Mortgage borrowers ready for interest rates to fall

1 Aug 2024- Downtrend in interest rates arrives

- Average mortgage borrowing terms are shorter than prior to past RBNZ easing cycles

- That’s despite the extra upfront cost of fixing short – borrowers are no longer just ‘picking the lowest rate’

- Suggests interest rate relief might be felt faster than otherwise

- But it’s still going to take a while. The effective mortgage rate is still rising

Following the Reserve Bank’s green-lighting of earlier rate cuts last month, pundits have been all a flutter trying to pick when and how much the Official Cash Rate (OCR) will be cut this year.

There are three RBNZ meetings remaining in 2024 – August, October, and November. Our formal view is that the process will begin with a 25bps OCR cut in November. But the risks are weighted towards an earlier start. A cut at any of the above meetings wouldn’t surprise.

The downtrend arrives

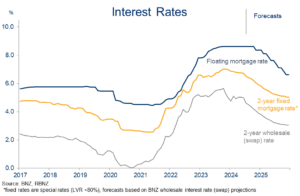

Stepping back from these short-term permutations, the broader point is that the downtrend in wholesale and retail interest rates is here. Even if the RBNZ opts to wait a bit longer to cut the cash rate, broader interest rates are likely to remain under pressure. Easier financial conditions are needed.

Financial conditions easing with unchanged OCR

We’ve already seen some sizeable moves. One- and two-year wholesale interest (swap) rates have declined 40-50bps since the July RBNZ announcement, the NZ dollar has fallen about 3% on a trade-weighted basis, and mortgage and term deposit rates have been trimmed.

How far, how fast?

The two big questions being asked at this point are: how far might interest rates fall from here? And how long will it take before any falls we do see start making a difference?

So, here goes. Getting too precise on the first question is fraught with difficulty. We’re also wary of getting ahead of ourselves given the cycle hasn’t even started yet. But our assumption is that the Reserve Bank will move in steady 25bps increments from November, taking the OCR from 5.50% currently to 3.50% by the end of 2025.

We describe this as an “assumption” rather than a forecast as it will almost certainly be wrong. For example, it is quite conceivable that the Reserve Bank will stop to pause and assess several times through the cycle, and there’s also the distinct possibility that a larger-than-25bps cut will be delivered at some point.

It’s just impossible to know when. Hence the assumed 25bps-per-meeting run rate. The timing and magnitude of the easing cycle will ultimately depend on how the economic data evolves and any unforecastable shocks that turn up along the way.

The cycle turns

The basic premise anchoring our OCR assumption is the need, in the first instance, for it to move closer to a “neutral” rate over time. The neutral rate being the (theoretical) OCR setting which is neither contractionary nor expansionary. The RBNZ’s various estimates of such comprise a wide (2.75%-4.0%) range but the key point is that they’re all a lot lower than the current 5.50% OCR.

It’s important to reiterate that financial markets are now already anticipating a good chunk of the expected easing cycle. In other words, sizeable declines in the OCR are baked into wholesale interest rates as they stand.

For this reason, a circa-200bps drop in the OCR through to the end of next year, if it does occur, could be expected to deliver a somewhat smaller drop in wholesale and retail rates. The aggressive easing already priced also raises the risk of a lurch back up in interest rates, should inflation pressures stick around for longer than markets currently assume.

Mortgage borrowers go short

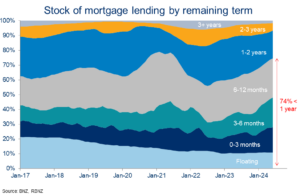

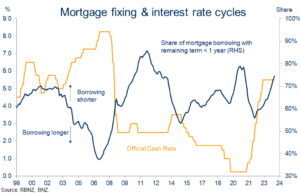

It’s not just financial markets that are anticipating lower interest rates. RBNZ data shows that, since late 2022, mortgage borrowers have been opting for progressively shorter fixed terms.

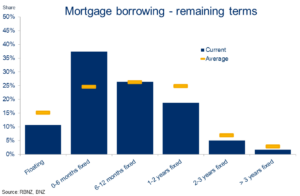

Since February, about three quarters of all new mortgage lending has been at terms of less than a year. This preference for shorter terms means the overall mortgage book is now quite short. The fixed terms on about 64% of mortgage lending will reset over the coming 12 months (74% including floating borrowing). That’s well above the 51% average run-off rate going back to 2017.

Shorter mortgage terms in vogue

A slightly more detailed breakdown, as in the following chart, shows that it is over the coming six months where the mortgage book is most short relative to average. About 36% of outstanding fixed rate borrowing will roll off over the coming six months. The post-2017 average is 24%.

All of this would tend to suggest that, if rates keep falling, interest rate relief will flow through to mortgage borrowers relatively faster than otherwise.

Third of the mortgage book resets over coming six months

Looking at a snapshot of the NZ mortgage book prior to past easing cycles highlights the point.

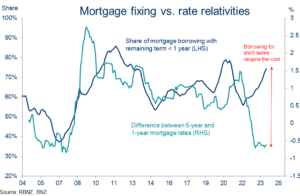

For example, just prior to the easing cycle starting June 2008, the proportion of mortgage borrowings with remaining fixed terms of one year or less was around 48%. Just prior to the 2015 easing cycle kick-off it was 54%. In May of 2019 it was 67%. As noted earlier, it’s currently 74%. So it appears mortgage borrowers have shortened up the term of their borrowing in anticipation of the coming easing cycle much more so than prior to past cycles.

Mortgage borrowers ahead of the curve?

This is all the more noteworthy given the extra upfront cost involved in going short. Short-term mortgage rates have been above longer-term rates (an “inverted” mortgage curve) since mid-2023. Over this period, one-year fixed rates, for example, have been an average of 50-60bps higher than three- and five-year rates.

The chart below plots this differential against fixing behaviour. Historically, fixing activity ‘chases’ the rate relativities available. For example, the last time the difference between five-year and one-year fixed mortgage rates was this negative, in 2008, a lot more mortgage fixing was done at the, lower, long-term rates. Conversely, when this differential is positive and rising (i.e. short-term rates are comparatively lower), like in 2009/10 or 2021/22, more people have typically fixed for shorter terms.

This time appears to be different. Borrowers have shortened their borrowing terms despite the extra upfront cost. There were always two-sided risk to this strategy. And the proof of whether it proves to be the right one will be in the pudding, and we’re not there yet, but the apparent break from the ‘pick the lowest rate’ past looks more like strategic risk management.

Borrowers not just picking the lowest rate

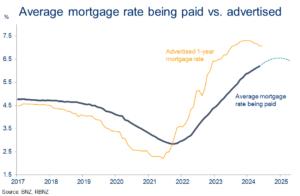

Mortgage borrowers may well be positioned for lower interest rates more so than past cycles, but it’s still going to take a while for lower rates to flow through. The tanker takes a while to turn, just like we saw on the way up.

The ‘effective mortgage rate’ – the average mortgage rate being paid on outstanding debt – is currently still rising. That’s despite mortgage rates having peaked around the start of the year. What’s more, and based on our interest rate forecasts and rough estimates, it’s got a little further to rise before flattening off around 6.5% towards the end of this year (chart below).

It’s another reason not to expect any immediate change in the fortunes of the presently weak NZ economy, even as interest rates start nudging lower. Most of the flow through effects will occur next year.

Effective mortgage rate: a little further to rise

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.