Property Pulse: Rates to the rescue

27 Aug 2024

- We don’t think mortgage rate declines will fuel an immediate lurch higher in the housing market

- But they will likely prevent a deeper correction

- We’re still expecting a 7% lift in house prices over 2025, following a pancake performance this year

- Mortgage borrowers to stay short

Welcome to our third quarter Property Pulse. Supporting our more regular EcoPulse updates, the aim here is to chat through recent housing and mortgage rate happenings, and provide our take on the outlook.

Included in report:

- The view, in brief

- House price outlook

- Mortgage rate outlook

- Appendix: Regional Heatmap

The view, in brief

We see recent falls in mortgage rates as more about preventing a deeper correction in house prices than providing the fuel for an immediate lurch higher. Interest rates aren’t the only game in town and there are also timing considerations to think about.

We do expect housing demand and sales activity to lift from here. But rather than squeezing house prices higher this extra demand will, in the first instance, be directed more towards working off the excess inventory overhanging the market.

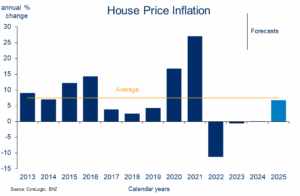

Reflecting these dynamics, our best guess is that house prices will continue to drift broadly sideways in the short-term. From around the end of the year we expect to see a modest upswing in house prices develop. After a dead flat 2024, we’re forecasting a 7% lift through calendar 2025. As with any house price forecast, there is significant uncertainty surrounding this view.

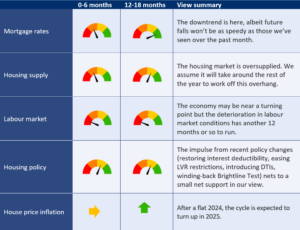

Impact of macro drivers on our house price view

The table below summarises the various drivers of house price inflation and their directional impact on our view.

As the dust settles on the Reserve Bank’s pivot to interest rate cuts, attention has shifted onto when we might start to see the impacts on the economy and housing market.

For the economy, the ship may be steadying but it will take a while to turn. Confirmation the interest rate cycle is finally rolling over seems to be helping confidence. But cash flow relief to date has been modest at best, the labour market is deteriorating, and economic activity is still going backwards.

For the housing market, some of the impacts could be expected to turn up sooner given sharp falls in carded mortgage rates. Anecdotal evidence points to a lift in prospective buyer enquiry and confidence. No doubt some of this reflects borrowing capacity estimates getting a small uplift and people being able to draw a line under prior concerns that interest rates may yet go higher.

Still, overall, we see recent falls in mortgage rates as more about preventing a deeper correction in house prices than providing the fuel for a lurch higher.

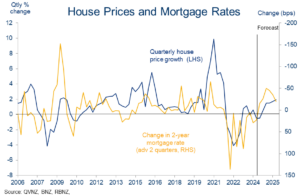

First, there are the lags to think about. Our rough rule of thumb suggests changes in mortgage rates can take six months or so to feed through to house prices (chart below). It’s far from an exact science but provides a reasonable directional steer.

Second, broader housing market fundamentals have deteriorated (table on first page), nullifying some of the impetus from falling mortgage rates.

We thus remain of the view that a sustained upswing in house prices is a story for late 2024/early 2025. Our forecasts for 2025 consequently remain exactly as they were in our last Property Pulse.

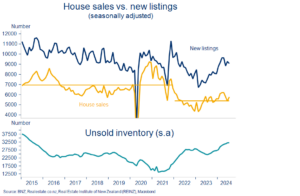

The immediate issue confronting the housing market is that it is oversupplied. Unsold inventory has continued to climb since our last update. There are 32,000-odd listings currently on the market – a nine-year high equivalent to around six months’ worth of sales (all figures seasonally-adjusted).

