Pulse check

22 Oct 2024- Economy still scraping along the bottom

- Inflation at target and likely to stay there

- House price expectations unchanged; we see a flat 2024 ahead of a 7% lift next year

- Little to stand in the way of additional interest rate declines. We expect a 50bp OCR cut in November, and a 2.75% low in the cycle by end of 2025

Interest rates of various stripes and terms continue to fall steadily. Returning from a break, we take the pulse of the economy, inflation, and housing market to get a sense of whether the trend will continue.

Our view remains that the Reserve Bank’s (RBNZ) official cash rate (OCR) still has a long way to fall. Retail interest rates have less downside by virtue of the fact that, depending on term, many of them already bake in aggressive OCR declines. But we think there’s still a ways to go for falls in particularly shorter-term mortgage rates.

1. The economy – spare capacity growing

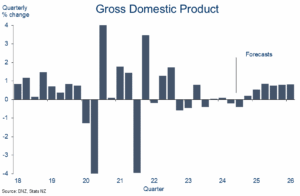

Forward indicators of NZ economic growth continue to turn less negative and confidence about the future has climbed. But any expectation that the economy might suddenly lurch back into significant growth mode is wide of the mark.

It’s like trying to start a lawnmower that’s been on ice all winter. It takes time and can be painful. And even when it does start there’s going to some blue smoke and spluttering before things get up and running properly.

BNZ growth expectations

The news flow over the past month has generally fit the view of an economy that’s stabilising at best. Future prospects have certainly lifted, but genuine expansion remains a story for (early) 2025.

For example, the latest (September) PMI and PSI readings confirm that the manufacturing and service sectors are still struggling to get out of contractionary territory, even if activity has firmed a little from the extreme lows of June.

We’ve also seen more evidence of the migration boom winding down, building consents remain in trend decline, and retail spending, while appearing to break the shackles of the downtrend, does not appear to have turned higher.

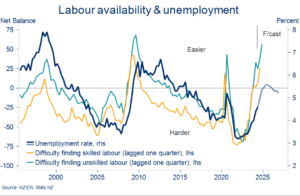

An important factor in the outlook for the latter is the deteriorating state of the labour market. Job ads are still going backwards according to yesterday’s Seek September data. And a slew of labour market and corporate profitability indicators from NZIER’s latest (third quarter) business survey made for grim, if unsurprising reading.

Our key takeaway from the survey was the confirmation that spare capacity in the economy, and labour market particularly, is such that a) labour market outcomes risk turning out weaker than our forecasts imply (5.6% peak unemployment); and b) previously high inflation now risks an undershoot of the Reserve Bank’s expectations.

Firms say labour now much easier to find

2. Inflation – from the ‘2’s to the ‘1’s?

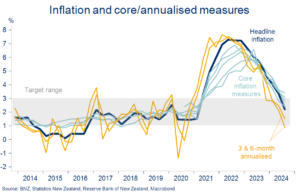

The potential for an undershoot was underlined by last week’s official Consumers Price Index (CPI) inflation figures. For the first time in thirteen quarters inflation was formally marked back in the RBNZ’s 1-3% target range. At 2.2% y/y, it even undershot our and RBNZ expectations by a sliver.

To strip out the volatile and unusual bits, it’s common to cut the numbers all sorts of ways to try and get a sense of underlying, or core, inflation. Annualised or quarterly (rather than annual) measures are also worth a look to get a more up-to-date feel for the pricing pulse. We plot a range of these adjustments in the chart below.

Whichever way we slice and dice the numbers, we get the same broad conclusion: inflation is well and truly beaten, and likely to stay that way in the short-term.

Inflation back under control

Yes, domestic or non-tradables inflation is still too high at 4.9% y/y. But the evidence, particularly from the labour market, suggests it will continue to climb down the hill from here (chart below). Our forecasts have headline inflation falling to 2.1% by mid next year, before spending some time in a 1.5-2.0% range late in 2025 and through 2026.

Non-tradables disinflating

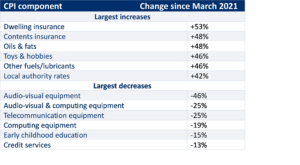

So, its job done for the RBNZ on inflation. True, but we remind that inflation is the rate at which consumer prices are changing. The inflation spike over the past three years has lifted many prices to a likely permanently much higher level. The table lays out the largest and smallest CPI component changes since high inflation broke out in 2021.

3. Housing – shuffling sideways

The chances of a sudden surge in the housing market throwing the Reserve Bank off its rate cutting stride appear low. Last week’s REINZ housing data for September was notable for producing more of the same. The market is still shuffling sideways. Recent and expected mortgage rate cuts have buoyed sentiment and interest, but not so much the hard numbers just yet.

