Eco-Pulse: 2024 – From Stagger to Shuffle

19 Dec 2023

- Another challenging year in prospect

- Change in labour market conditions a notable feature

- But some hopeful signs, cycle to turn in second half

- Interest rates to fall from Q3

- Brace for further volatility

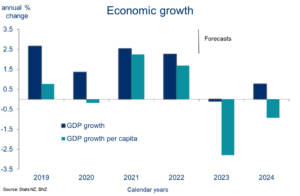

Following last week’s awful third quarter GDP figures, it looks to us as if the economy will end 2023 around the same size it started. That flat-lining performance comes despite an extra 140,000 people in the country. The circa-3% per capita economic contraction, in the year to September, certainly speaks to the tough economic conditions experienced by many this year.

The challenge of laying out thoughts for the year ahead is aptly framed by last week’s big GDP surprise. Economic output turned out to be 1.8% below what the Reserve Bank understood it to be when it released its forecasts only two weeks prior.

As a way of processing the murk, we’ve tackled the 2024 outlook by listing the reasons we’re cautious, the reasons we’re hopeful and, finally, trying to mash it all together. It’s by no means an exhaustive list but, hopefully, it hits the key themes. This is my final note for the year. Thanks for reading and have a safe and restful break!

From stagger to shuffle

Reasons to be cautious

- Mortgage grind continues

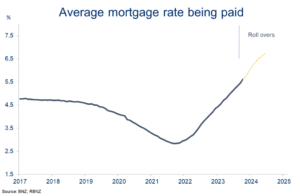

The post-COVID economic hangover looks set to drag on into 2024 for households. The pace of cost increases is now clearly slowing overall, notwithstanding ongoing chunky increases in hard-to-avoid rates, insurance, and rent bills. But, for many of the approximately one third of households that have mortgages, there’s still a little more pain to come from interest rates.

Three quarters done

The average mortgage rate being paid is currently 5.4%. This will rise at least another 100bps before the cycle is done, as old fixed terms expire and folk roll onto new rates north of 7%. Roughly a third of the mortgage book will refix over the coming six months. Household budgets will come under further pressure as a result.

2. Labour market sea change

Not helping the cash flow calculus for households will be a reduced buffering effect from labour market incomes.

In our view, there will be a much different feel to the labour market next year. Prior heat has already been all but extinguished by the surge in migration-lead labour supply. In 2024, we expect outright slack to appear as the pace of hiring slows up even as the supply of workers keeps rising.

Labour market heat disappears

It’s a recipe for higher unemployment, reduced wage growth, and a knock to general perceptions of job security. We’re quick to add that our expectations for all of this are far from weak in an outright or historical sense. It’s just the change from where we’ve been that will take some getting used to. Wage demands are going to be met less often, and there will be less poaching, churn and job opportunities about.

3. Global backdrop not helpful

Parts of our rural sector are under significant pressure. Some of this pressure may ease next year, but the overall picture is likely to remain challenging.

While sub-par growth will be the order of the day for most of our key trading partners, recent indicators suggest we’re probably past the worst. Offshore prices for our exports may nudge higher. However, such has been the cost explosion in recent years that profitability will remain under strain. This is particularly so for the forestry and lamb sectors. Dairy returns may fare a little better – we recently nudged up our Milk Price forecast to $7.50 kg/ms. Still, caution remains given the sluggish Chinese recovery and the likelihood of a higher NZ dollar next year.

Sub-par global outlook

4. All roads lead to spending restraint

Combined, the three factors above – a deteriorating labour market, chunkier mortgage bills and strained farmer cashflows – all point to spending restraint carrying through into the New Year. Retail spending volumes have already been in trend decline for 18 months and we’ve pencilled in another six months of the same.

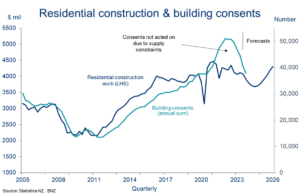

5. Slow build

Despite a growing need for more houses, the nascent downturn in residential construction activity looks set to deepen next year. It’ll be another weight for the broader economy. Building consent numbers are already down 30% from 2022 highs.