Contrary to some of the commentary, this is not a reflection of surging supply. Yes, new listings have lifted from the 2023 lows. But they’re still only running at about an average pace. Undershooting demand explains more of inventory lift. Smoothing through the monthly ups and downs, the pace of monthly house sales is still tracking 20-25% below the 2015-2021 average.

These dynamics have seen the ratio of sales/listings – a good barometer of overall market balance – tip further into oversupplied territory indicative of downward pressure on prices. Prospective buyers have plenty of choice and time. The median days to sell a house has lengthened out to 46 days (long-run average 39).

Against this background, the flat-to-falling house price trend unsurprisingly continued in last week’s REINZ data roundup for July.

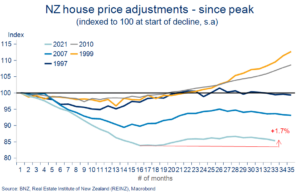

The small fall in the House Price Index over the month was the 3rd in a row (seasonally adjusted). It’s now been fifteen months since the market bottomed in April 2023. Over that period house prices have ground a net 1.7% higher (chart opposite).

We do expect housing demand to gradually lift from here, helped in no small way by falling mortgage rates. But rather than putting upward pressure on prices, this extra demand will, in the first instance, be directed more towards working off the supply overhang.

There are also a couple of demand drivers blowing a little harder in the other direction:

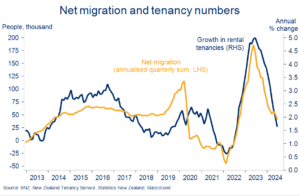

- The prior population boom is in the process of deflating. Monthly net migration flows have slowed from a flood to a trickle, reducing (annualised) population growth from 3%+ to sub-1% currently. This has coincided with a draining of excess demand in the rental market (covered recently here), indicative of reduced pressure on housing resources generally.

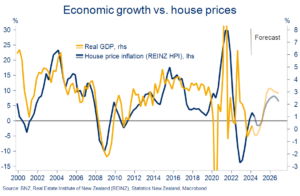

- Late cycle economic pressures remain intense. This is not something usually associated with rising house/asset prices (chart below). Moreover, while economic activity may be in the process of stabilising, labour market conditions – wage growth, job security, and employment opportunities – are likely to continue deteriorating through most of next year. With house prices already unaffordable, this is likely to further hold back housing enthusiasm.

Pulling it all together, our best guess is that house prices will continue to shuffle broadly sideways through to around the end of the year. Our house price inflation forecasts for calendar 2024 are flat.

Around the turn of the year we see an ‘average’ sort of upturn taking hold as lower mortgage rates and a more supportive policy backdrop bolster demand. We continue to forecast a 7% lift in house prices through 2025. As always though, there is significant uncertainty attached to these projections.

Mortgage rate outlook

Floating rates – down we go

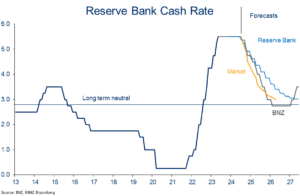

Not only did the Reserve Bank (RBNZ) cut the official cash rate (OCR) 25bps earlier this month, but it’s language and forecasts paved the way for a steady stream of additional cuts over the coming two years.

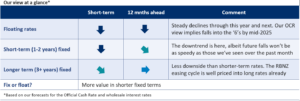

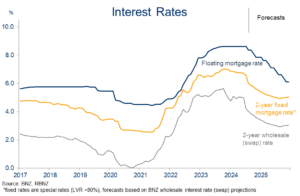

Our forecasts had already allowed for this shift in stance and haven’t changed. We assume a 25bps OCR cut is delivered at every RBNZ meeting from here until a 2.75% OCR is reached in early 2026. Should this profile broadly pan out, floating interest rates could be expected to fall a long way from here. Our forecasts have them in the low ‘6’s by the end of next year.

