possible, if upcoming inflation and (particularly labour market) capacity information doesn’t show core inflation pressures receding in the way the Bank needs to see. Keep an eye on the Q2 CPI on 19 July and the 4 July NZIER Business Opinion survey as important in this regard.

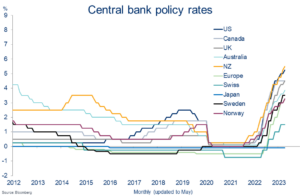

Nonetheless, we maintain there’s a high hurdle for the Reserve Bank to change its tune on being done. The indicators are going the right way, the Bank has confidently declared its position on the side-lines and, notably, NZ is already ahead of the global pack in getting the cash rate to a highly restrictive position. It’s the others who are arguably playing catch up (chart below).

RBNZ cash rate highest amongst peers

On this basis, we continue to believe NZ wholesale interest rates are currently around the peaks for the cycle, with a move lower slated for later in the year as the eventual interest rate cutting cycle draws into view. This supports the view espoused in our May Property Pulse that mortgage rates are in the process of peaking but unlikely to fall materially until next year. It’s a waiting game.

Sideways drift

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. This publication is intended only for the person in New Zealand to whom it is sent by BNZ, and must be treated as strictly confidential. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.