This ‘inverse’ supply response to booming housing demand reflects a strong financial disincentive to build, in our view. Our research suggests the average cost of building a home relative to buying existing has never been higher. In short, the macro-level maths doesn’t add up.

Our best guess is that the construction cycle will turn late next year. Buoyant net migration inflows and the turn in the house price cycle bode well in this regard.

Residential construction activity to fall

Reasons to be hopeful

- People

More people in the country means more economic activity. Tourism numbers have climbed back to around 80% of pre-COVID levels. The trend recovery should continue next year, albeit at a slower pace than what we’ve seen to date.

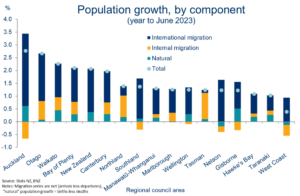

Booming numbers of permanent migrants are also attracting more attention. We’ve already flagged the economic outperformance developing in those regions enjoying relatively larger helpings of population growth. That’s something likely to carry through into 2024. Importantly though, the impacts on supply (via the labour market) appear to be at least as large as this boost to demand.

Where are we all going?

Net migrant inflows are expected to slow through 2024, as once plentiful job opportunities dry up. We might also see some policy changes. But even if our arguably heroic assumption of a decline from an annual pace of 130k to more like 80k is correct, that’s still a very large number (equivalent to prior historic highs) likely to have big impacts on the economy.

2. Business angst departs

There’s no doubt businesses are feeling much less downbeat about their lot. We can see it in the business confidence numbers and we’re hearing it from them directly. The big question is how much of this is politics, and how much is genuine and, hence, likely to be reflected in investment, hiring and activity. There are elements of both, but our feeling is that the majority is genuine.

But far from a sense that things are racing away – confidence is only back to around “average” levels after all – it’s more that firms can now see a path out of the current mire. In other words, we’re in the dark part of the economic cycle but, like any cycle, it will turn.

We’re banking on the business investment cycle burbling back to life over the second half of 2024. Recent gains in surveyed investment intentions and profitability metrics are encouraging in this regard.

Things can only get better

3. Exchange rate doing its bit

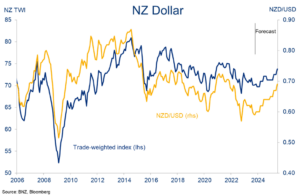

The NZ dollar has done a whole bunch of not much this year. It’s washed around levels about 6% below the 5-year average in the case of NZD/USD (2023 average of 0.6140) and 2% below in the case of the trade-weighted exchange rate (2023 average of 70.9). The lowish exchange rate has acted as the usual shock absorber against recessionary domestic conditions and lacklustre global export prices.

USD down = NZD/USD up

Our best guess is that the currency will remain at generally supportive levels next year, but less so than 2023. Our view of a mild appreciation in the NZD/USD to around 0.6500 by year-end largely hangs off the ailing fortunes of the US dollar. By contrast, the trade-weighted NZD is expected to track broadly sideways.

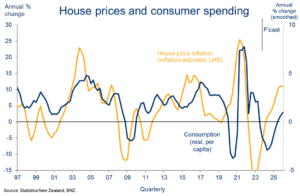

4. Housing vibes to settle spending patterns

National house prices knocked out a 0.4% (s.a.) gain in November, meaning prices have now lifted about 3% since the downtrend ended in April. We think the uptrend will establish itself a little more forcefully next year (see our latest Property Pulse). We’ve pencilled in a 5-10% lift in house prices, with Auckland leading the way.

It’s not a pretty picture for affordability, but we know that, for better or worse, New Zealanders spend a little more freely when the housing market is pointed up. We suspect higher house prices will help sure up spending patterns and eventually construction activity next year. There are probably early whiffs of this occurring already with consumer confidence scraping off near record lows. The rub is that this positive wealth effect is kryptonite to the Reserve Bank (but more on that later).

Strong link between housing and spending

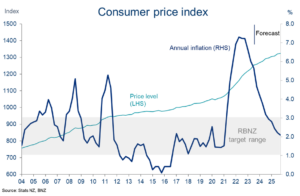

5. Bulk of cost bulge behind us

CPI inflation is still far from beat at 5.6% y/y. Fortunately, most of the indicators point to an overdue retreat through 2024. On our forecasts, and noting all the usual uncertainties, a return to ‘normal’ sub-3% inflation is in prospect by the end of 2024.