It bears repeating that there’s significant uncertainty around any interest rate forecasts over that sort of time horizon. The RBNZ’s projections, for example, have the OCR ultimately falling to a similar level as do we, but at a much slower pace. By contrast, financial market pricing implies a much more front-loaded easing cycle (chart below).

Our position as piggy in the middle is a fair assessment of the risks to our view. On the upside, it seems likely the RBNZ will pause and assess the lay of the land at some point, rather than maintain a 25bps-per-meeting run rate forever. But this risk is balanced by the potential for the Bank to deploy one or more larger 50bps cuts somewhere along the way. There is a clear read across to floating rates from this OCR risk profile.

Fixed rates – more downside on shorter terms

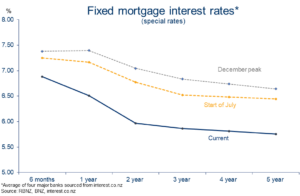

Since the start of July, one-to-three-year fixed mortgage rates have fallen 65-85 basis points. Floating and six-month fixed rates have fallen by considerably less.

These falls in retail borrowing rates follow similarly large declines in term wholesale rates. More of the same is expected in both as the downtrend runs through the remainder of this year and well into next.

One thing to bear in mind though is that wholesale market pricing already factors in an OCR at about 3% by the end of 2025. With an aggressive easing cycle baked into the cake already, it seems reasonable to assume:

- Additional declines in wholesale and retail rates from here will not be as rapid as that seen over the past 1½ months.

- Shorter-dated mortgage rates (floating out to 18 months) which, by their nature incorporate less of the expected easing cycle, have more room to fall than longer-term (3-5 year) mortgage rates.

These considerations are important inputs into our broad interest rate view. Altogether it implies, at a high-level, a two-year fixed mortgage rate closer to 5.00% by mid-2025 (-100bps from the current ~6.00%), with a 5-year fixed rate a little higher than that around 5.4% (-40bps from the current 5.8%).

If correct, this would amount to a steepening of the mortgage curve and a return to the ‘normal’ situation of an upward-sloping curve – longer-term rates sitting above shorter-term rates.

Mortgage strategy

Before diving into the rate fixing debate, it’s worth reiterating that getting a mortgage strategy “right” is primarily about meeting a borrower’s financial needs and requirements for certainty. Trying to pick the timing of interest rate movements is fraught with difficulty.

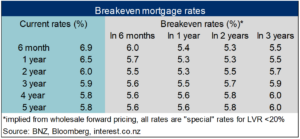

We made the point recently that mortgage borrowers are already positioned for interest rates to fall. 63% of all mortgage borrowings have fixed-rate terms of 12 months or less (74% including floating). That’s a much higher percentage of short-term borrowing than prior to previous RBNZ easing cycles. It’s more noteworthy given the extra upfront cost shorter-term borrowing has entailed.

This upfront cost remains. For example, the average six-month rate of around 6.9% is almost one percentage point above the equivalent two-year rate of around 6.00%.

Fixing for these longer-terms is not necessarily to be sneezed at. Two-year rates, for example, are now more than 100bps below the peak, the easing cycle is already well priced (as above), and the additional certainty of a longer fixed term may suit some borrowers.

However, we suspect the trend towards fixing for shorter periods, six months in particular, will remain in vogue. The downtrend in interest rates is still in its infancy, and short-term rates appear to have more downside from here.

Based on our interest rate view, there’s a good chance the ‘breakeven’ hurdle on the upfront cost of borrowing short is met. That is, our forecasts tend to undershoot the estimated breakeven rates in the table below. All else being equal, that indicates there may be value in fixing for shorter-terms up to one-year.

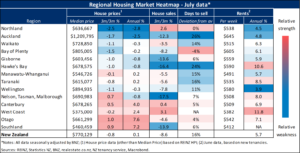

Appendix: Regional Heatmap

Our housing market heatmap provides a snapshot of the relative strength of housing markets around the country. Overall, it’s (relatively) warmer in the south, cooler in the north.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.