Eco-Pulse: Progress

28 Apr 2023- Surging migration flows a possible game changer

- Inflation battle being won but victory still a ways off

- Interest rate peak edges closer

- Risks around our house price view flip to the upside

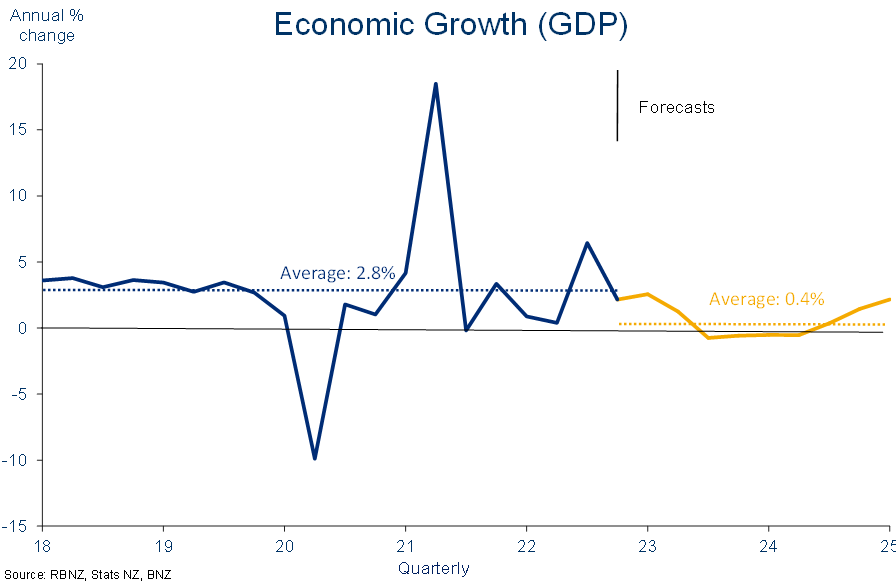

Whether or not the NZ economy is ultimately confirmed as having entered a recession, one could argue recessionary conditions are already in place. Caution abounds, budgets are under pressure, and expansion plans are being checked. We expect this slow and low sort of growth environment to stick around for a while (chart below).

But, relative to the situation a couple of months ago, we’re at least seeing a few more indicators move in the right direction. There’s clearer evidence emerging of the economic rebalancing we’ve been anticipating, and that the Reserve Bank (RBNZ) is trying to deliver.

Inflation has peaked, the labour market is slowly turning and interest rates and the housing market appear at or close to turning points. It seems the RBNZ’s interest rate hikes are doing the business on demand, allowing the economy’s supply potential to catch up a bit. It’s progress.

Slow and low

What have we learned over the past few weeks?

1, Migration flows a possible game changer

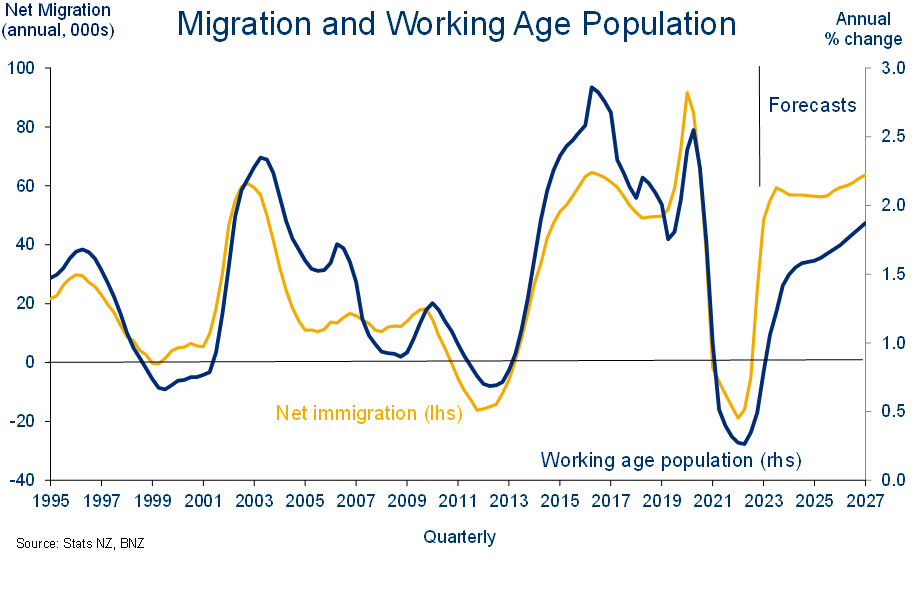

Headlining the latest round of econo-news was the confirmation last week that inward migration into NZ is going bananas.

