Five takeaways from the Budget & Reserve Bank meeting

6 Jun 2024

- No big surprises from Budget 2024

- Interest rate risks tilt higher for longer

- House price forecasts trimmed

- Confidence impacts awaited

The May Budget and Reserve Bank meeting were both important for the economic outlook. Here are five key takeaways coming out the other side.

- Interest rate risks tilt higher for longer…but how long is “longer”?

Despite economic activity undershooting Reserve Bank (RBNZ) expectations, the ‘higher for longer’ messaging from last week’s Statement was clear.

Still, there’s a wide dispersion of views around how long is “longer”. For example, the RBNZ is now forecasting no change in the OCR until the back half of 2025 (previously mid-year). If there was to be a change in the short-term, the Bank says it’s more likely to be a hike than a cut.

Wholesale markets, by contrast, continue to put strong odds (~80%) on a rate cut before 2024 is out. That’s almost 12 months earlier than the RBNZ’s view.

We’re somewhere in the middle. Our official forecast is that the first easing will come in February next year. That’s a delay from our prior November view, albeit we’re not ruling the latter out.

Stuck in the middle

What to make of this difference in opinion?

We doubt we’ll see any material convergence in views ahead of CPI inflation finally making its way back into the Reserve Bank’s 1-3% target range. At that point the narrative could abruptly change. But the earliest that could conceivably happen (which is also our current forecast) is in the September quarter (2.7%y/y forecast), reported in October. That’s still five months away, meaning uncertainty looks set to persist in the meantime.

For now, the fact market pricing is little changed means that, in our view, wholesale and hence retail interest rates are more likely to keep shuffling sideways at current high levels than take another leg higher.

- Fiscal outlook deteriorates, but is it contractionary enough for the Reserve Bank?

At first glance there was nothing in yesterday’s Budget to materially change any of our views. On the whole, it washed up close to expectations.

There are all sorts of numbers that pour out of the Budget but, for us, the two big macro questions to be answered were:

- How much of a net contractionary impact will the fiscal situation impart on the economy?

- Will there be enough of an offset to the stimulus from tax cuts to assuage the Reserve Bank’s hawkish tendencies?

On 1), the promised tax threshold changes were delivered, alongside spending cuts, to ensure broad fiscal neutrality. Nonetheless, and despite big cuts to future operational spending allowances, the weaker economy and tax take saw the return to surplus delayed to 2028. Even then, the forecast surplus is a) wafer thin (0.3% of GDP) and b) susceptible to disappearing given the Treasury’s tax take and economic forecasts look a touch optimistic to us. Future spending allowances are also very tight and will be tough to achieve.

So, overall, there will be a consistent contractionary impact over the Treasury’s five-year forecasting horizon, but of a magnitude roughly similar to that we’d figured on.

The question, though, is whether it will be contractionary enough to give the Reserve Bank comfort its inflation objectives won’t be unduly impacted.

We’re not sure the Bank will be thrilled in this regard. We saw a couple of high-level wrinkles:

- The fiscal impulse – a summary measure of the all- told change in the fiscal contribution to the economy – has been revised noticeably higher for 2024/5 relative to prior (HYEFU) projections (chart below). It subsequently turns more negative.

- The RBNZ was explicit that, even if there is fiscal neutrality across the projection, the phasing – i.e. folk getting a (31 July) tax cut before the full extent of spending cuts kick in – could still be problematic.

2024 fiscal impulse higher than HYEFU

The RBNZ’s assessment of fiscal matters can be hard to gauge. And, importantly, it’s going to be at least July before we hear from it on the above. Our suspicion is that any unhelpful changes in the fiscal picture may well end up lost in the wash of all the other strongly disinflationary pressures in the economy.

In short, we think it unlikely that fiscal settings will cause the Reserve Bank to raise interest rates again. However, near term, the Bank will be a tad nervous about the move in the fiscal stimulus.

- Growth forecasts unchanged, but still downside risk

We’ve already flagged that our late 2024 economic growth forecasts are on notice for a possible downgrade (see our recent note Green shoots pruned). This is in the context of:

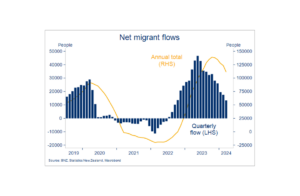

- Rapidly slowing migration. Just as the population boost helped paper over some of the economy’s cracks on the way up, we need to be wary of the risk it does the reverse on the way down. Our forecast for a fall in net migrant inflows to 80k by year-end previously looked like a stretch, it may now prove too high.

- Dimming prospects for interest rate relief this year

- Drooping forward indicators. Spending and investing intentions are being trimmed again, and services & manufacturing indicators are still contractionary.

Net inflows falling fast

We’re now assessing what the various competing impacts of the Budget announcements will have on our growth forecasts. All else being equal, the tax changes will provide a boost for consumption spending and, hence, GDP. But this effect will be offset, in part or entirely, by lower government spending.

For now, our official forecasts, and associated downside risks, remain unchanged. The broader point remains that, whatever the exact numbers end up being, it’ll be well into 2025 before it feels like any sort of recovery has arrived.

Slow recovery

- House price upswing pushed back, small impact from LVR, DTI announcements

Deteriorating economic and labour market conditions, higher-for-longer mortgage rates, and a market displaying signs of excess supply all point to the current house price stasis sticking around for longer.

This was the crux of last week’s Property Pulse, in which we lowered our house price inflation forecast for calendar 2024, to 2.0%. As ever, treat point forecasts as a best guess. Call it “flattish”.

Loosening up

We’re not fans of the term “buyers’ market”. Buyers still have to stump up with an average of seven times their income to own a house in NZ. But the swing in market conditions affording prospective buyers extra choice and time seems unlikely to change until interest rates do.

We note in this regard that the ratio of house sales to listings – in our view the best measure of market tightness – points to a further swing towards buyers in coming months (chart above).

The confirmation from the RBNZ this week that, from July, loan-to-value (LVR) ratios will be eased, and debt-to-income (DTI) ratios introduced, doesn’t change our view. Both have been long signalled and expected. DTI limits have been purposefully set at non-binding levels (for now).

The net of the changes is probably a small support for demand, particularly amongst first home buyers (FHB) for which building a deposit can be a major constraint. Indeed, over the past two years about three quarters of all high-LVR (>80%) bank lending has been to FHB.

- Confidence test

We’ll get an early ‘vote’ on the RBNZ and Budget announcements via the next round of business and consumer confidence readings (due late June).

The vibes matter. Confidence metrics reflect the sorts of decisions being made on spending, investment, and output that ultimately show up in recorded economic activity.

Confidence has sagged noticeably over the past three months. The profitability and activity gauges from Wednesday’s April ANZ business survey fell to levels consistent with annual GDP growth near zero. Employment intentions have slipped to levels portending outright job shedding. And consumer confidence has gone from bad to worse, signalling no respite from deeply negative per-capita retail spending growth (chart below).

Confidence lost

It’s unlikely these trends will be turned around anytime soon. But it will be interesting to see if the net of May’s big events is a nudge in a slightly less negative direction.

To subscribe to Mike’s updates click here

| Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. This publication is intended only for the person in New Zealand to whom it is sent by BNZ, and must be treated as strictly confidential. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. |