Re: Construction

26 Sep 2024

- Downturn in residential construction not over yet

- Challenges from elevated build costs, falling house prices, and an easing population tailwind

- But a trend change in macro fundamentals provides hope for a more constructive 2025

Residential construction is one sector in the ‘interest rate sensitive’ set being talked about a little more now that rates are on the way down.

We provide our chart-heavy take below, covering: recent NZ & global activity, the stabilisation in consents, the weak short-term outlook, still lofty construction costs and the gap to existing home prices, the reducing population tailwind, improving macro drivers and our forecasts for next year.

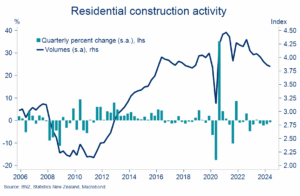

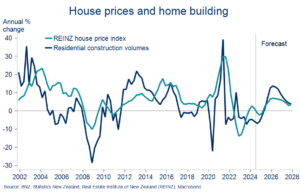

- Residential construction activity has declined in six of the last seven quarters. It’s now down 14% from the peak in 2021.

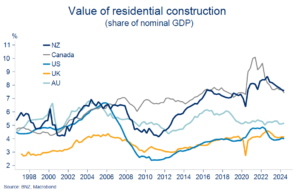

- That’s big, but not miles out of line with global trends. Construction has been a declining part of many of our trading partner’s economies. The share of NZ’s GDP devoted to home building nevertheless remains much higher than most.

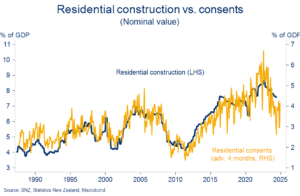

- We keep an eye on building consent issuance for a steer on future building activity. The pace of monthly issuance is still running about a third below the 2022 highs but, more encouragingly, consent issuance has stabilised this year.

- This has been led by a lift in consents for stand-alone houses, with consents for townhouses and apartments still on the back foot. Amongst the regions, Otago, Canterbury, and the Waikato have shown the most obvious signs of life.

- Stabilisation or not, the low level of consenting – not to mention the usual lags to getting a spade in the ground – suggest the downturn in residential building activity has got a little further to run.

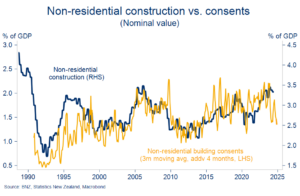

- The same can be said for non-residential (commercial, industrial, government etc.) building activity.

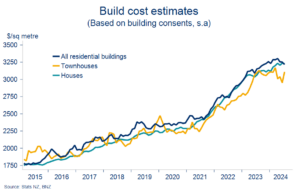

- One of the sector’s biggest challenges has been an explosion in costs. Construction cost inflation soared 35-40% from 2020 to 2023. It’s since flattened off, but the overall level of costs is still elevated.

- The average build cost of a standalone house, implied from consents, has held at about $3300/square metre. That’s about $1000/square metre more than in 2020. As we’ve noted before, these estimates are likely to be understated.

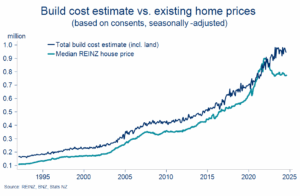

- Adding in the average cost of a section to these figures produces an average build cost estimate that is still well north of the median cost of an existing home. The analysis is indicative, but it lines up with the anecdote: it’s still generally cheaper to buy existing than to build new.

- This historically wide differential has dampened the financial incentive to build. Indeed, the current house price/build cost combination is consistent with small declines in building activity. History suggests that a turn in the construction cycle is usually, but not always, preceded by a lift in this ratio.

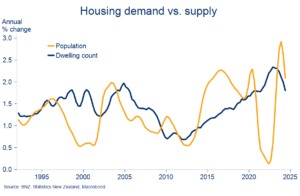

- The tailwind from buoyant housing demand has also eased. The rate of house construction undershot estimated population requirements through 2023 as migration boomed. But the rapid cooling in population growth since means changes in housing demand and supply are now less out of whack.

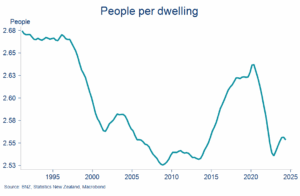

- An indicator of pressure on the housing stock – the number of people per dwelling (PPD) – rose over 2023 but may have already peaked at a lower level than might have been expected (2.6). That’s after PPD fell aggressively over 2021 and 2022 as home building activity caught up with prior growth in the population.

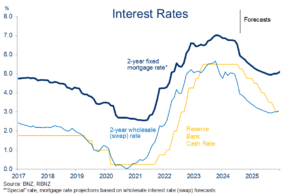

- Despite all these headwinds, a couple of key macro factors are starting to move in a more supportive direction for residential construction. Interest rates are in decline and house prices are expected to rise a little next year.

- In time we expect these factors to help drive a turn in the residential construction cycle. We’ve pencilled the beginnings of this in for early 2025. Picking investment cycles is still a tall order though and our sense is that there’s risk of delay.

- When the sector does find its feet it will have an important steadying influence on some of the other beaten up sectors of the economy that have links to construction. Areas like manufacturing and (durables) spending.

- We’d note as well that the sector itself appears to be feeling less downbeat. Surveyed construction intentions have perked up noticeably. If that’s sustained, it should help solidify the stabilisation underway in consenting activity.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.