Eco-Pulse: whistle stop global tour

25 Jun 2024

- NZ economic news goes from bad to worse

- But forecasts for global growth still being nudged higher

- We take a quick tour of our top five trading partners

- It underlines NZ’s recent underperformance but also highlights some positive signs for our export markets

The NZ economy may have wriggled out of technical recession in the first quarter of this year, but recessionary conditions remain in full force. From some of our recent discussions, it seems more than a few are wondering how to reconcile the steep declines in orders, revenue and profitability increasingly commonplace with the fact aggregate economic activity (GDP) has ‘only’ gone sideways for the past 18 months.

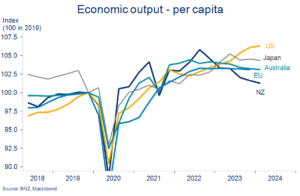

It highlights again that GDP per-capita is a more relevant measure of the economic conditions being experienced by many. Particularly given the population boom of the past few years.

On a per-capita basis, the economy has now contracted for six consecutive quarters, amounting to a cumulative retrenchment of 4.3%. That’s the largest decline we’ve seen (excluding lockdown disruptions) in data going back to the early ‘90s. As the chart shows, it’s also a noticeably weaker performance than our trading partners.

NZ from outperformer to unders

More recent eco news hasn’t been much better. Indeed, it looks as if current quarter (Q2) GDP will prove even weaker than Q1. We’ve recently nudged down our forecast for such to -0.2%q/q.

May seems to have been a particularly miserable month for the NZ economy. The pace of decline in many areas accelerated.

For example, over the past fortnight we’ve learned that May retail spending fell by even more than we’d expected (0.9% m/m), the manufacturing sector slid further into recessionary territory (PMI from 48.9 to 47.2), house prices fell 0.4% (REINZ HPI, s.a.), the Performance of Services index slumped to the lowest level since records began (ex- lockdown months), consumer confidence backslid 12% (Westpac Q2 measure), and job ads fall another 5% to be 31% back from year ago levels.

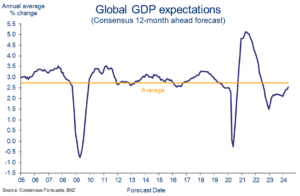

One area where the news flow has been a little more encouraging is in relation to the global economy. That’s helpful to the extent it’s the shop floor where we sell our exports.

There’s a tonne of risks around, but confidence that the worst for the global economy is behind us continues to slowly build. Year-ahead forecasts for global growth have been nudged in a firmer direction for five straight months. At 2.5%, these forecasts are by no means strong, but the direction is certainly welcome.

Global growth worm has turned

Below, we scratch the surface on the global outlook via a quick tour of our top five trading partner economies (rankings determined by total trade – exports plus imports). We include broad macro expectations for each, and finish with some of the potential implications for NZ.

Table notes: In all cases trade statistics reference year to March 2024,

|

|

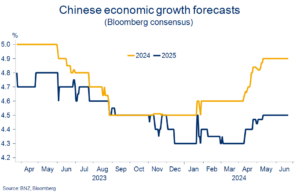

China’s economy has some well-known challenges, both cyclical and structural. Its economy has tended to undershoot expectations in the post-COVID period, with a deep property market malaise keeping consumers cautious amid generally high debt.

These challenges remain but, over the past few months, there’s been a noticeable reduction in pessimism about the current cycle. Since April, consensus growth forecasts for 2024 are up almost ½ percentage point to just under authorities’ 5% GDP growth target.

Chinese growth pessimism reducing

Confirmation of the growth target itself has probably helped, as have a bunch of policy measures designed to both limit weakness in the property sector and support the other sectors (e.g. infrastructure, manufacturing) that are helping fill the gap left by the construction industry. Exports are also surging, in contrast to the rest of the world.

There are still concerns that some of these support measures are more band-aids than enduring fixes. And the scope of the stimulus, particularly in the property market, is small relative to the size of the ‘problem’. There are also risks of an escalation in trade tensions in the wake of the US and EU increasing tariffs on Chinese EV imports.

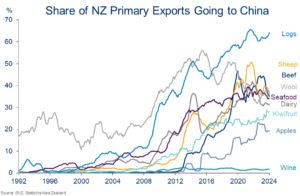

Still, for now, the turn up in growth expectations is helpful given NZ’s large trade exposures (chart below). We’ve already seen some of our export commodities benefit from a lift or at least stabilisation in Chinese demand.

Primary exports highly exposed to China

| 2. Australia 15% of exports, 16% of imports

|

|

As we said in our recent note: “…the cyclical positions of the two <antipodean> countries are not that different. It’s just that Australia’s economy is in an outright stronger position in nearly all areas.”

Australian economic growth is slowing, household budgets are under pressure, spending growth has cooled, and unemployment is rising. But the magnitudes of all of these trends have been much milder than in NZ and some other economies, and they’re forecast to remain that way.

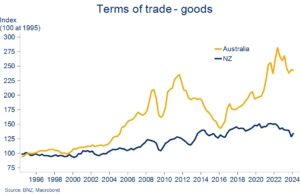

Favourable trade winds

Part of this reflects the Reserve Bank of Australia’s less aggressive approach to raising interest rates. But there’s also been some big cushions for the Aussie economy in the form of a full-blown housing market upswing (now slowing), and a favourable trade position (chart above). A Federal Budget in surplus also means that fiscal policy is now able to be tilted in a more expansionary direction, in contrast to many other countries (NZ included).