We looked into the migration figures in some detail last time. But the February estimates, released by Stats last week, hint at a much more marked acceleration than anyone has been expecting. It’s potentially a big deal.

Around 52k migrants (net) have settled into NZ in the 12 months to February, and monthly arrivals still appear to be accelerating. By the time we get the data for this month it’s conceivable this number will be closer to 70k. That’s around 1.8% of NZ’s working-age population.

More people in the country means more economic activity, more spending, extra available workers, and additional pressure on the country’s housing resources. So it seems likely that the migration surge is sitting behind some of the more proximate economic developments we’ve witnessed recently including: easing (but still elevated) staff shortages, reasonable retail spending values, and signs of stabilisation in the housing market. However, the ultimate impacts on inflation, and hence interest rates, are less clear given the extra migration will add to both demand and supply factors.

We still think the NZ economy is destined for recession this year. But if anything was to pull us back from the brink, all the extra people in the country, both migrants and tourists, stand out as the most obvious candidate. In the least, it should help round off the edges of the slowdown.

Inward migration surges

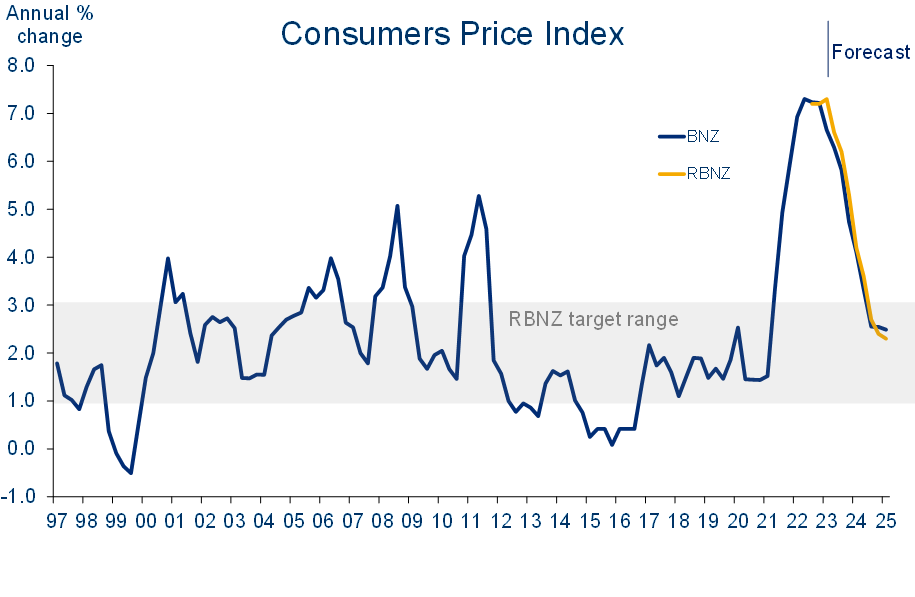

2, Inflation past the peak

Our expectation that NZ inflation has peaked was confirmed by last week’s larger-than-expected first quarter abatement. The annual rate of inflation, according to the Consumers Price Index, fell from 7.3% y/y to 6.7%. It was a pleasant surprise for all, but particularly for the Reserve Bank who weren’t anticipating any inflation relief until the June quarter.

Even though it’s only a small fall, it’s important. If for no other reason than things are finally headed in the right direction. The debate will now shift from “how high the peak?” to “how fast the fall?” which, in of itself, will be important in dampening the public’s inflation expectations.