That would of course be welcome but lower “inflation” still means rising prices. Essentially – the 20% spike in the general price level of the past three years stays with us.

The more likely candidate for an easing in cost of living pressure is for inflation to fall below wage growth. That would restore a little of the purchasing power lost in recent years. Mortgage rate declines would obviously help too. We reckon there’s a good chance we’ll see both late in 2024.

Bittersweet

Potentially challenging this more benign picture is the fact that firms are still saying cost pressures are intense. Not only in anecdote, but also in business surveys where cost expectations are holding up more stubbornly than pricing intentions. That’s particularly so in the service sector. Clearly, margins are under increasing strain. Stuttering demand is no longer conducive to widespread cost pass through. It’s an uncomfortable but typical part of the disinflationary cycle and probably has further to run.

Bob each way

We’ve done our best to divide everything neatly into positives and negatives, but there are a couple of big factors that could still go either way:

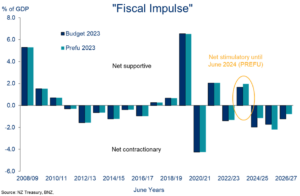

- Fiscal picture still murky (and stimulatory?)

Much has been made of the aggressive spending cuts the new government intends to deliver. Given the splurge in government spending of the past few years, this cold turkey treatment could conceivably kick a leg of support out from under the economy next year. However, bear in mind:

- Spending cuts will be used to fund proposed tax relief to the tune of about $15b over four years. That is, reduced government activity will be offset to some degree by additional activity in the private sector. Just how much is still up in the air.

Fiscal stimulus supportive until mid-2024

- The ship may take a while to turn. Most of the proposed fiscal changes are likely to occur in the 2024/25 fiscal year (starting June 2024), meaning the overall fiscal stance is likely to remain largely stimulatory for the meantime (chart opposite).

- Many of the details will come through in next year’s “big” Budget, with this tomorrow’s “mini” version providing a taster of things to come.

2. Interest rate arm wrestle

Which side prevails in the 2024 interest rate debate will go a long way towards shaping the state of the economy.

The Reserve Bank has been cautioning that there will be no cuts to the cash rate until early 2025 and, what’s more, if there was to be a move next year it would be more likely to be up than down. This guidance felt a touch strong to us when it was delivered and even more so now in the wake of the crumbling GDP numbers of last week.

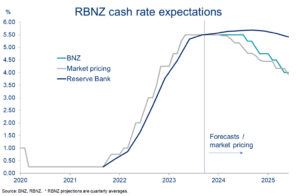

Our own view is that we’ll see cuts to the cash rate around the third quarter of next year. Market pricing is now even more aggressive, baking in a full 25bps cut from May as part of a move to a 1.00% lower rate by the end of the year (chart below).

If markets are right, lower retail interest rates from around mid-year would add weight to a second half recovery. By contrast, if RBNZ worries about sticky domestic inflation bear out and the cash rate is held at 5.50% all year (or lifted), the economy will be shuffling sideways into 2025. Fourth quarter inflation data out 24 January will be critical.

Market pricing calling for cuts from May 2024

The final tally

Stirring all of the various overs and unders into the pot leaves us with a view that we’re in for another challenging year in 2024. But unlike this time last year, there are a few more green shoots to note with the overall outlook starting to tilt very marginally upwards rather than firmly down.

We think we’ll be bouncing along the bottom for another six months or so before growth starts to resume over the second half. It’s not the 2023 stagger, but it’s still a shuffle.

Finally, while all of the above is our best guess, it’s worth remembering the dominant role various (and mostly negative) shocks and surprises have played in setting the economic landscape in recent years. There could well be more.

With this in mind, we’ll have one eye on global politics next year given over half of the world’s population goes to the polls including –importantly – the US, and Taiwan. More volatility seems assured. So we’ll finish the year with the same line we ran this time 12 months ago: Take forecasts with a grain of salt, and make a plan but be flexible in case the economic environment shifts unexpectedly. Because it no doubt will.

To subscribe to Mike’s updates click here

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.