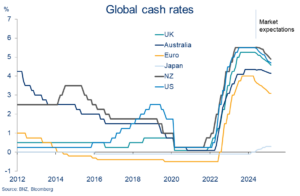

Against this backdrop, it’s less clear in Australia as elsewhere that inflation pressures are sufficiently tamed for the central bank to be contemplating lower interest rates. Indeed, market pricing has Australia as one of the last developed markets to cut. Partly as a result, we’re forecasting some appreciation in the Australian dollar against the US and NZ dollars.

Less aggressive approach from RBA

| 3.USA 15% of exports, 11% of imports

|

|

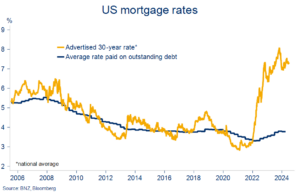

The economic narrative in the US has shifted over time from hard landing, to soft landing to…no landing. Despite 525bps of Federal Reserve rate hikes (same as in NZ), US GDP growth actually accelerated over 2023 and early 2024, with only a mild slowdown picked for next year.

If US “exceptionalism” has become a consensus view, the reasons behind it are not. Our take is that it reflects some combination of interest rate insensitivities in parts of the economy (chart below), productivity gains linked to the AI/tech sector, and ongoing fiscal largesse. So, some solid foundations, some less so.

There are few signs the US is about to tone things down on the fiscal front, regardless of who wins the November election. The US Congressional Budget Office recently revised its federal deficit forecast for 2025 to 6.5% GDP (US$1.9t), more than double NZ’s 3.1% deficit forecast.

Fed rate hikes – muted impact on paid mortgage rates

We expect some of the US’s growth advantage to be chipped away over the coming 12-18 months. There are signs of this occurring already. For example, past Fed policy tightening appears to be slowly catching up with the US labour market. Retail spending has also clearly slowed, and construction indicators have turned south.

Federal Reserve interest rate cuts before the end of the year should help limit any downside. There’s been fierce debate about the timing and magnitude of such this year. Our base case is two 25bps cuts starting in September.

| 4. European Union 6% of exports, 13% of imports

|

|

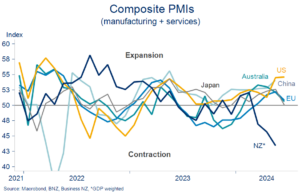

EU economies appear to be stabilising, on the whole. As ever, forecast growth rates across the EU are unlikely to get anyone’s pulse racing. But, having avoided a recession last year, improving albeit still low growth numbers are expected for this year and next.

The region continues to recover from energy price spikes in the wake of Russia’s invasion of Ukraine. Falling inflation is expected to help lift consumption spending, as is rising wage inflation given tight labour markets. Lower interest rates will provide additional assistance, with the European Central bank kicking off an easing cycle earlier in June.

Weakness in the German manufacturing sector remains a drag on the area, but there are signs that this drag is at least abating. The impact of upcoming fiscal consolidation, politics/elections (note recent volatility in French asset markets), and any escalation in the Ukraine war are all key risks to keep an eye on.

NZ takes the low road

| 5. Japan 4% of exports, 5% of imports

|

|

Japan has been recording economic growth in the “ones”, at best, for many years. Growth this year will struggle to stay positive. Next year, though, is looking more promising amid strengthening wage growth, fiscal support, and a relatively healthy business sector. The consensus expects 0.3% y/y economic growth this year to lift to 1.1% next.

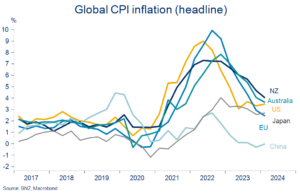

Japan not exempt from global inflation spike

Standing out as an obvious contrast to other developed economies, the Bank of Japan (BoJ) started raising interest rates in March, in response to above-target inflation (chart above). That’s the first time interest rates have been lifted in 17 years. More tightening is expected although the BoJ has been cautious on the pace of such given the country’s long history of deflation.

Even with expectations of higher interest rates, Japan’s exchange rate has been under huge pressure this year. The Yen recently fell to 34-year lows against the USD. That’s causing some hand-wringing amongst policy makers, but the weak currency is helping exporters and the appeal of Japan as an tourist destination.

What might it mean for NZ?

First, should it all go to plan, the expected grinding recovery in global growth would be a positive for our own economic prospects. We previously expressed caution it was overly US-centric, but the recent reduction in Chinese growth pessimism is encouraging.

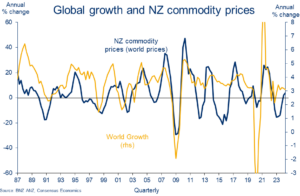

It’s helpful for our commodity export demand and hence pricing (chart below). The impacts can be mixed across individual commodities, and supply dynamics are equally, if not more, important. But signs of extra global demand are becoming evident, most notably in the 35% dairy price recovery from the August 2023 lows. We’re still cautious about how far these trends can run overall, given global growth forecasts are still sub-trend, but the worm is at least pointing upwards.

Stabilising influence

Second, there might be exchange rate implications. On the face of it, the NZ economy’s position as a relative underperformer on the global stage could be construed as a negative for our currency.

We would argue this is mostly ‘priced in’ already, with the exception of NZD/AUD for which we expect some modest depreciation. More importantly, we tend to observe a strong positive correlation between the global growth cycle and the NZD/USD particularly.

Improving global growth tends to coincide with NZD/USD appreciation, likely a reflection of the positive implications for our commodity prices as noted above. This aligns with our generally firmer NZD/USD view over the coming 12 months. That view of course comes with massive uncertainty given all the upcoming economic and political risk this year.

Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.