In the wake of the weaker March quarter CPI numbers, we’ve trimmed 0.6 percentage points off our calendar 2023 inflation forecasts. We’ve now got 4.7% on the board by year-end. Some of the factors expected to deliver this forecast inflation relief include:

- Lower commodity prices

- Falling freight costs

- Easing construction cost inflation

- Reduced imported inflation, reflecting untangling supply chains and falling global inflation

- Increased consumer resistance to price increases

Over the hump

Of course, 4-5% inflation is still too high and the process of bringing down core, domestically-orientated, inflation may well prove tricky. Indeed, most of the March quarter downside CPI surprise was in “tradeable” prices, with “non-tradable” inflation hitting a fresh 33-year high of 6.8% y/y.

In other words, small falls in inflation – to date – are more a reflection of offshore supply shocks starting to normalise than the Reserve Bank’s hikes getting into their work in disrupting domestic inflation.

2, Interest rate peak approaches

This being so, it doesn’t change our expectation that the Reserve Bank will deliver one final 25bps hike in the Official Cash Rate on the 24th of May. It does, however, afford us a touch more confidence in this being the final hike of the cycle.

Still, even if this proves to be on the money, we doubt the Bank will sound the ‘all-clear’ on inflation anytime soon. Doing so could green light earlier-than-desired falls in retail interest rates, something the RBNZ has shown itself as very keen to avoid at this stage.

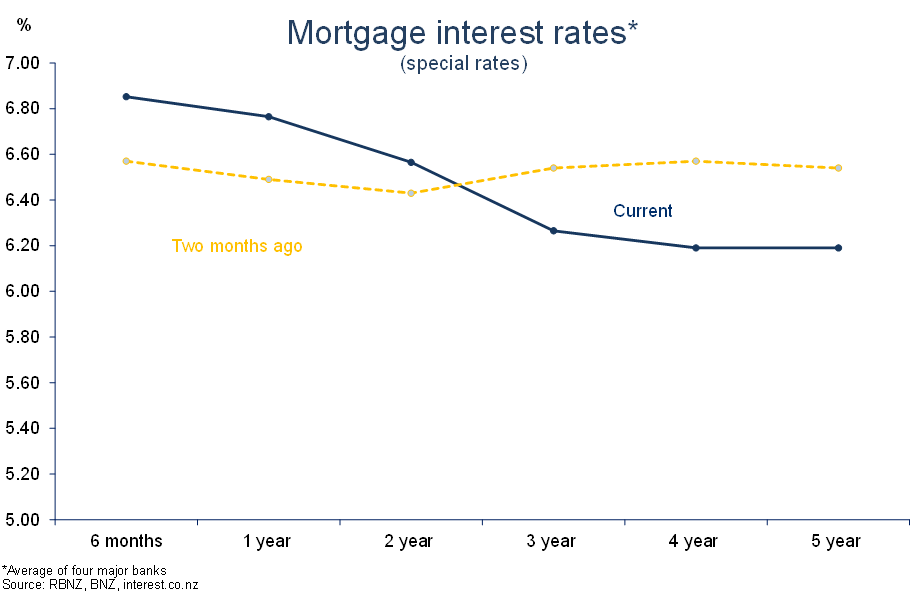

This reinforces our view that, while most mortgage rates have likely peaked, we shouldn’t get excited about widespread declines anytime soon. Rather, our view has been for further “inversion” of the mortgage curve – longer-term rates nudging lower even as short-term rates push a little higher.

This has largely played out over the past few months, as the chart below shows. The two-year fixed rate has proved to be something of a pivot point, with mortgage rates for terms shorter than this rising while longer-term rates have fallen a little further.

More inverted

At some stage, and assuming we don’t get any more nasty inflation surprises, we’ll see shorter term rates start to fall as well, as the OCR easing cycle, increasingly priced into longer term rates, draws closer into view. This still looks like a story for the second half of the year to us, and probably the second half of the second half at that. We don’t expect cuts in the OCR until May of next year.

3, Housing market turning earlier than expected?

We made the case in our debut Property Pulse publication last month that the housing market correction was nearing its end and “we may see signs of stabilisation emerge over coming months.”