Monthly house sales are slowly grinding their way towards normality but remain below average (5900 s.a. in September vs. long-run average of 6800). And that’s despite a relative abundance of available listings.

Claims that house prices are now rising again require some context. Yes, the September REINZ House Price Index lifted 1.1% m/m from August. But most of that was the usual seasonal spring lift. Seasonally-adjusted we put the increase at 0.3% m/m. That’s firmly in keeping with the past 18 month trend for small monthly ups and downs and little net change. National house prices are down 0.6% over the year to date.

Our view has been that for house prices to start rising in a sustained fashion the first thing that needs to happen is the excess supply currently overhanging the market needs to be worked off.

There hasn’t been a whole lot of progress in this regard, as the sales/listing ratio in the chart shows. This being so we remain comfortable with our view for a broadly flat house price performance over the remainder of 2024.

Housing market still oversupplied

We continue to expect more of a lift as we move into next year. Our forecasts remain consistent with a 7% increase in house prices through calendar 2025.

It sounds bullish but it’s almost bang on the long-run average. Note too that if it’s even ballpark correct, house prices would still end 2025 around 10% below the 2021 peak. Compare that to Australia where prices surpassed the previous (2022) peak late last year.

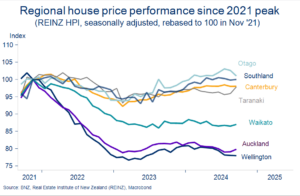

Perhaps the most interesting thing to drop out of the latest housing stats was another reminder of the patchwork nature of the market up and down the country.

The weak conditions prevailing since 2021 have been felt by far most acutely in Auckland and Wellington. The South Island, meanwhile, continues to experience reasonable growth in house sales and prices having had, in the case of Otago, only a comparably mild downturn through 2022. Prices there are back above the 2021 peak.

Mainland resistance

Interest rates – more downside on shorter mortgage terms

Pulling the above threads together, spare capacity in the economy is growing, the labour market is weak and getting weaker, interest rate sensitive sectors like housing and construction are not expected to race away, and inflation is already at target. At the same time the Official Cash Rate, at 4.75%, is still at levels the Reserve Bank describes as ‘restrictive’.

The case to keep pushing it down rapidly is thus clear. An OCR setting much closer to “neutral” (the theoretical OCR level that’s neither a brake nor an accelerator) appears to be warranted.

All the debate is about how quickly it will get there. Our view is that, following this month’s 50bps OCR cut, another -50bps adjustment is likely in November, with 25bps cuts at each meeting next year taking the cash rate to a low point of 2.75% by the fourth quarter of 2025.

We’ve tended to run a more aggressive rate cut view (on both speed and the ultimate end-point) than most. But given the state of inflation and the economy it’s not hard to make a case to go even harder than our projections. Hence the current speculation of a larger 75bp cut in November (currently priced by markets as about a one third chance).

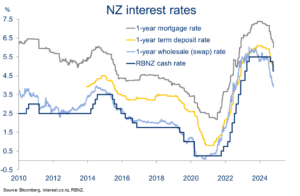

The important point is that markets are still doing the RBNZ’s work. The guidance from the Bank since July has been clear, and we’ve seen large falls in retail rates as hefty OCR cuts have been factored into the interest rate curve.

Twelve-month term deposit rates have fallen around one percentage point since July, with 1-5 year mortgage rates down 80-120bps. That compares to the cumulative 75bps of cuts to the OCR.

Downtrend takes hold

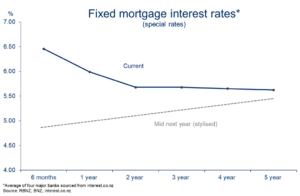

One thing that was notable in last week’s round of mortgage rate cuts was the larger (20-25bps) declines at the short end of the curve compared to the modest 5bps or so of cuts at terms of two years or more. We think that might be a taste of things to come with those lower, longer-rates already factoring in a schedule of OCR cuts similar to our own forecasts.

Shorter-term rates, by contrast, have more downside as they follow the cash rate down. We don’t forecast the full range of mortgage terms. But the chart opposite provides an indicative sense of how the mortgage curve could look by mid next-year, based on our OCR and wholesale interest rate forecasts.

Since the start of 2023, mortgage fixers have been busily shortening fixing terms in anticipation of lower interest rates. In August (the latest month we have data for), a record 86% of new mortgage lending by value was written for terms of 12 months or less.

This preference for shorter terms will probably stick around in the short-term but we wouldn’t be surprised to see more of an inclination to look at longer terms as we head towards the end of the year.

Mortgage curve ‘normalising’

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.