Emerge they have. In fact, over the past two months, the housing-relevant data and news flow has unequivocally fallen on the stronger side of the 20% peak-to-trough house price correction baked into our forecasts. And bear in mind that’s a forecast that was already on the less-weak side of the consensus and RBNZ expectations. To wit:

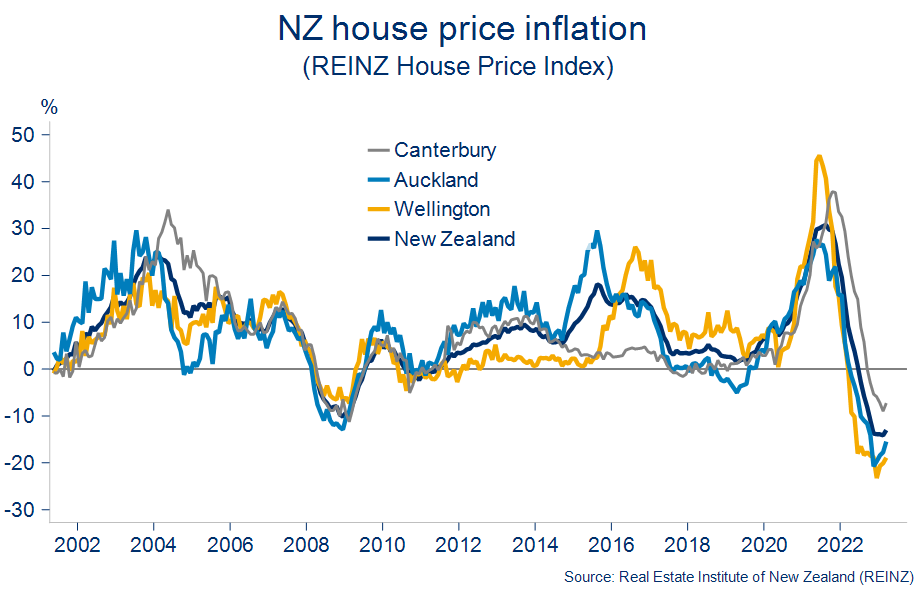

- House prices held roughly steady (seasonally adjusted) in March according to the REINZ House Price Index, the first time they haven’t registered a monthly fall since November 2021. Signs of a thawing in housing activity are also starting to come through, with sales having stopped falling month on month, and median days to sell a house reducing a touch.

- As noted earlier, inward migration flows are surging which should put something of a floor under the market (most obviously and initially in Auckland).

- It looks as if mortgage rates for all but the shorter terms have now peaked. We remain of the view that significant relief is unlikely this year, but this nevertheless may reduce some of the uncertainty hanging over the market.

Signs of stabilisation

We’re not in the business of trying to pick the exact turning point, and we expect to see a bit more chop in coming months’ housing statistics. For example, we wouldn’t be surprised if the Reserve Bank’s surprise 50bps OCR hike at its last meeting puts a chill through some of the April housing statistics.

Still, the weight of the above means we’ve flipped the risk assessment around our house price view from the downside to the upside. At the same time, we continue to believe that any house price recovery later this year will underwhelm.

What of the RBNZ’s proposal to ease loan-to-value restrictions (LVRs)?

First, the proposed changes are relatively minor.[1] Second, they’re not a major surprise. We’d already flagged a possible easing this year, noting the RBNZ “won’t want a restricted credit supply to starve the market of oxygen, risking a harder landing.” That indeed seems to be the motivation for the change. Finally, we doubt the RBNZ would have proposed the changes if it thought they’d have any material impacts on the state of the market. Mortgage rates and population growth will remain the much more powerful drivers.

To subscribe to Mike’s updates click here

_______________________________________________________________________________________________________________________________

| Disclaimer: This publication has been produced by Bank of New Zealand (BNZ). This publication accurately reflects the personal views of the author about the subject matters discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author do not necessarily reflect the views of BNZ. No part of the compensation of the author was, is, or will be, directly or indirectly, related to any specific recommendations or views expressed. The information in this publication is solely for information purposes and is not intended to be financial advice. If you need help, please contact BNZ or your financial adviser. Any statements as to past performance do not represent future performance, and no statements as to future matters are guaranteed to be accurate or reliable. To the maximum extent permissible by law, neither BNZ nor any person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. |

[1] The ‘speed limit’ on high LVR (>80%) owner-occupier lending is proposed to increase from 10% to 15% of new lending. The LVR cap for investors is proposed to be increased from 60% to 65%, with the 5% speed limit on high LVR lending to remain unchanged.